Why trade indices with us?

For professional clients only. Capital at risk. Tax treatment depends on individual circumstances.

What is indices trading?

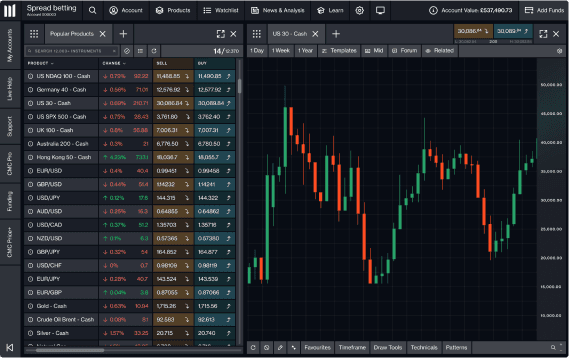

Index trading is the buying and selling of a group of stocks that make up an index, such as our UK 100 index (based on the FTSE 100), which tracks the largest 100 companies on the London Stock Exchange.

Trading on indices is popular with short-term traders who want to speculate on highly-liquid assets, with tight spreads and minimal slippage. Speculating on indices offers traders exposure to a wide range of stocks.

News

Loading...

Loading...

Loading...

Any questions?

Email us atclientmanagement@cmcmarkets.co.uk

or call on +44 (0)20 7170 8200We're available whenever the markets are open, from Sunday night through to Friday night.

1 0.009 seconds CFD median trade execution time on CMC Markets' web and mobile platforms, 1 April 2024-31 March 2025.

2Max discount in tier. Discounts are based on our tiered-volume discount scheme and are variable per product. View our Price+ page for more details.

3FSCS is an independent body that offers protection to customers of financial services firms that have failed. The compensation amount may be up to £85,000 per eligible person, per firm. Eligibility conditions apply. Please contact the FSCS for more information.

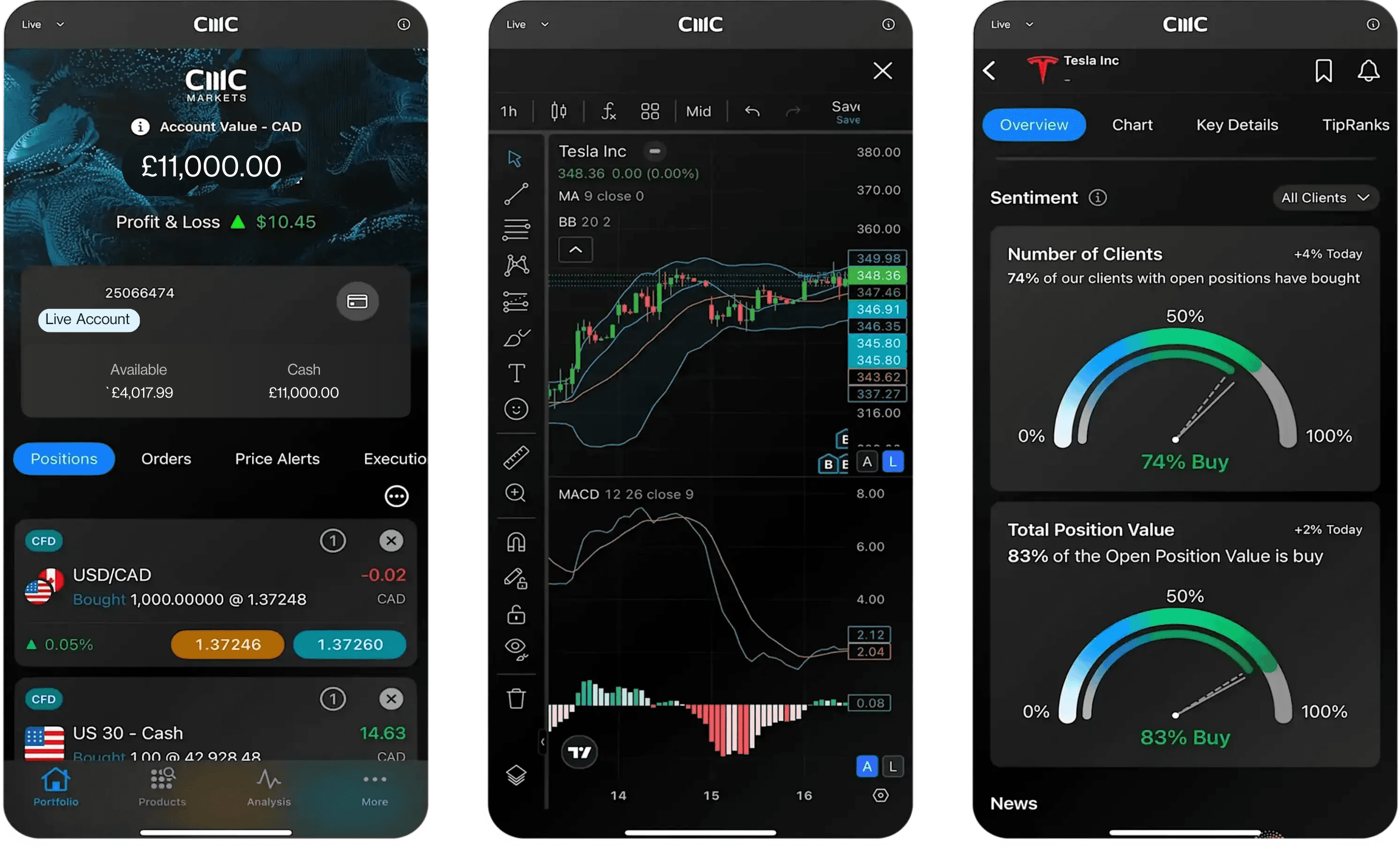

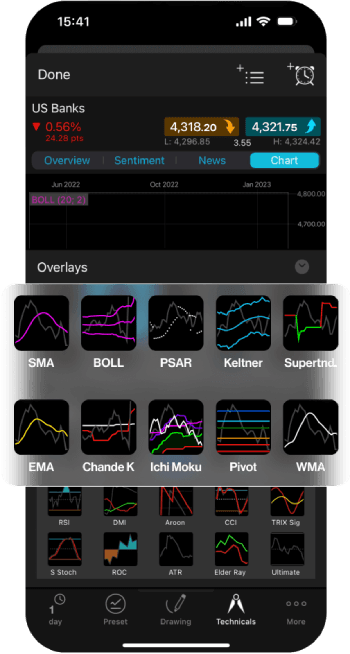

4Best Mobile Trading Platform, ADVFN International Financial Awards 2024; No.1 Web Platform, ForexBrokers.com Awards 2023; No.1 Most Currency Pairs, ForexBrokers.com Awards 2023; Best Charting (Germany), Investment Trends Leverage Trading Report 2023; Best Customer Service (Germany), Investment Trends Leverage Trading Report 2023; Best In-House Analysts, Professional Trader Awards 2023; No.1 Platform Technology (UK), ForexBrokers.com Awards 2022; Best CFD Provider (UK), Online Money Awards 2022; Industry Pioneer with "Outstanding" Customer Rating (Germany), Focus Money Test Edition 36/2022, "Very good" Trading Platform (Germany), Deutsches Kundeninstitut (DKI) Survey 2022.

5Based on over 2 million unique user logins across CMC's trading and investing platforms, including partners, as at November 2025.

6Interest scheme T&Cs apply.

Loading...

Loading...