Markets are in chaos. Liquidity, spreads, and the depth of even the most liquid benchmarks are suffering, and volatility has skyrocketed. Based on fear levels and positioning indicators, it's safe to say the market is capitulating.

According to the theory of contrary opinion, this is when the best opportunities could arise. However, it's crucial to gain perspective and focus on the root cause of the problem to determine whether this is the start of something bigger.

Biggest flight to safety since Covid

Markets are seeing their strongest flight to safety since Covid, comparable to the 2008–2009 financial crisis. US crude oil benchmark West Texas Intermediate is plunging past yearly lows, US 10-year Treasury yields have dropped below 4%, and the S&P 500 is down 20% from its peak, testing a long-term uptrend from 2020, 2022, and 2023 lows.

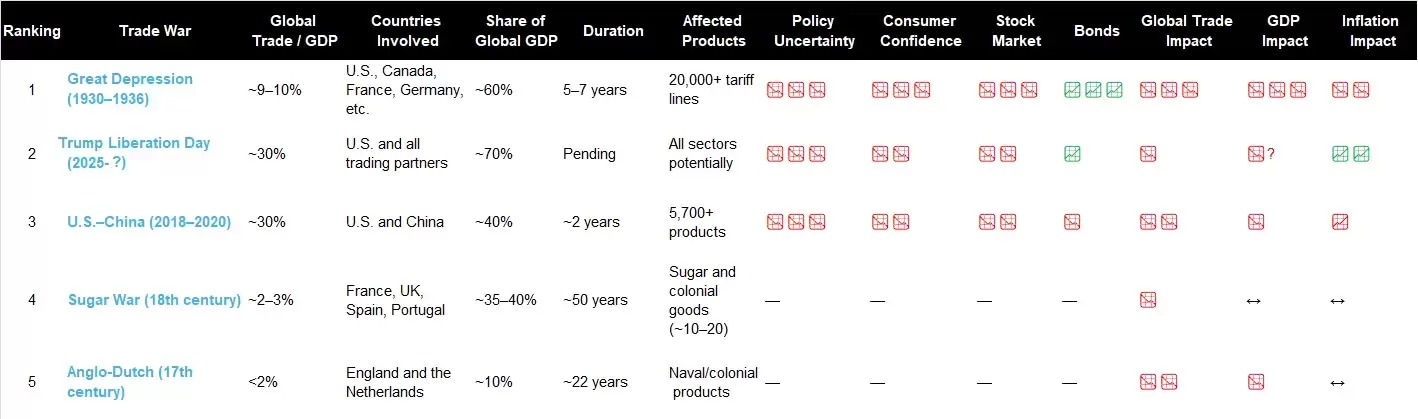

The trigger is President Trump’s "Liberation Day" and the trade war it launched. To put it into perspective, we’ve compiled a historical comparison and ranking of trade wars.

Trade wars ranked

For now, with China matching Trump’s tariffs, we could be entering a new US-China trade war like that of 2018–2020, with a comparable market crash.

Are we closer to 2018 or 1930?

The difference between 2018 and 1930 is stark. In 2018, the trade war eased, and markets quickly stabilised. The 1930 trade war deepened the recession and led to the Great Depression, with dire consequences for the economy and stock markets.

If the current trade war escalates and major economies like Europe, India, and Japan follow China’s lead and hit back at Trump’s reciprocal tariffs, we could face a worst-case scenario, potentially exceeding the Great Depression’s scale and global impact. The damage could be worse this time, as today’s economies are far more interconnected and global trade plays a much larger role in GDP. High global debt levels add to the risk if a recession hits, fuelling concerns from those warning of a great reset.

If the trade war doesn't escalate and other economies choose negotiation over retaliation, the worst-case scenario may fade, and markets could attempt a recovery. From a technical perspective, a first sign of this may be stock CFDs recovering the upper band of this week's downward opening gap (5,039 points for the S&P 500).

Time is running out

Beyond any announcements from parties involved in the trade war, the high level of uncertainty is taking its toll on economies, particularly the US. Last week’s ISM surveys show a sharp drop in business activity, and falling consumer confidence continues to signal recession risks.

On 11 April at 3pm (UK time), the University of Michigan will release its latest consumer sentiment index. Any market rebounds without an improvement in macroeconomic indicators may prove short-lived.

CMC Markets er en ‘execution-only service’ leverandør. Dette materialet (uansett om det uttaler seg om meninger eller ikke) er kun til generell informasjon, og tar ikke hensyn til dine personlige forhold eller mål. Ingenting i dette materialet er (eller bør anses å være) økonomiske, investeringer eller andre råd som avhengighet bør plasseres på. Ingen mening gitt i materialet utgjør en anbefaling fra CMC Markets eller forfatteren om at en bestemt investering, sikkerhet, transaksjon eller investeringsstrategi. Denne informasjonen er ikke utarbeidet i samsvar med regelverket for investeringsanalyser. Selv om vi ikke uttrykkelig er forhindret fra å opptre før vi har gitt dette innholdet, prøver vi ikke å dra nytte av det før det blir formidlet.