US inflation, as measured by the personal consumption expenditure (PCE) price index, was up 6.3% in the year to April, having slowed from 6.6% in March.

Simon Moore, senior contributor at Forbes, wrote that “stripping out food and energy, annual inflation fell back to 4.9%, a rate of growth we last saw in December 2021. It’s too early to be sure, but inflation may be trending lower”. He’s referring to core PCE, the Fed’s preferred measure of inflation, which excludes food and energy costs. Needless to say, if you cut out two of the areas where prices are soaring fastest, that’s bound to take the edge off inflation.

An update on another key measure of inflation, the consumer price index (CPI), will be released on 10 June, just before the next Federal Reserve meeting on 14-15 June.

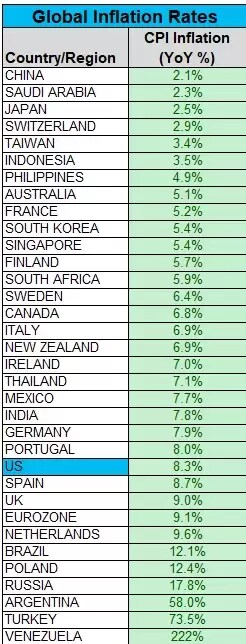

As the chart below shows, US inflation as measured by CPI is running at 8.3% – a higher rate than in most other developed economies.

In anticipation of a tamer CPI reading in the year to May, the overall stock market is holding near-term support with many investors counting on the Fed to be less extreme on their rate-raising narrative. But are retail investors being too optimistic?

Commodity prices have surged

Because core PCE removes food and energy costs from its calculations, it paints a prettier picture of inflation than that which consumers are experiencing. The price of a barrel of Brent crude oil is selling for around $120, up almost 50% this year. Other commodities, such as wheat, corn and soybeans, have seen similar rallies, leading to concerns about global food shortages.

Take this as a good or bad sign, but if one adjusts for inflation, oil prices remain 30% below their 1980 level when prices had quadrupled.

High inflation – but it could be worse

The global economy is dealing with weak growth, rising prices driven by reasonably strong demand, supply chain issues, and a large money supply from years of monetary accommodation by central banks. Looking at the above table of global inflation rates, you may be surprised to see that China’s rate of CPI inflation is only 2.1%, while Venezuela’s is 222%.

While inflation in the US and the UK appears modest in comparison to Venezuela, Turkey and Argentina, inflation in the world’s largest and fifth-largest economies remains relatively high at 8.3% and 9.0%, respectively.

What worries me is that if oil and food prices remain in an uptrend, these inflation numbers are still relatively small compared to what they could be.

Pressure on the dollar

Another aspect of inflation must be examined through the US dollar. We often hear experts say that while the dollar is strong, the price of goods will not rise too much.

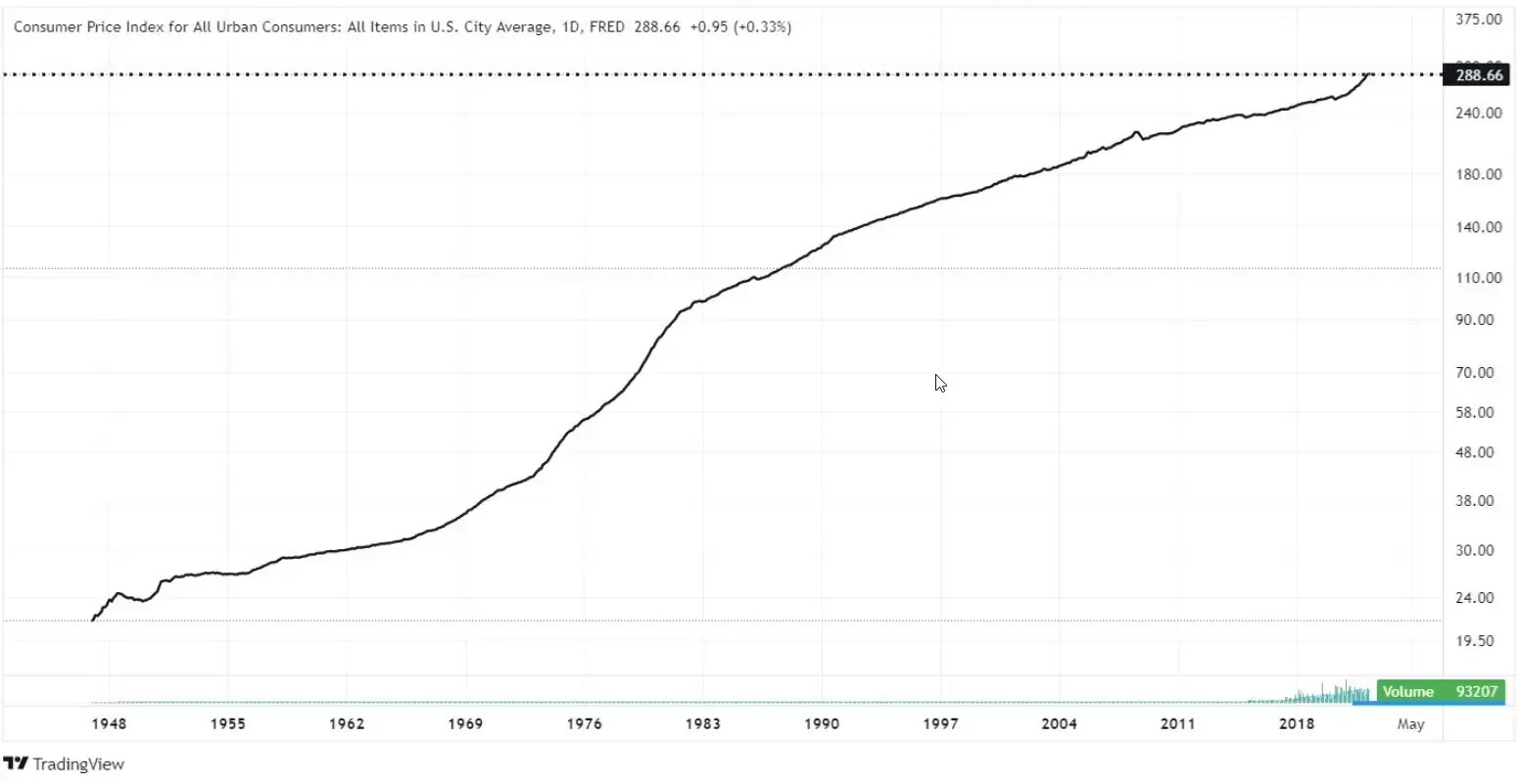

Which brings me to the below chart showing the CPI destruction of purchasing power related to the dollar. If we compare 1947 to today, $1 then would be worth about 7.4 cents now.

Despite having a relatively strong run-up, the US Dollar may very well have peaked for now, having reached its highest levels since 2017.

If, as seems possible, the dollar has already peaked, a declining dollar will almost certainly result in a significant rise for gold, as I have discussed previously.

Cheap gold

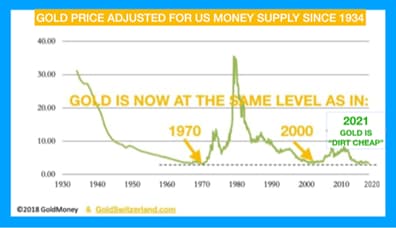

Speaking of gold, its price adjusted for US money supply since 1934 tells its own harrowing inflation story.

The key takeaway from the below chart is that it would be an understatement to say that gold is dirt cheap. If oil is still well below historical, inflation-adjusted prices, then gold is basically the same price as it was in 1970, again adjusting for inflation. The conclusion that inflation has peaked therefore seems naive.

Rising prices for fossil fuel stoke interest in renewables

To layer in another factor, as the price of oil rises, interest in alternative energy sources increases.

However, an analyst at JP Morgan warned that the cost of a green tomorrow is that capital expenditure on mining needs to double. The analyst claimed that the transition to renewable energy will be expensive if we are to prevent metal shortages and achieve net zero.

Gathering storm clouds?

Several factors are now piling up. We have droughts in the west of the US and hurricanes in the east, the Russia-Ukraine war shows no signs of abating, oil prices remain stubbornly high despite an increase in production, employers are offering higher wages to lure workers yet pay rises are still well below inflation, China is emerging from its Covid slumber, the shift towards alternative energy could increase demand for metals and rare earth minerals, and global food shortages are creating the potential for social unrest.

My conclusion? As far as inflation is concerned, we’re not out of the woods yet.

ETF support and resistance levels

S&P 500 (ETF ticker: SPY) 417.44 to clear

Russell 2000 (IWM) watch for second close over 50-DMA at 190

Dow (DIA) 334.73 the 50-DMA resistance

Nasdaq (QQQ) 314.56 resistance

Regional banks (KRE) 65 resistance

Semiconductors (SMH) Watch for a push towards 250

Transportation (IYT) 241 next area to clear

Biotechnology (IBB) 112 support area

Retail (XRT) 68 to clear

Agriculture (DBA) 22.18 the 50-DMA, 21.80 support area

Gold (GLD) 171.89 pivotal

Oil (USO) 20.65 to clear

Mish Schneider is MarketGauge’s director of trading education and research. Read more of her market analysis here, or visit marketgauge.com.

CMC Markets er en ‘execution-only service’ leverandør. Dette materialet (uansett om det uttaler seg om meninger eller ikke) er kun til generell informasjon, og tar ikke hensyn til dine personlige forhold eller mål. Ingenting i dette materialet er (eller bør anses å være) økonomiske, investeringer eller andre råd som avhengighet bør plasseres på. Ingen mening gitt i materialet utgjør en anbefaling fra CMC Markets eller forfatteren om at en bestemt investering, sikkerhet, transaksjon eller investeringsstrategi. Denne informasjonen er ikke utarbeidet i samsvar med regelverket for investeringsanalyser. Selv om vi ikke uttrykkelig er forhindret fra å opptre før vi har gitt dette innholdet, prøver vi ikke å dra nytte av det før det blir formidlet.