Share trading costs

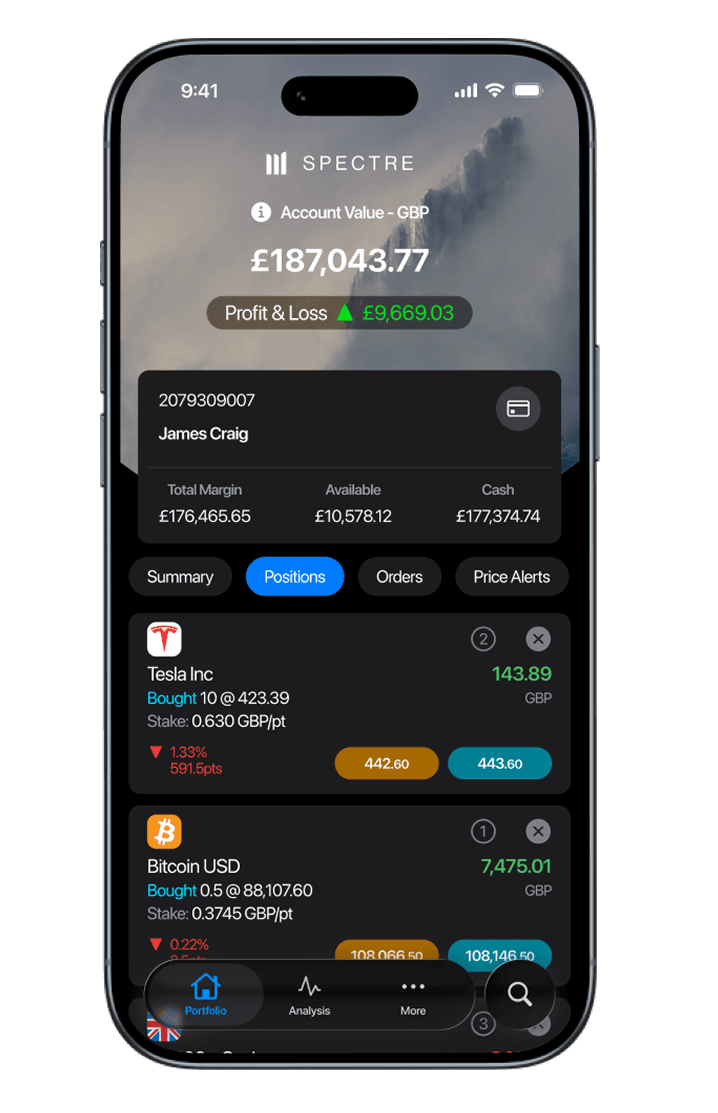

Invest, spread bet, or trade CFDs on over 10,000 global shares, and get exposure to the world's largest companies. Enjoy 0% commission on UK and European share CFDs (excludes Greek shares).

Share dealing

0% commission

0.50% FX conversion fee – Applied to non-UK shares

Spread betting

Spread – The difference between the buying and selling price of an instrument.

Additional spread – There's an additional spread on share spread bets when you enter and exit a trade, which is built into the prices displayed on our platform, and which varies depending on the country where the specific share originates.

French shares: Additional spread of 0.10%

German shares: Additional spread of 0.10%

Spanish shares: Additional spread of 0.10%

British shares: Additional spread of 0.10%

US shares: 1-4 cents**

Overnight holding cost – At the end of each day (10 UK time/5pm EST), positions held in your account may be subject to a holding fee.

CFD trading

Commission – Varies depending on the country where the specific share originates.

French shares: Commission of 0.10% (Minimum commission EUR 9.00)

German shares: Commission of 0.10% (Minimum commission EUR 9.00)

Spanish shares: Commission of 0.10% (Minimum commission EUR 9.00)

British shares: Commission of 0.10% (Minimum commission GBP 9.00)

American shares: Commission of USD 0.02 % (Minimum commission USD 10.00)

Spread – the difference between the buying and selling price of an instrument.

Overnight holding cost – At the end of each day (10pm UK time/5pm EST), positions held in your account may be subject to a holding fee.

FX conversion fee – applied to non-UK shares.

Options trading

0% commission & no holding costs

Spread – The difference between the buying and selling price of an instrument.

FX conversion fee – Applied to non-UK shares

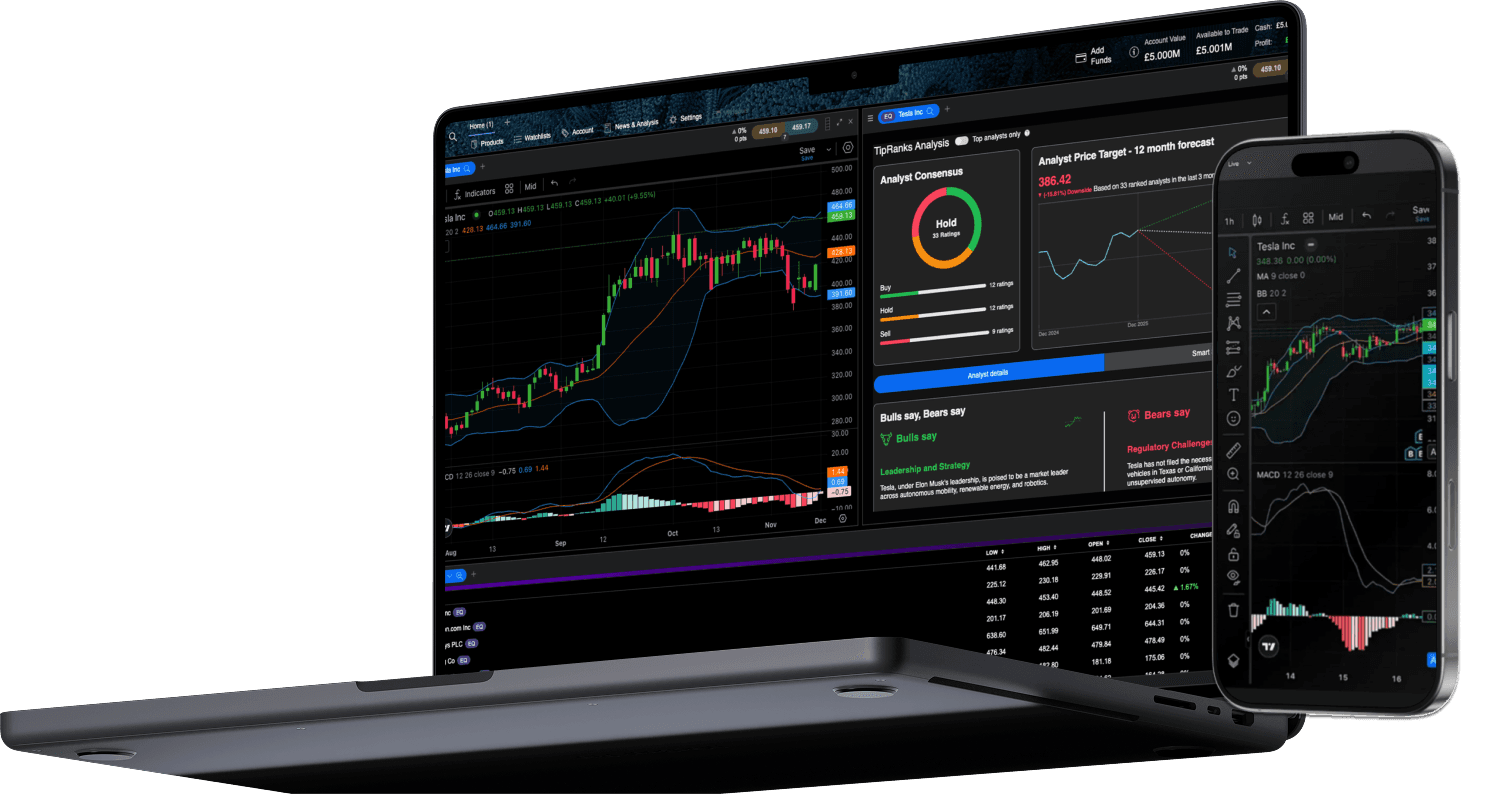

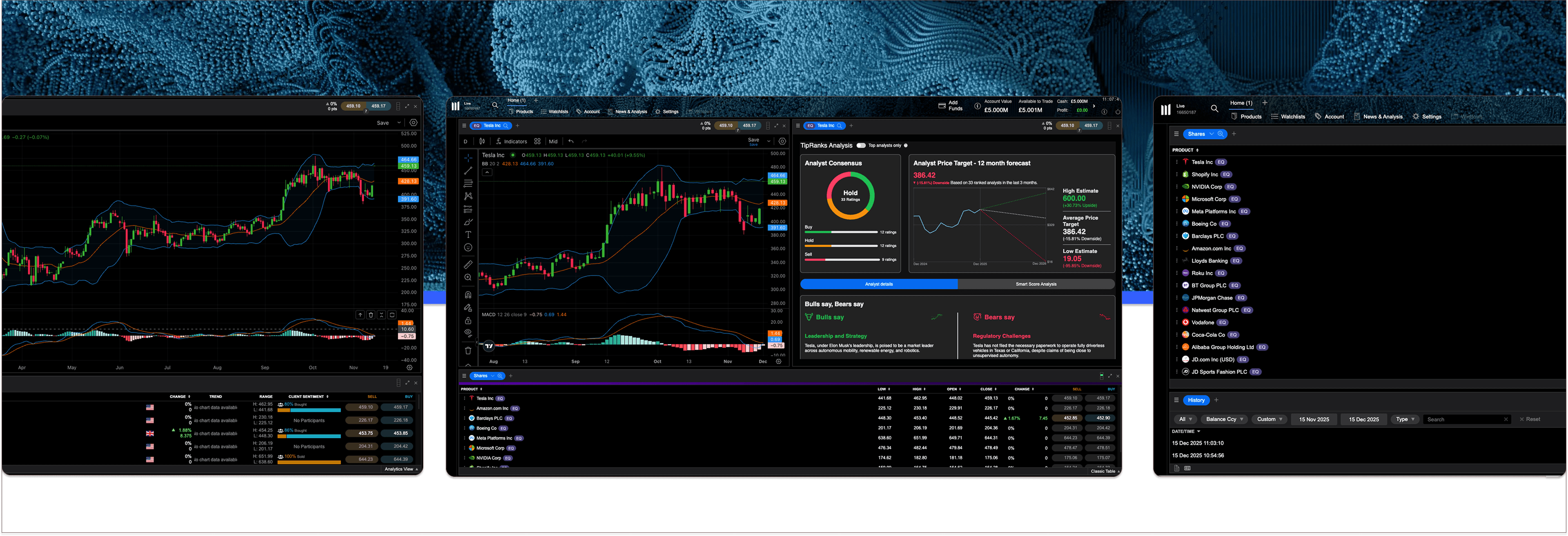

Why buy or trade shares with us?

For professional clients only. Capital at risk. Tax treatment depends on individual circumstances.

Ways to trade shares

Dive deeper

Any questions?

Email us atWe're available whenever the markets are open, from Sunday night through to Friday night.