Last week saw a strong performance from European markets, despite a shaky start, with the FTSE100 closing at a 19-month high, and above 7,200 for the first time since February 2020.

For all the negativity around port disruptions, supply chain delays, labour shortages and surging energy prices, investors are taking the positives from earnings reports, which by and large are beating expectations across the board.

While there are understandable concerns about the effect surging energy prices will have on consumer disposable incomes, there appears to be rising confidence that with the amount of excess savings still unspent that there is a bit of a buffer in the event we do get some element of demand destruction in the weeks ahead. The big question is around how large that buffer is, and how in terms of higher prices can consumers withstand?

US markets also finished the week in solid fashion, with the Dow posting its best week since June, and within 1% of its record high, with the S&P500 and Nasdaq also finishing the week strongly.

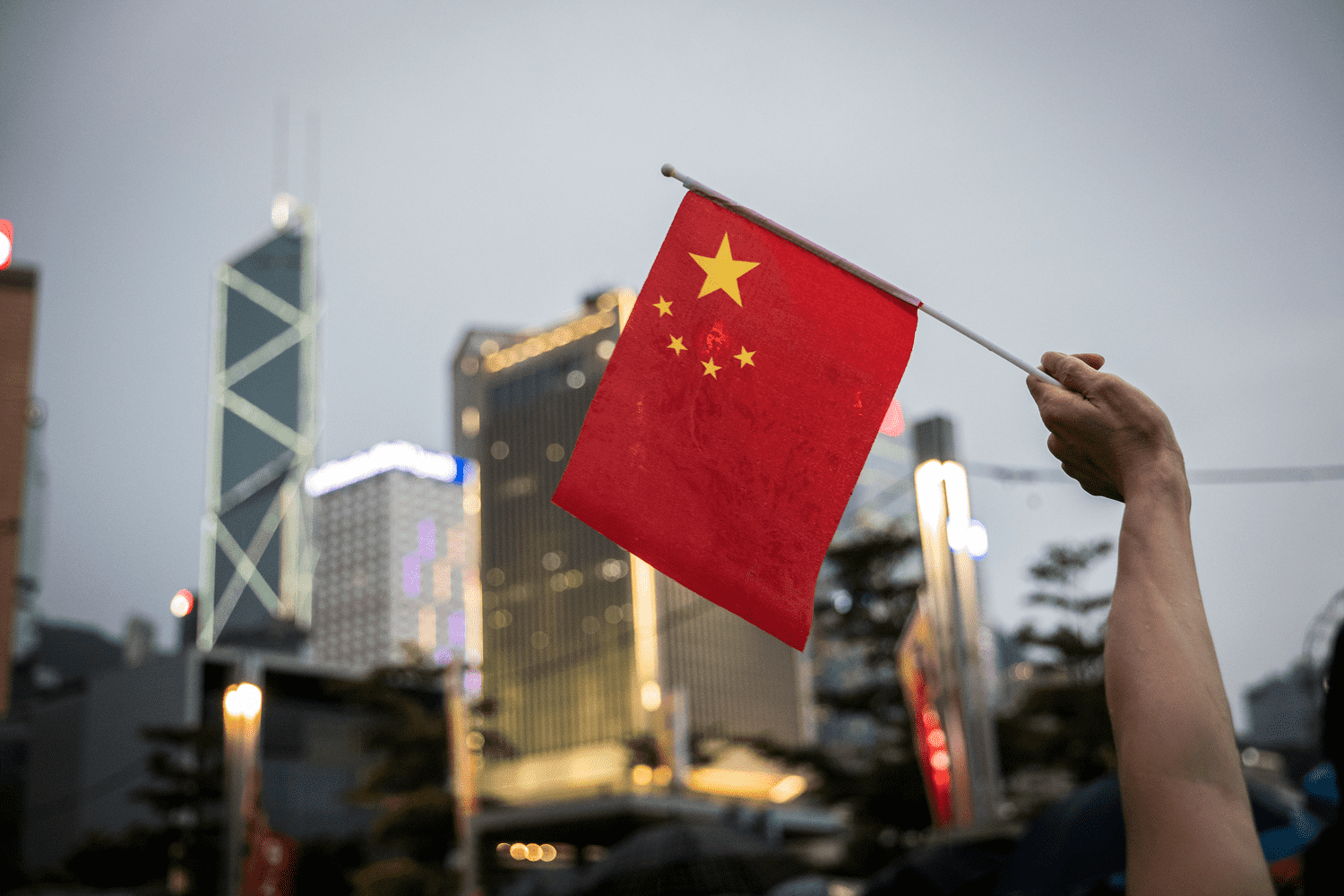

Markets in Asia have got off to a shaky start, with the main attention on this morning’s disappointing China Q3 GDP, and retail sales and industrial production data for September.

At the beginning of this year, it was widely expected that the Chinese economy would see annual GDP growth of around 6%, a number at the time which was thought to be somewhat on the pessimistic side.

As it turns out this now looks a little too optimistic, given the sharp slowdown we’ve seen in this morning’s Q3 numbers.

In Q1 the Chinese economy grew by 0.4%, and 18.3% on an annual basis. On an annual basis this slowed sharply in Q2, to 7.9% although on the quarter we did see a modest improvement to 1.3%. This morning’s latest numbers saw the Chinese economy almost grind to a halt on a quarterly basis, with a rise of 0.2%, below expectations of 0.4%.

It’s not hard to understand why this morning’s Q3 GDP has disappointed with the various port disruptions seen throughout the quarter due to covid restrictions, supply chain issues, as well as surging power costs and enforced shutdowns of the Chinese economy. The performance of the economy hasn’t been helped by the various crackdowns by Chinese authorities on various parts of the economy, as well as the problems around Evergrande and the property sector.

The recent slowdowns in recent PMI numbers have shown a sharp slowing in economic activity and demand for imports has also slowed. Today’s 0.2% economic expansion has also translated into a weaker year on year number of 4.9%, which currently puts it below the Chinese governments mandated 6% target.

The various factory shutdowns in September, due to rising energy costs, also acted as a drag on industrial production in September, coming in at 3.1%, well below expectations, although retail sales which slowed sharply in August to 2.5%, came in better than expected at 4.4%.

The pound had a strong week last week, hitting its highest level against the euro since February 2020, and a 5 year high against the Japanese yen, as rising gilt yields increase its attractiveness, against the low and negative yielders. Bets that the Bank of England could well look to react to rising inflationary pressures before the end of the year has seen the market start to price in a number of rate hikes before the end of 2022.

Despite concerns that the Bank of England might be about to make a policy mistake, governor Andrew Bailey did nothing to alleviate the prospect that the central bank might well have to act before the end of this year, when he said that if inflation expectations start to become more entrenched the MPC would act. While he insisted that he still believed the current increase in energy prices was transitory, he did say it could last longer than originally anticipated.

EUR/USD – the rebound from support at 1.1520 ran out of steam at the 1.1625 area last week. We have resistance at the October highs at 1.1640/50. A break above that, targets resistance at 1.1760. Below 1.1520 targets the 1.1450 area.

GBP/USD – had a solid week pushing above the 1.3750 area on Friday. This puts us on course for a move towards 1.3900, however we need to break above trend line resistance from the June highs at 1.3820 first. Support now comes in at 1.3670.

EUR/GBP – slipped back to the 0.8420 area last week, which potentially opens up further weakness towards 0.8280, and the 2020 lows. We now have resistance at the 0.8470 level, as well as the 0.8520 area.

USD/JPY – found support at 113.20, last week, and has now broken through 114.00 putting us on course for a move towards the 2018 peaks at 114.75 the next target. We could slip back towards the 112.40 level, on a break below 113.00.

CMC Markets erbjuder sin tjänst som ”execution only”. Detta material (antingen uttryckt eller inte) är endast för allmän information och tar inte hänsyn till dina personliga omständigheter eller mål. Ingenting i detta material är (eller bör anses vara) finansiella, investeringar eller andra råd som beroende bör läggas på. Inget yttrande i materialet utgör en rekommendation från CMC Markets eller författaren om en viss investering, säkerhet, transaktion eller investeringsstrategi. Detta innehåll har inte skapats i enlighet med de regler som finns för oberoende investeringsrådgivning. Även om vi inte uttryckligen hindras från att handla innan vi har tillhandhållit detta innehåll försöker vi inte dra nytta av det innan det sprids.