Calculating spread betting margins

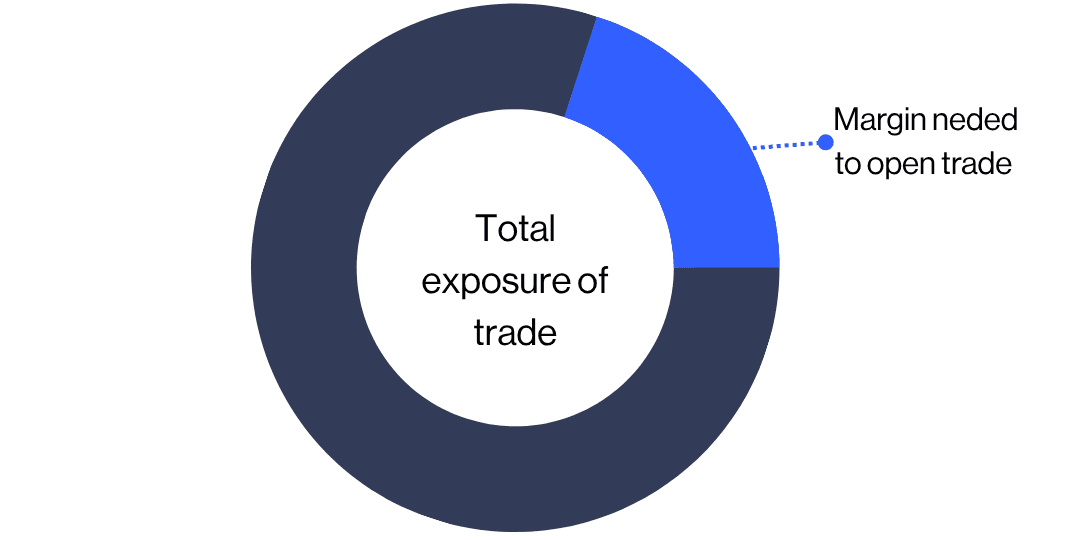

Spread betting is a leveraged product, which means you only have to place a percentage of the full trade value to open a position. For example, if you placed a spread bet on a share you would need to deposit 20% of the full trade value as the margin requirement.

Spread betting margin explained

When trading with a margin account, the margin you will be required to deposit reflects a percentage of the full value of the position you wish to open. We refer to this as 'position margin' on our platform. The position margin will be calculated using the applicable margin rates, as shown in the product library area on the platform.

For shares, different margin rates may apply depending on the size of your position or the tier of your position (or a portion of your position) in that instrument. The portion of the position that falls within each tier is subject to the margin rate applicable to that tier.

In order to calculate the position margin, the level 1 mid-price (shown on our trading platform) is used.

Position margin example

Here is an example using Company ABC (GBP) margin rates.

The sum of:

Stake in Tier 1 x Tier 1 Margin rate

Stake in Tier 2 x Tier 2 Margin rate

Stake in Tier 3 x Tier 3 Margin rate

Stake in Tier 4 x Tier 4 Margin rate

Stake in Tier 5 x Tier 5 Margin rate

x level 1 mid-price x point multiplier

Based on the margin rates in the table below for Company ABC (GBP), a position of £65 per point, using the level 1 mid-price of 275.0 (£2.75), would require a position margin of £5,018.75.

Spread betting margin calculator

Your position margin requirement is calculated as follows:

The notional value of your total position is: £17,875.00 (65 x 275).

Spread betting margin requirement

Spread betting using margin allows you to open a position by only depositing a percentage of the full value of the position. This means that your losses will be amplified and you could lose all of your capital. Profits and losses are relative to the full value of your position. Learn more about our trading fees.

Spread betting using margin is not necessarily for everyone and you should ensure you understand the risks involved and if necessary seek independent professional advice before placing any spread bets.

At CMC Markets, our margin rates are the same across both spread betting and CFD products. For example, you can trade on 330+ currency pairs starting at just 3.3% margin, or 80+ global indices starting at 5%. Browse our range of markets for more examples.

In trading, the spread is the difference between a financial instrument's buy price and sell price. The buy price is typically higher than the sell price. The spread can widen or contract depending on market conditions. Read more about calculating the bid-ask spread.

Spread betting position margin is calculated margin rates, which vary depending on the asset class (forex, indices, commodities) and specific instrument you trade on. Spread betting margin also depends on the size of the position that you wish to open.

You can deposit as much or as little capital as you want into your spread betting account, once you’ve opened an account with us. Leveraged trading means you only need to pay an initial deposit to open a trade, based on the instrument’s margin requirement. However, you need to have sufficient funds in your account to cover your margined trades and prevent account close-outs.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.