The US dollar has plummeted sharply, with the CMC USD index down nearly 8% from its 25 February high of 1.124. The decline has been virtually vertical, with hardly any consolidation or rebounds, and indicators now show oversold conditions.

The US dollar index is nearing key support levels, including the 2023 and 2024 lows. Major currency pairs are also approaching important technical benchmarks: USD/JPY is near ¥139.57, the low marked after the collapse caused by carry trades closing in September 2024, while GBP/USD is testing $1.3434, the 2024 high and a long-term sideways band.

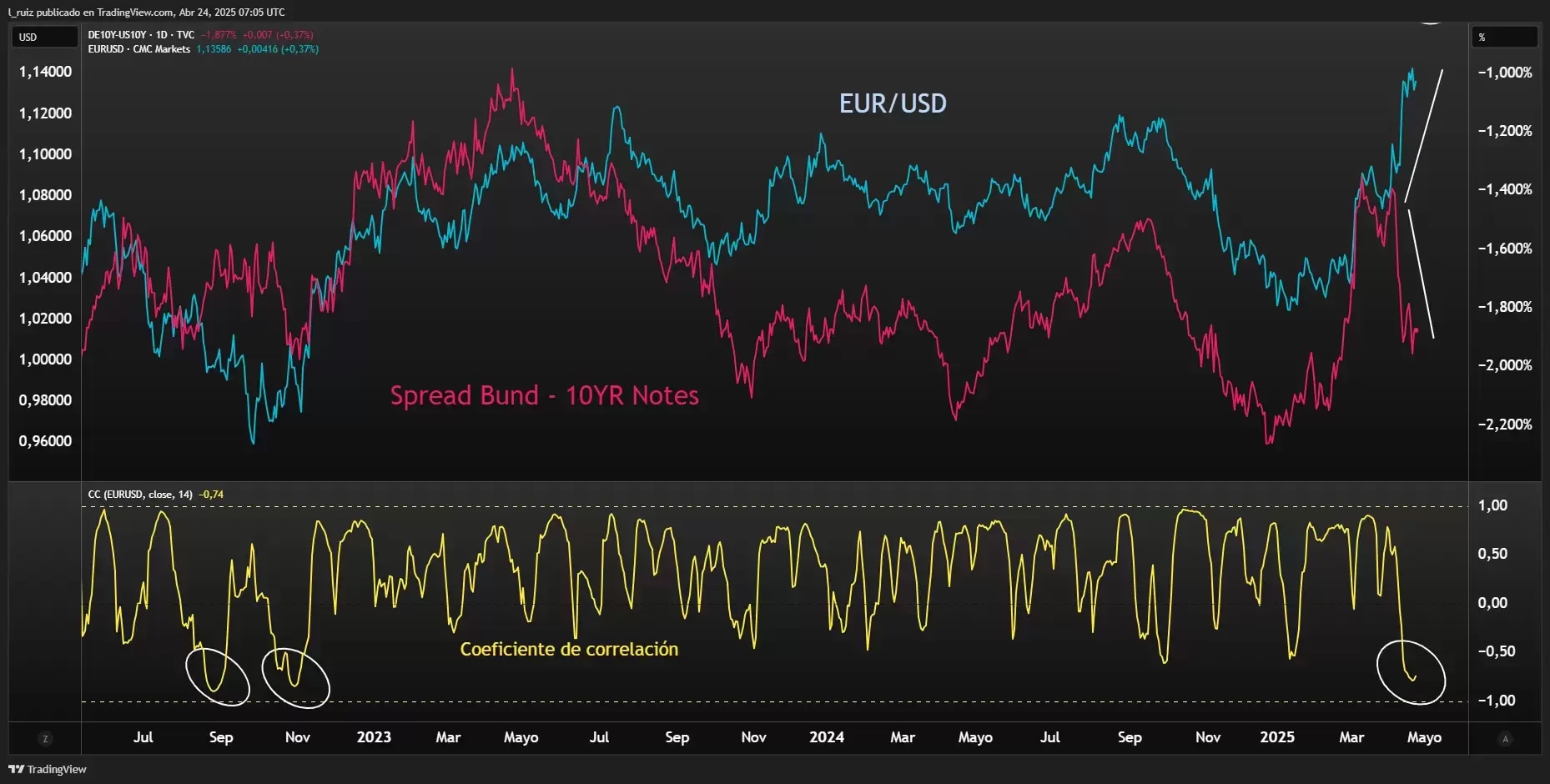

From a fundamental perspective, the US dollar's decline hasn’t been accompanied by falling interest rates; in fact, US interest rates have risen sharply, signalling growing distrust in the economy. Thus, despite a sharp increase in interest rate differentials favouring the US (nearly 2% at the 10-year mark against the German Bund), carry trades have been unable to stop the dollar’s slide.

The situation could shift if the Trump administration restores confidence and stops fighting the rest of the world. In this regard, belligerence has decreased significantly this week; Trump isn't planning to fire US Federal Reserve chair Jay Powell and is reaching out to China on trade. If this “return to normal” continues, the battered greenback may try to stabilise at key support levels.

CMC Markets erbjuder sin tjänst som ”execution only”. Detta material (antingen uttryckt eller inte) är endast för allmän information och tar inte hänsyn till dina personliga omständigheter eller mål. Ingenting i detta material är (eller bör anses vara) finansiella, investeringar eller andra råd som beroende bör läggas på. Inget yttrande i materialet utgör en rekommendation från CMC Markets eller författaren om en viss investering, säkerhet, transaktion eller investeringsstrategi. Detta innehåll har inte skapats i enlighet med de regler som finns för oberoende investeringsrådgivning. Även om vi inte uttryckligen hindras från att handla innan vi har tillhandhållit detta innehåll försöker vi inte dra nytta av det innan det sprids.