Take control of your investing journey with price plans best suited for you. Get access to the following:

6,000+ investments

Flexible Cash ISA

Flexible Stocks & Shares ISA

Self-invested Personal Pension (SIPP)

General Investment Account (GIA)

USD & EUR wallets (GIA only)

£0 commission per trade (other charges apply)

Capital at risk.

Our corporate account offers access to a CFD trading account for your business.

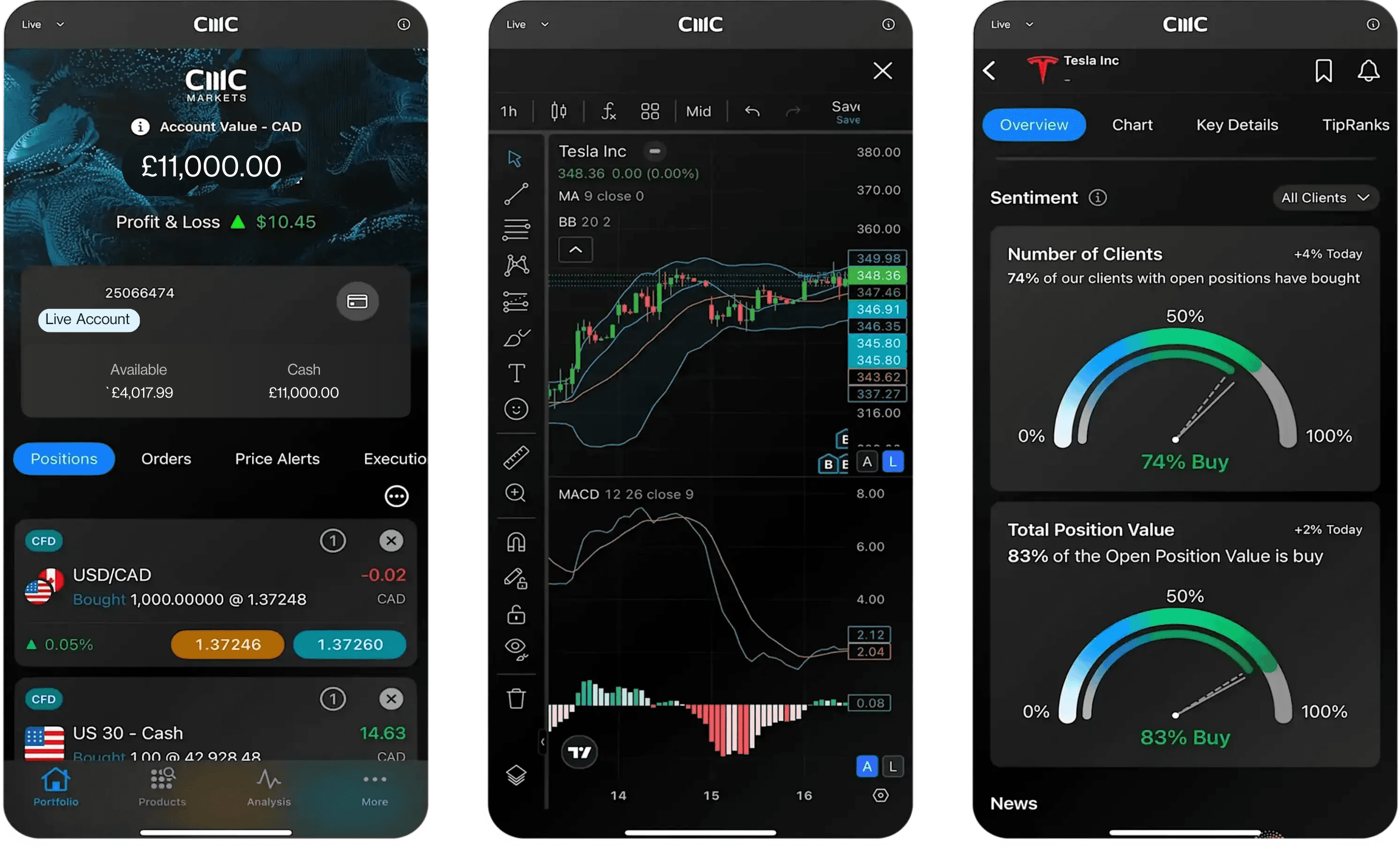

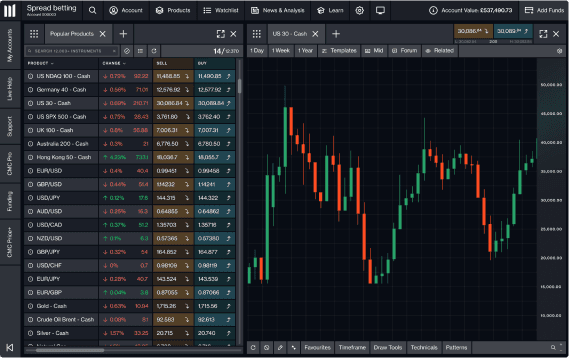

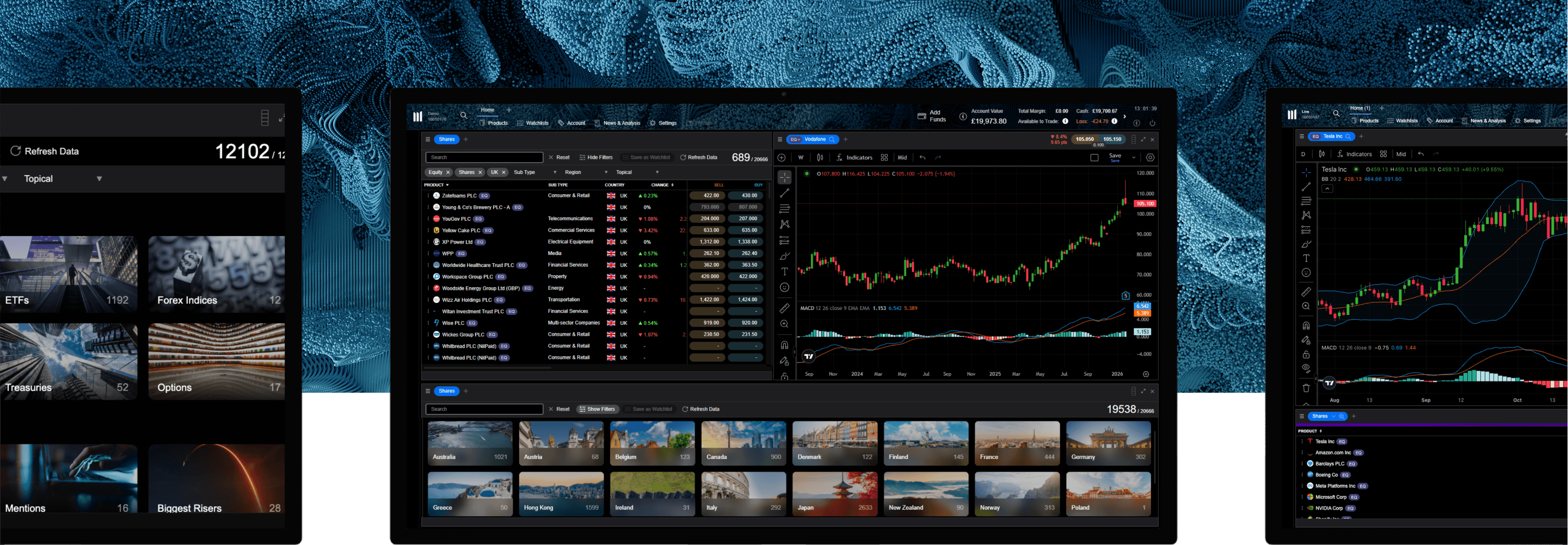

- 12,000 instruments

Trade with leverage

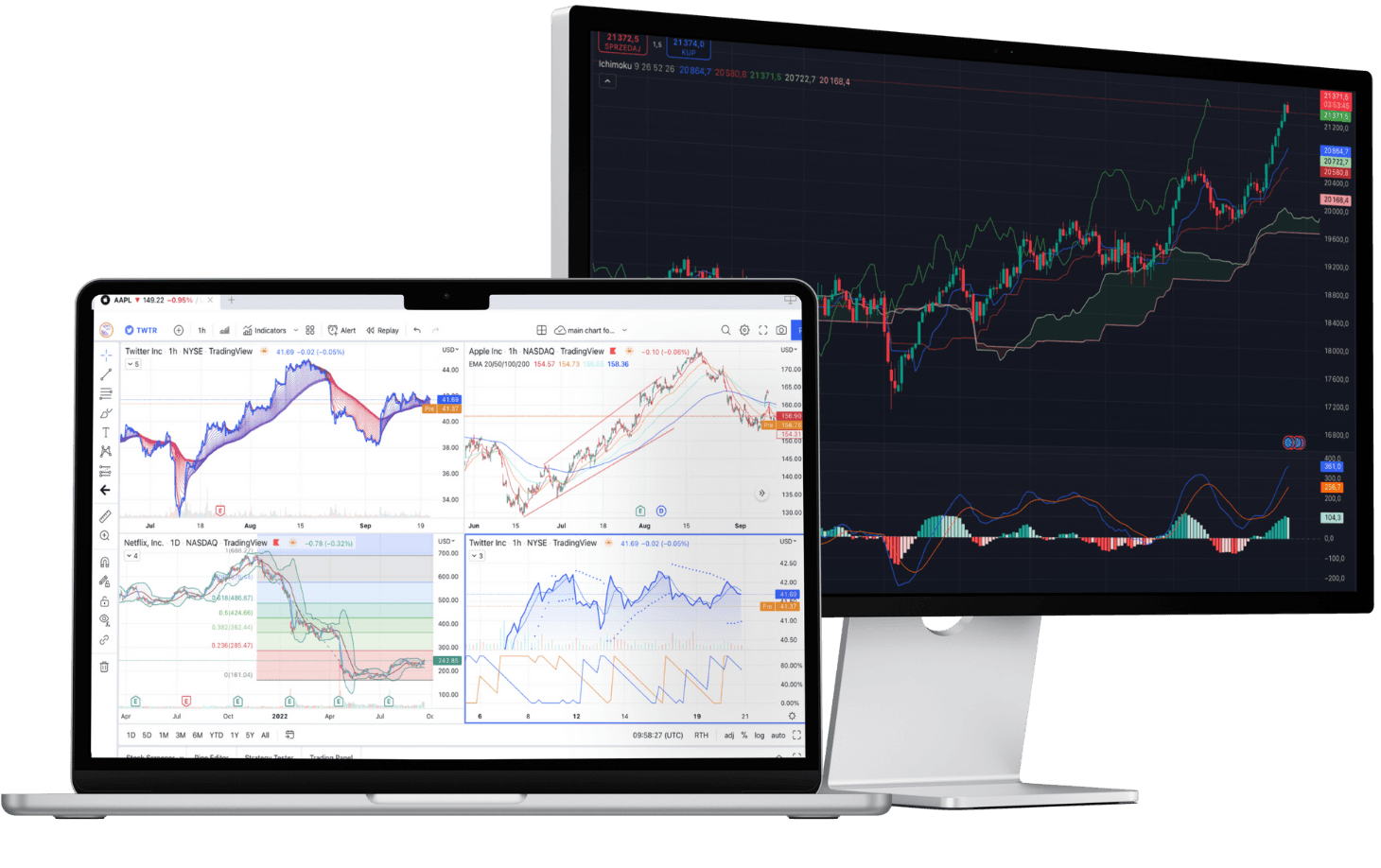

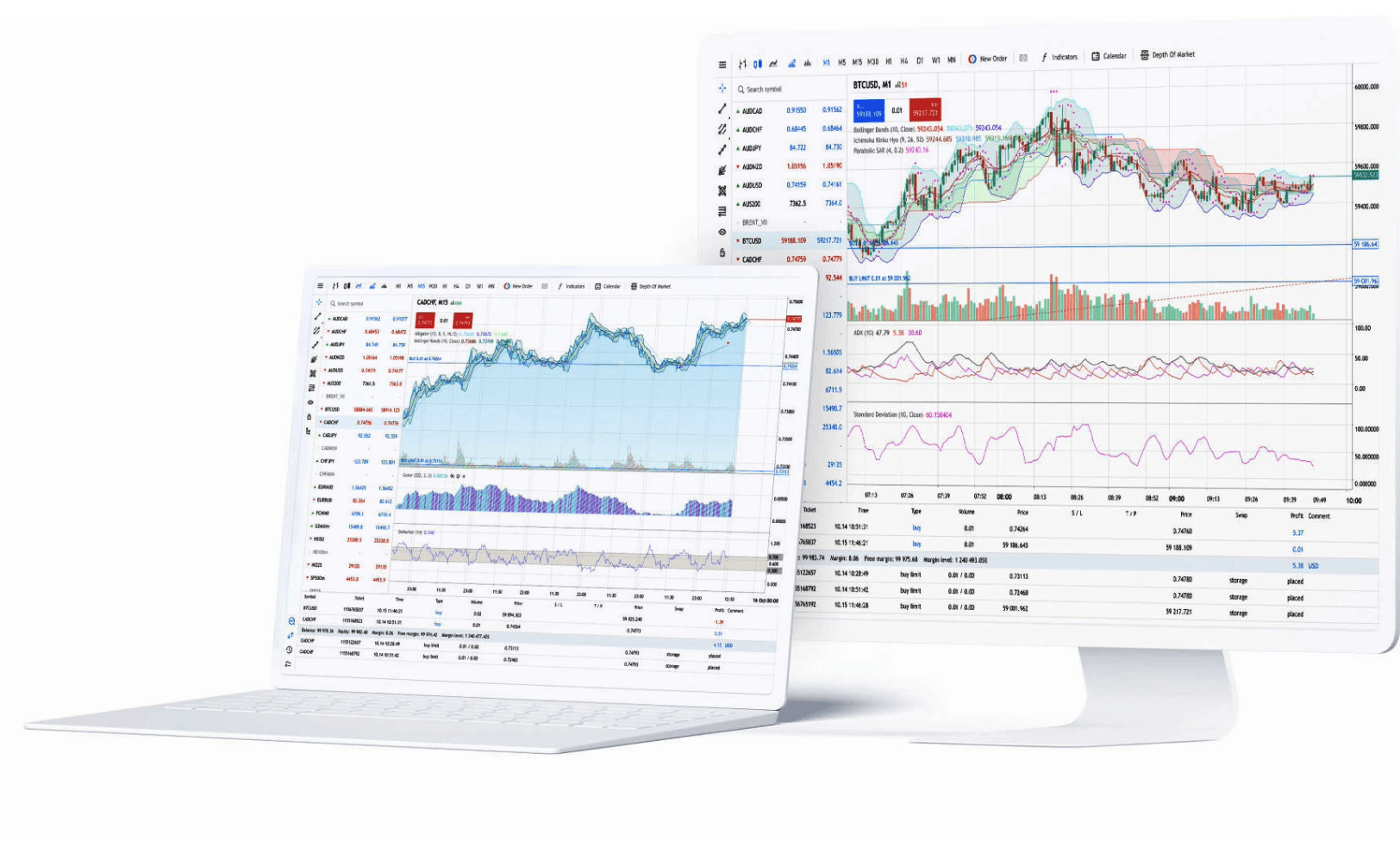

CMC web platform, iOS and Android app

MT4 platform available

24/5 customer support

Any questions?

Email us atclientmanagement@cmcmarkets.co.uk

or call on +44 (0)20 7170 8200We're available whenever the markets are open, from Sunday night through to Friday night.

1Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK

2Fixed commission at $2.5 per $100,000 notional value traded.

3Recent awards include: Best Broker for Active Traders, Professional Trader Awards 2025; Best Mobile Trading Platform and Best Spread Betting & CFD Education Tools, ADVFN International Financial Awards 2025; No.1 for Commissions & Fees & No.1 Most Currency Pairs, ForexBrokers.com Awards 2025; Best-in-class for Overall Excellence, Mobile Trading App, Platform & Tools, and Research, ForexBrokers.com Awards 2025.

4Based on over 2 million unique user logins across CMC's trading and investing platforms, including partners, as at November 2025.

Loading...

Loading...