Forex forward contracts

Spread bet and trade CFDs on our forex forward contracts. Enjoy competitive spreads, one of the UK's highest-rated web and mobile platforms, plus the best customer service in the industry*.

Browse our table of FX forwards below and use the search bar to browse the most popular forward contracts that we offer within the forex, commodities, indices and treasuries markets. Log in to our platform or create an account on the right-hand side to access the 220+ forward contracts available.

Pricing is indicative. Past performance is not a reliable indicator of future results. Client sentiment is provided by CMC Markets for general information only, is historical in nature and is not intended to provide any form of trading or investment advice - it must not form the basis of your trading or investment decisions

What are forex forward contracts?

Our FX forward contracts represent a number of major, minor and exotic currency pairs within the forex market. Forex forwards are derivative products that allow traders to buy or sell a currency pair at a specific price on a specific future date. This means that you do not take ownership of the asset, but rather speculate on its price, based on whether you think that the base or quote currency will strengthen against the other by the specified end date of the contract.

You may wish to trade currency forwards if you aim to open longer-term positions within the FX market without the extra fees, as these are not subject to overnight holding costs. You can spread bet on FX forwards tax-free in the UK and Ireland** or trade CFDs on a global level. Our forex forward contracts are traded over the counter (OTC), and they are not standardised for everyone.

FX forward rates

Our FX forward rates are calculated based on the spot rate (current market valuation) and the length of time that you intend to hold onto the contract, plus the contract expiration date. The currencies that market participants intend on trading are also factored into the calculation.

The main benefit of this approach is that it allows market participants to “lock in” an exchange rate for a future date, at any time. This process helps market participants to hedge against forex exchange market risk between the date they went long or short on the FX forward and the date of its expiration.

It’s worth noting that when spread betting or trading CFDs on FX forwards, you are speculating on the price movements of the contract and not actually purchasing the underlying forward contract itself.

The terms FX forwards contracts are usually agreed upon include:

- The date on which the contract should end

- What time the contract should end

- Whether the contract is to buy or sell the currency

- What amount should they be bought or sold in

What are FX forward curves?

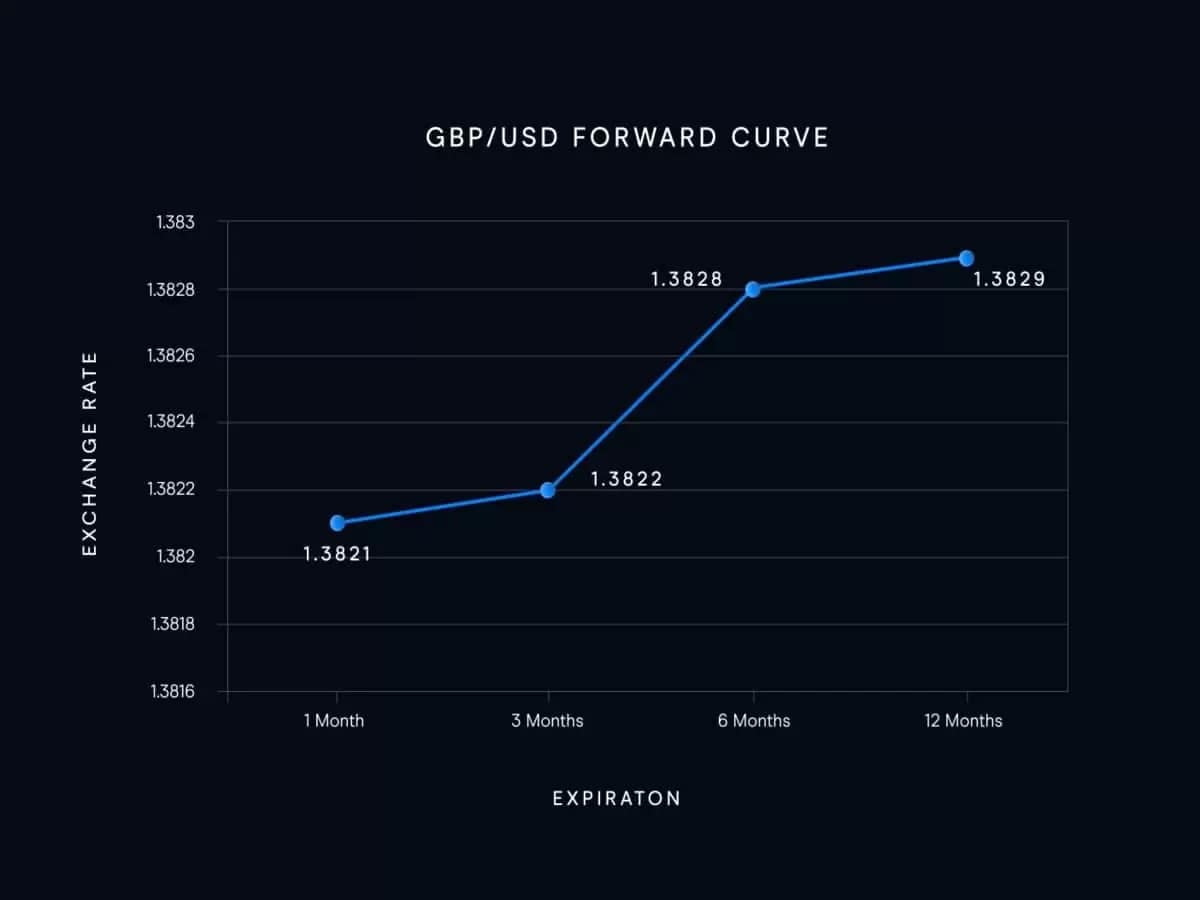

FX forward curves are visual representations of the settlement prices of the asset that you are planning to enter a contract for. It’s important to note that the curve does not display the current market values of assets, so a settlement price offer in one months’ time may be higher or lower than what the current FX forward contracts are valued at.

There are two types of “curves”: an upwards curve that reflects an increasing in the expected settlement price of the held asset, which is referred to as a normal curve; and an inverted curve, where the settlement prices decrease over time.

Trading hours shown in London local time

Why trade FX forwards with CMC Markets?

No.1 Web-Based Platform

ForexBrokers.com

No.1 Platform Technology

ForexBrokers.com

Best Spread Betting Provider

City of London Wealth Management Awards

FAQs

New to trading?

Is it free to open an account?

There's no cost when opening a live spread betting or CFD account. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you will need to deposit funds in your account to place a trade. You can find out more about the costs of placing a trade.

Is CMC Markets regulated by the FCA?

Yes, CMC Markets UK plc (registration number 173730) is fully authorised and regulated by the Financial Conduct Authority (FCA) in the UK. Retail client money is held in segregated client bank accounts and money held on behalf of clients is distributed across a range of major banks, which are regularly assessed against our risk criteria.

Is CMC Markets covered by the FSCS?

Yes, your eligible deposits with CMC Markets are protected up to a total of £85,000 by the Financial Services Compensations Scheme (FSCS), the UK's deposit guarantee scheme. If CMC Markets ever went into liquidation, retail clients would have their share of segregated money returned, minus the administrator's costs in handling and distributing these funds. Any shortfall of funds up to £85,000 may be compensated under the FSCS.

How does CMC Markets segregate client money?

Under the FCA’s Client Money rules, we’re required to segregate client money (unless you agree with us otherwise) from CMC’s own funds. The funds held in segregated bank accounts do not belong to CMC and will be held in a way that enables it to be identified as client money. Learn more about client money regulations

How does CMC Markets make money?

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, make a minor contribution to our overall revenue.

We never aim to profit from our clients' losses. Our aim is to build long-term relationships by providing the best possible trading experience through our technology and customer service.

What can I trade on with CMC?

You can spread bet and trade CFDs on over 12,000 instruments with us. See a list of all our popular markets and instruments.

FX Forwards

How are FX forwards priced at CMC Markets?

The price of our forex forwards is based on the spot rate that we generate at the time the contract is made and the interest rate differentials between the two currencies. Pricing will change for each individual currency pair as they don’t share the same values. Read more about forex trading.

How can I hedge currency risk with forward contracts?

Our FX forward contracts are binding, so traders can hedge against currency risk by locking-in the current exchange rate of the pair that’s being traded on. This helps to minimise the chance of losses from fluctuating exchange rates, which are often affected by supply and demand and the overall stability of the forex market. Remember that you’ll still be trading a derivative product and not purchasing the forward contract directly. Learn more ways you can hedge currency risk.

How is FX forward gain/loss calculated?

Traders can make a profit or loss from our FX forwards depending on how the currencies strengthen or weaken against each other throughout the duration of the contract, in comparrison with our benchmark at spot rate.