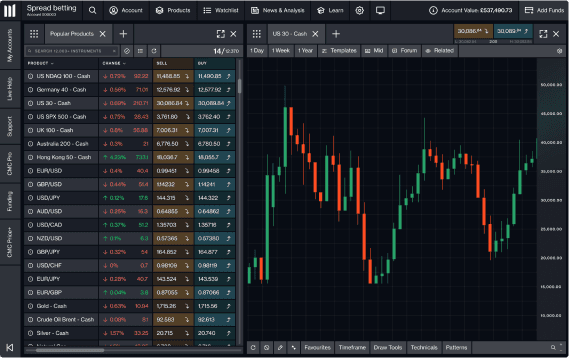

The UK's best online trading platform¹

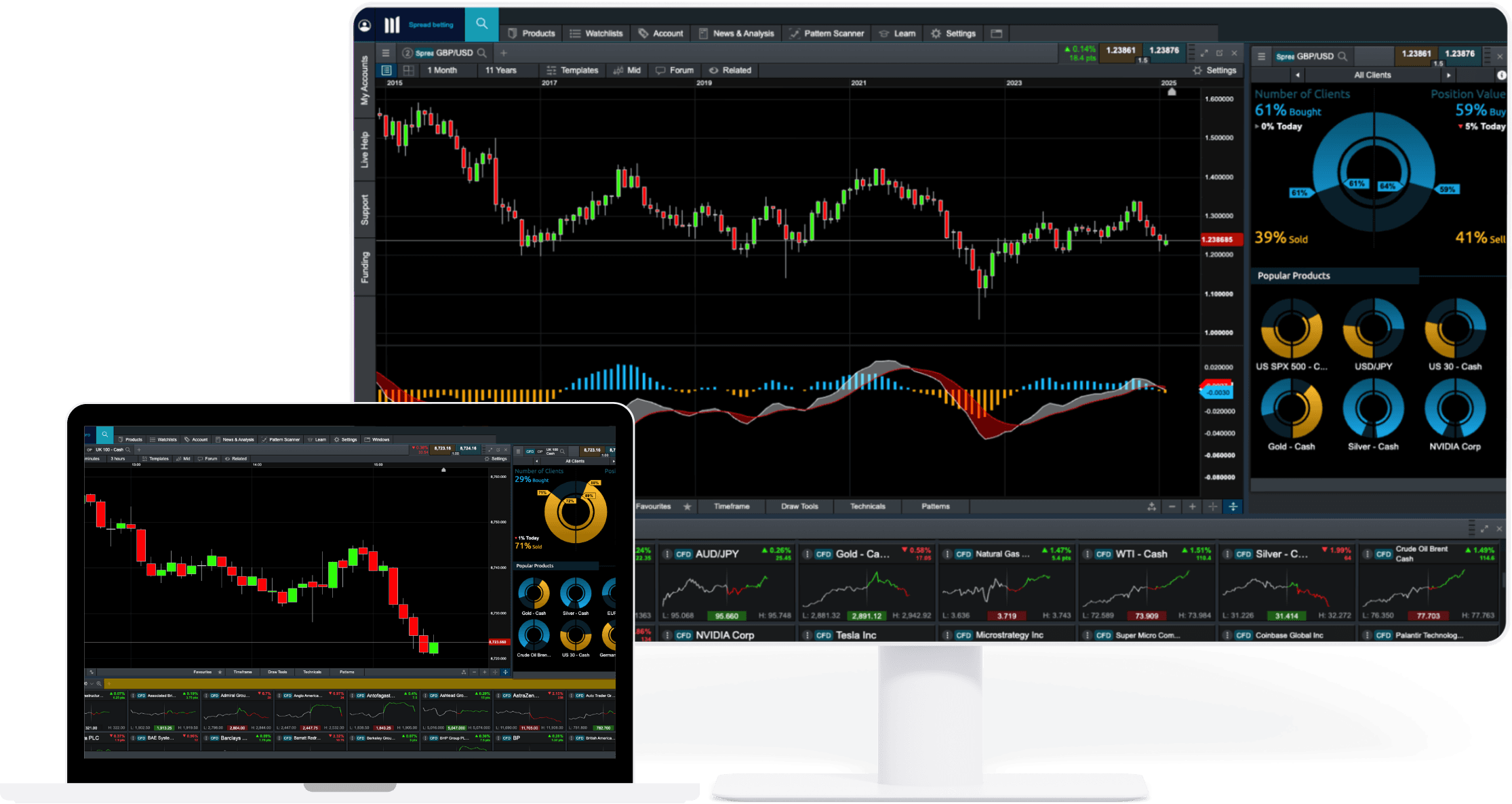

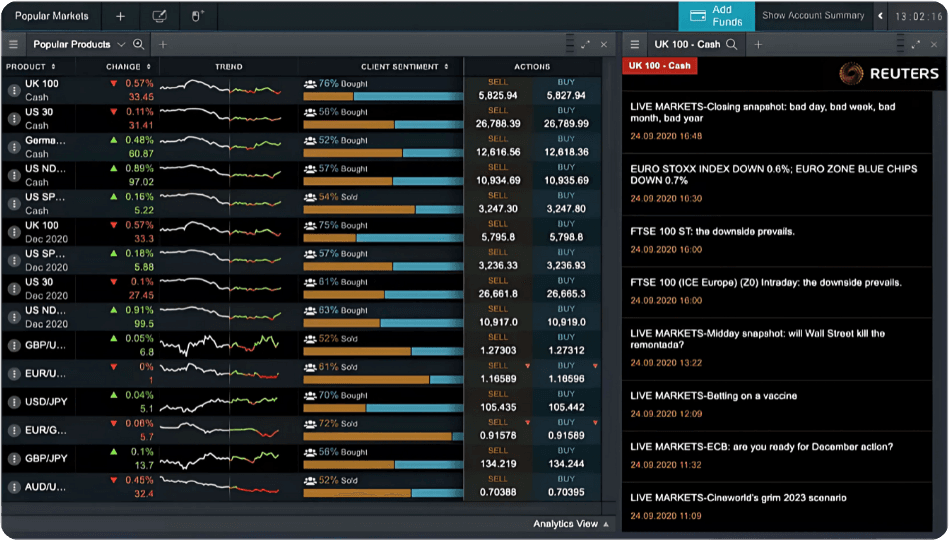

Our web trading platform is powerful and intuitive, combining leading-edge features and security, lightning-fast execution², and best-in-class insights. Designed to support any strategy.

ADVFN International Financial Awards

ForexBrokers.com Awards

Professional Trader Awards

Tools built to enhance your analysis

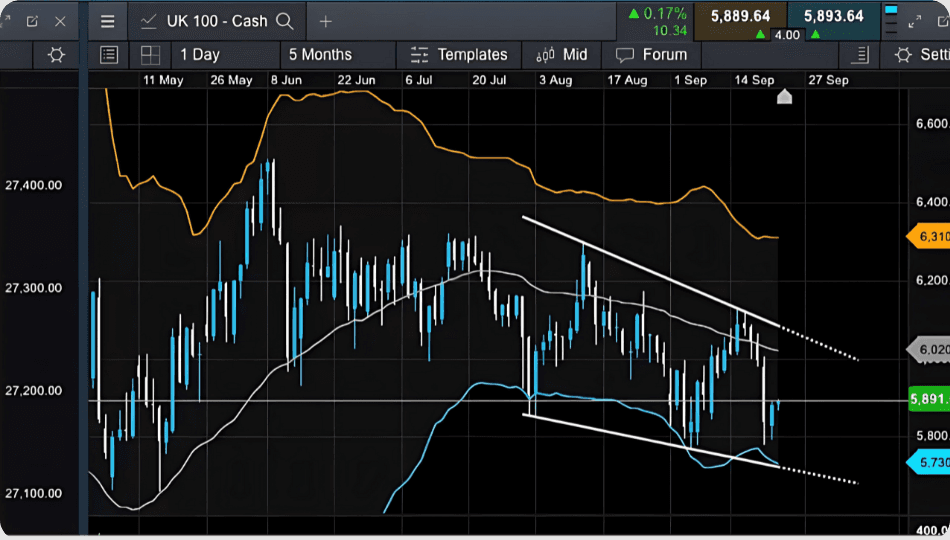

Powerful charting capability

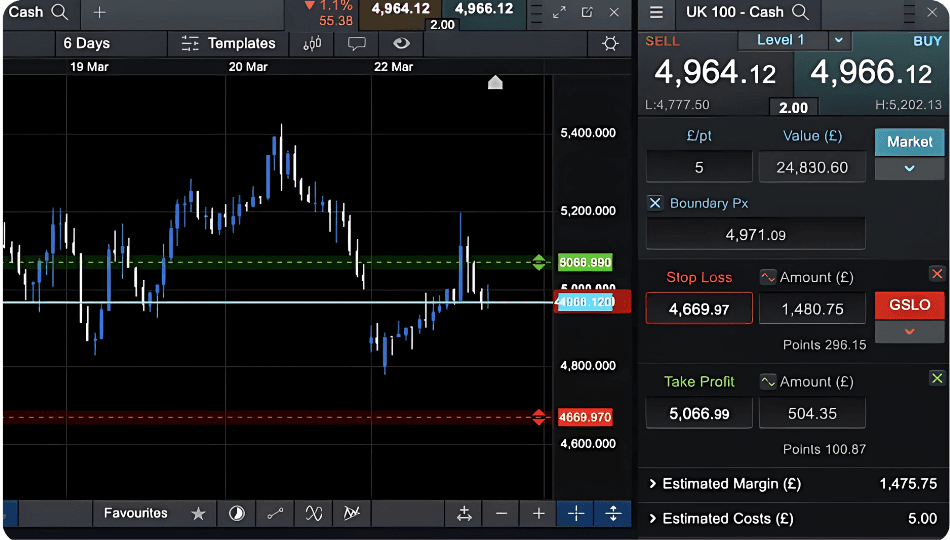

Advanced order execution

We offer a range of advanced order types, including trailing and guaranteed stop-loss orders, partial closure, market and boundary orders, so you have the flexibility to trade your way.

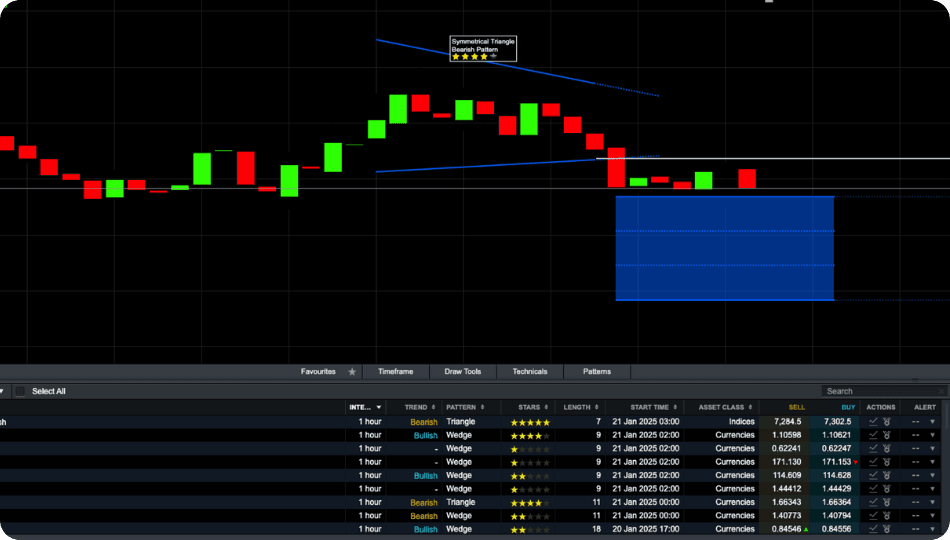

More on order executionPattern recognition scanner

We automatically scan over 120 of our most popular instruments every 15 minutes for emerging and completed chart patterns, such as wedges, channels and head & shoulders formations.

More on pattern recognitionReuters news and analysis

Stay up to date with market-impacting news through our streaming Reuters newsfeed, plus market insights from our analyst and trading teams.

Morningstar reports

Morningstar provides traders with independent equity analysis and ratings to help identify potential opportunities and risks. Using a quantitative fair value estimate, you can see whether a stock's price is potentially over- or undervalued. In addition, view cash flow data from the past five years, available exclusively for live account traders.

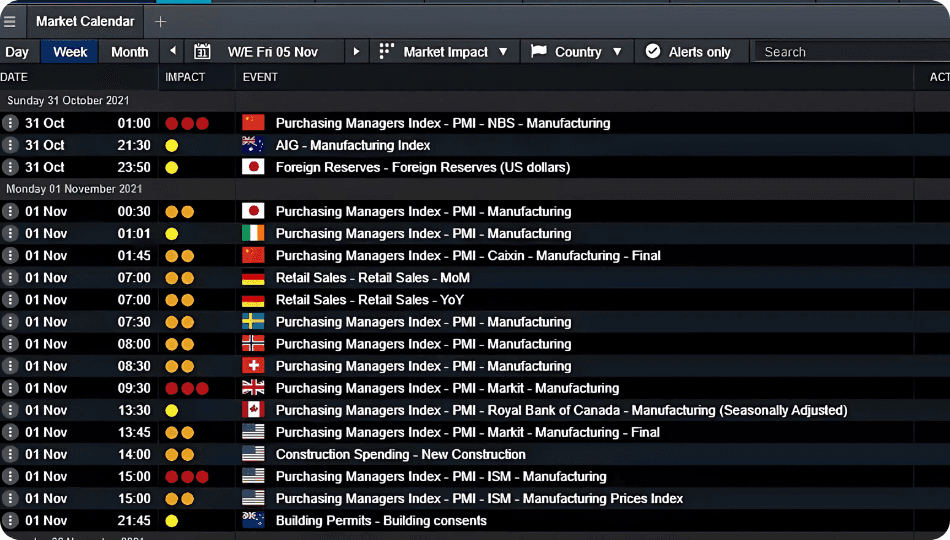

Economic calendar

Our interactive economic calendar, powered by Reuters, details hundreds of upcoming global macroeconomic events, with a variety of layout options which can help you understand how each event potentially impacts forex, index, equity and commodity markets.

Pinpoint pricing

Set your default position size and enter with a single 'click'.

All orders are fully executed without dealer intervention, regardless of your trading size.

We consistently achieve core platform uptime⁴, so you can focus on your trading.

We crunch 225m prices every day, from up to 14 tier-one liquidity provider feeds.

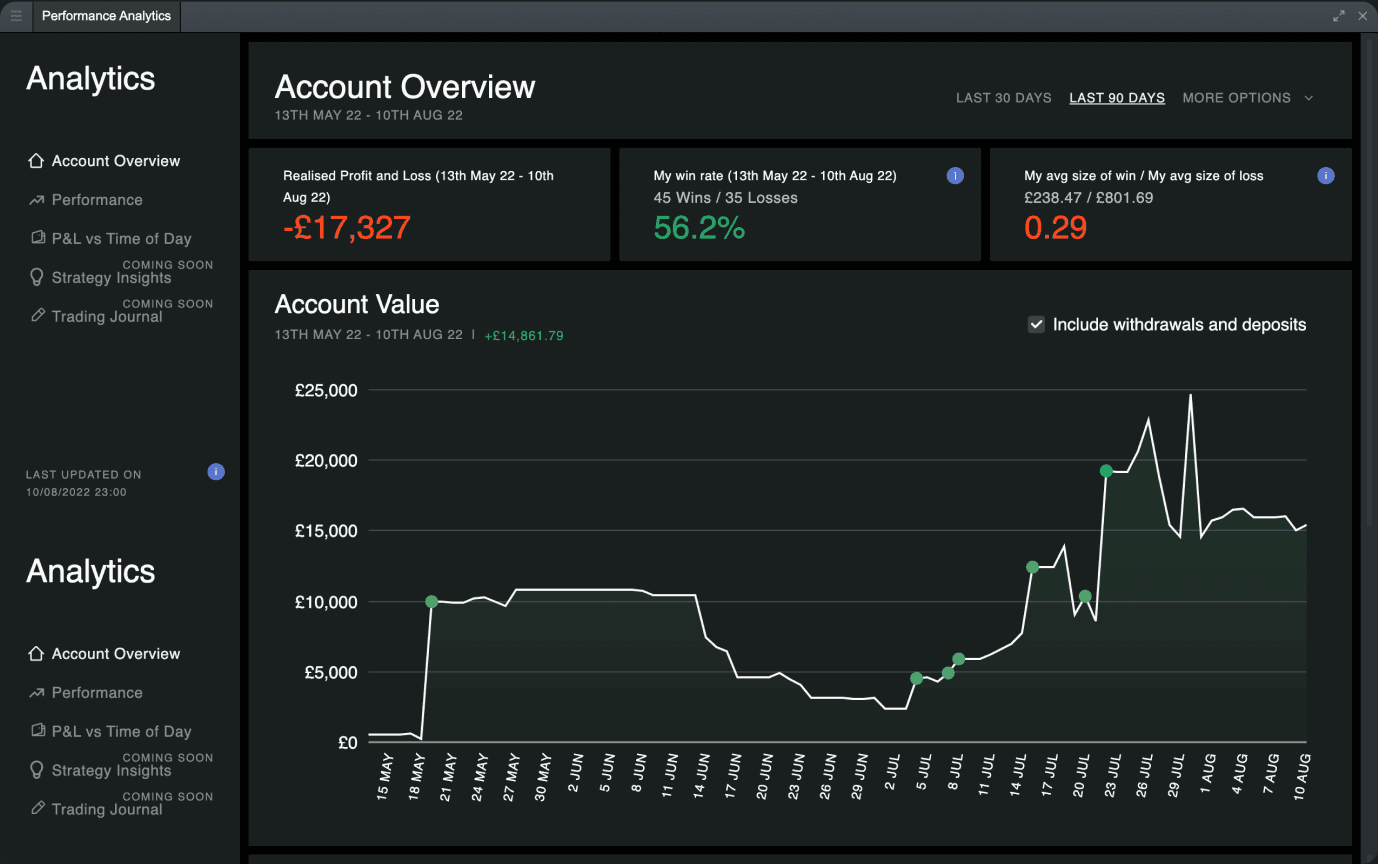

Perfomance analytics

Analyse your trading history and view your data in an intuitive and meaningful way. Understand which trading behaviours and patterns are making you the most money, where your strategy may be leaking money, and your current level of risk.

Available to all live account holders.

Supporting your risk/reward strategy

Our large range of risk-management options can help you remain in control. Choose your preferred order types and set trading limits and price alerts to react to the latest market movements.

Define your entry and exit prices using limit, stop, and take-profit orders, along with options such as trailing stops, partial close-out, and boundary orders.

Track the markets that matter to you and stay on top of the latest price action.

Get 100% certainty that your stop-loss will be executed at the price you choose.

You can be sure that your trade will be filled with no dealer intervention.

Your space, your place

Choose your own setup by customising the web-based platform to suit your individual style.

Editable auto stop-loss order

Default trade sizes

Charting templates

Customisable dashboards

Our account types

Equities trading

Buy and own shares from global stock markets.

- Invest in 10,000+ global stocks

Buy shares from the US, UK, across Europe, and more

0% commission and no platform fees (a 0.5% FX fee may apply)

Earn 2% (gross) on uninvested cash

CMC web platform, iOS and Android app

CFD trading

- Go long or short on 12,000 instruments

Trade with leverage

CMC web platform, iOS and Android app

- Pay no stamp duty on CFD trading⁵

MT4 platform available

Available schemes: Price+, Alpha

Options trading

Unlock new opportunities with our options on leading indices and shares.

Go long or short with call and put options

Zero commission

Trade with leverage

Access fractional options

Hedge market risk and help protect your downside on an existing portfolio

Available schemes: Price+, Alpha

FX Active

Commission-based forex trading⁵, designed for CFD traders who want to trade on pure price action.

- Go long or short on 12,000 instruments

Trade with leverage

CMC web platform, iOS and Android app

- Pay no stamp duty, or capital gains tax on profits⁵

MT4 platform available

- Spreads from 0.0 pips on six major pairs⁶

25% spread discount on all other FX pairs

Available schemes: Price+, Alpha

Spread betting

A tax-efficient way of speculating on the price movement of global financial instruments.

- Go long or short on 12,000 instruments

Trade with leverage

CMC web platform, iOS and Android app

Tax-free profits⁶

MT4 platform available

Available schemes: Price+, Alpha

Options trading

Unlock new opportunities with our options on leading indices and shares.

Go long or short with call and put options

Zero commission

Trade with leverage

Access fractional options

Hedge market risk and help protect your downside on an existing portfolio

Available schemes: Price+, Alpha

What do our customers say about trading with us?

Platforms to suit every trader

ForexBrokers.com Awards

Web platform

We've invested over £100m into our proprietary platform, creating pioneering technology to suit all styles of trading.

ADVFN International Financial Awards

Mobile app

Get the functionality of our web platform in your pocket, with mobile-optimised charting, full order-ticket features and real-time alerts.

Spread bet or trade CFDs on MT4

MetaTrader 4 (MT4)

Trade on one of the world's most popular platforms, and access our free premium MT4 indicators and Expert Advisors.

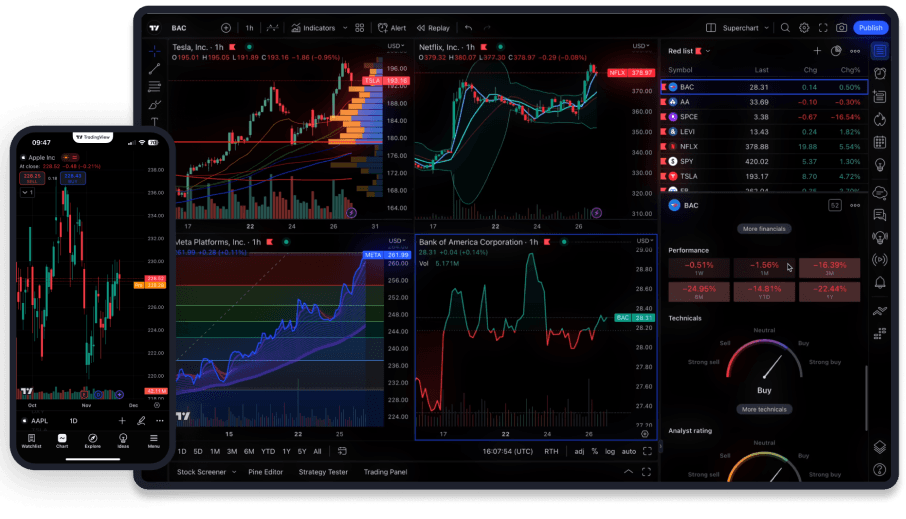

Research with TradingView, trade with us

TradingView

A globally-renowned charting experience for every trader. Enjoy the best of both worlds: TradingView's supercharged charts coupled with our tight spreads.

FAQs

Our web platform means there's no download required to install the platform, while our charts are clear and easy to read, and you can view multiple charts simultaneously on one screen.

The platform that best suits your needs depends partly on the product and instrument you would plan to trade, as well as your trading style. You can try demo accounts on most platforms, including ours, to explore and test your ideas.

You can spread bet and trade CFDs on 12,000 financial instruments with our award-winning platform. This includes indices, forex, commodities, shares, ETFs, and treasuries, as well as our exclusive share baskets, forex indices and commodity indices. Our platform is equipped with a number of powerful features and tools, including a comprehensive charting package.

You can also trade on MetaTrader 4 with us, and spread bet or trade CFDs on a large number of forex pairs, as well major indices, and commodities. You'll need to download the platform, and there are an array of advanced features and tools, including 30 free, premium Expert Advisors (EAs) and indicators. With MT4, you can also download or create Expert Advisors, which are algorithms that can monitor and automate your trading.

We also offer the ability to trade through TradingView with your CMC Markets account.

Our web-based platform works across multiple browsers, while you can also trade on your mobile or tablet via our app, which includes mobile-optimised charting and in-app push notifications. Learn more about our mobile app, which works with iOS and Android.

No – you can create an account and log in to our web-based platform using your chosen browser. You'll be able to access the financial markets without installing any special software.

There's no cost to open a live trading account with us. You can also view prices and use tools such as charts, Reuters news, or Morningstar quantitative research equity reports, free of charge. You'll need to deposit funds in your account to place a trade.

Yes, CMC Markets UK plc (registration number 173730) is fully authorised and regulated by the Financial Conduct Authority (FCA) in the UK. Retail client money is held in segregated client bank accounts and money held on behalf of clients is distributed across a range of major banks, which are regularly assessed against our risk criteria.

Under the FCA's Client Money rules, we're required to segregate client money (unless you agree with us otherwise) from CMC's own funds. The funds held in segregated bank accounts do not belong to CMC, and will be held in a way that enables it to be identified as client money. Learn more about client money regulations

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, also make a contribution to our overall revenue.

Ready to get started?

Any questions?

Email us atWe're available whenever the markets are open, from Sunday night through to Friday night.

2 0.009 seconds spread bet and CFD median trade execution time on CMC Markets' web and mobile platforms, 1 April 2024-31 March 2025.

3 FSCS is an independent body that offers protection to customers of financial services firms that have failed. The compensation amount may be up to £85,000 per eligible person, per firm. Eligibility conditions apply. Please contact the FSCS for more information.

4 99.93% system uptime: the percentage of trading hours clients were able to trade on the CMC trading and investing platforms between 1 April 2024 and 31 March 2025.