Spread betting forex

Published on: 09/11/2021 | Modified on: 31/01/2023

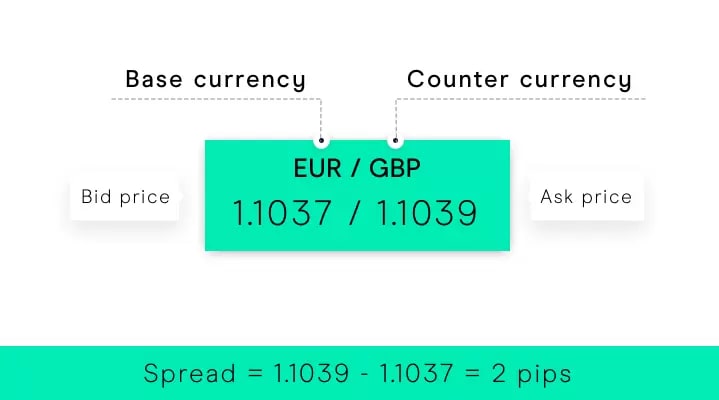

Spread betting forex is a type of spread betting that involves speculating on the price movements of currency pairs. Spread betting in forex involves opening a position based on whether you think the price of a currency pair is due to rise or fall, resulting in either profits if the market moves in your favour, or losses if the market goes against you.

This article discusses the best tips and strategies for currency spread betting, along with the differences between spread betting and CFDs. We offer 300+ forex pairs on our online trading platform, including major forex currency pairs, such as the EUR/USD and USD/JPY, as well as minor and exotic crosses.

KEY POINTS

- Spread bets are a derivative trading product that allow you to trade tax-free in the UK* and Ireland

- You can bet on both sides of the market, taking either a buy or sell position

- A narrower spread means you can enter and exit trades more quickly

- Our margin rates start at just 3.3% or a 30:1 leverage ratio for major currency pairs

- Popular forex trading strategies that can be used with a spread betting account include scalping, day trading, swing trading and hedging