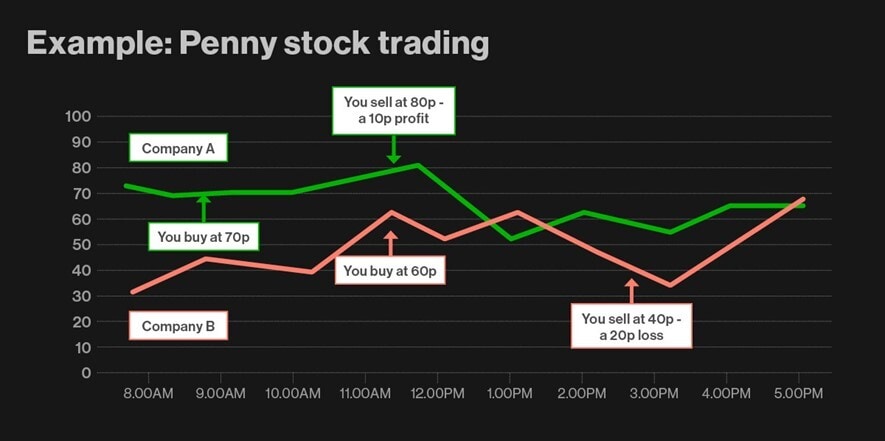

Trading on penny stocks

Published on: 02/11/2021 | Modified on: 31/08/2023

Many of the world’s biggest and well-established companies were once trading as penny stocks for under £1 a share. In 2000, Apple was worth just $0.80 — then the equivalent of £0.55. In December 2019, Covid-19 vaccine maker Novavax traded for $4 and just as recently, Ford stock was worth $2. But what are they? Read on to find out how these types of stocks are defined, the pros and cons of trading and how to spot the low-price bargains that could potentially make you money.

KEY POINTS

- Penny stocks are some of the cheapest — trading for under £1 on UK exchanges and $5 on US exchanges

- They can be very volatile, bringing potential for sudden sizable profits but equally losses

- Many are small, young companies, making them a high-risk trade

- Most do not trade on large stock exchanges and sometimes are over the counter (OTC) assets

- Some of the world’s largest companies began as penny shares