The US non-farm payrolls data for December 2024 is set to be released at 1.30pm (UK time) on Friday 10 January. The CME S&P 500 mini options market is pricing in a move of over 90 points (1.5%), potentially increasing volatility and breaking the index out of its recent triangle pattern.

Strong labour market and high interest rates

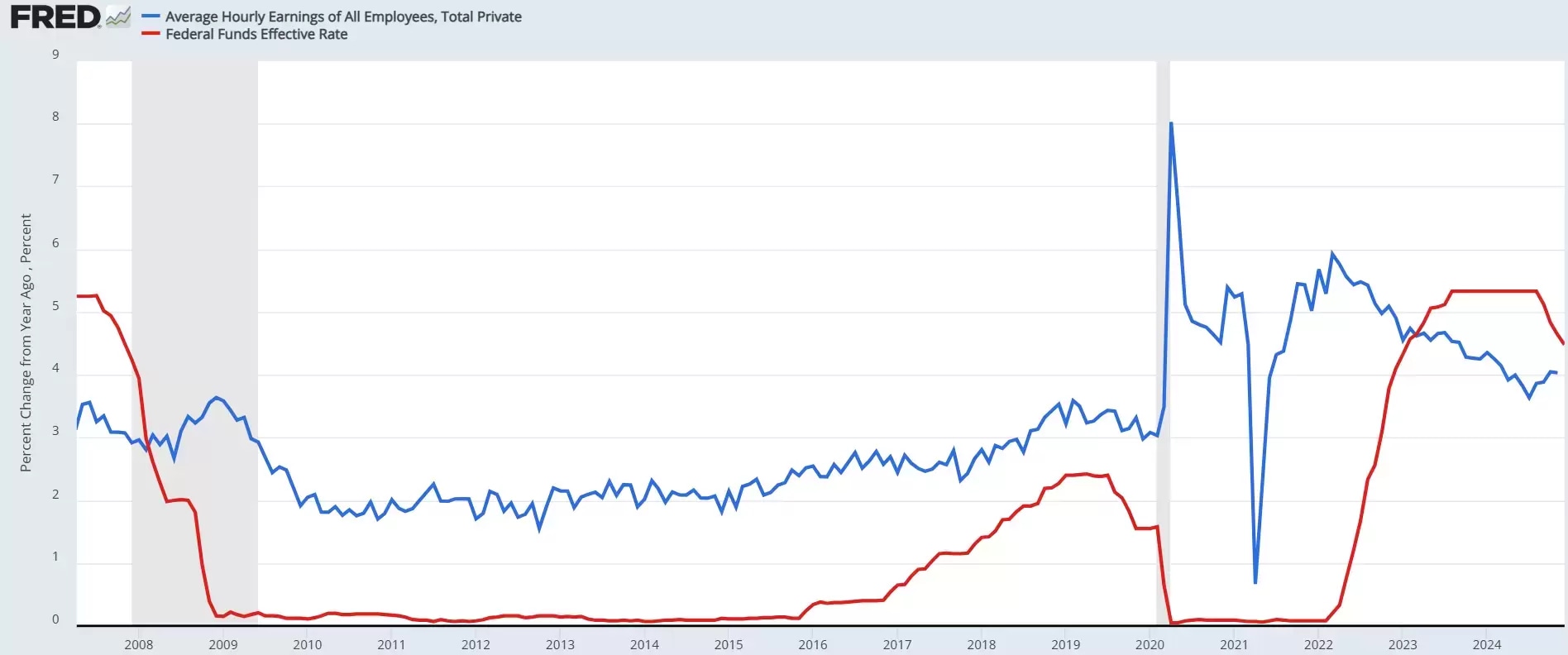

The Thomson Reuters market consensus expects a reading of 160,000 payrolls, down from 227,000 in November, while the unemployment rate is expected to remain steady at 4.2%, and average hourly earnings are expected to continue to rise at an annualised rate of 4%.

If these estimates are correct, tomorrow’s report could indicate a strong labour market: full employment, steady job growth and rising incomes, a combination that could point to potential inflationary pressures.

A paradoxical impact on stock markets

The US economy’s strength (the Atlanta Federal Reserve’s latest GDP Now estimates 2.7% GDP growth in Q4 2024), increasing inflationary pressures (with ISM services at 64.4 in December 2024) and possible Trump policies have prompted the Fed to adopt a stricter monetary policy stance, as reflected in the latest Federal Open Market Committee minutes. This has driven a sharp rise in US interest rates, with 10-year notes reaching 4.70% and T-Bonds around 4.90%, levels not seen in recent months.

High interest rates and a strong US dollar are weighing on stock markets, which are paradoxically reacting negatively to positive economic data. In this context, stronger-than-expected employment data could hurt stocks if rates continue to rise, while weaker data might boost markets if rates ease.

CMC Markets erbjuder sin tjänst som ”execution only”. Detta material (antingen uttryckt eller inte) är endast för allmän information och tar inte hänsyn till dina personliga omständigheter eller mål. Ingenting i detta material är (eller bör anses vara) finansiella, investeringar eller andra råd som beroende bör läggas på. Inget yttrande i materialet utgör en rekommendation från CMC Markets eller författaren om en viss investering, säkerhet, transaktion eller investeringsstrategi. Detta innehåll har inte skapats i enlighet med de regler som finns för oberoende investeringsrådgivning. Även om vi inte uttryckligen hindras från att handla innan vi har tillhandhållit detta innehåll försöker vi inte dra nytta av det innan det sprids.