What is CFD trading?

A contract for difference is a financial derivative product that pays the difference in the settlement price between the opening and closing of a trade. CFDs can be a tax efficient1 way of speculating on the financial markets, making them popular among FX and commodities traders. CFD trading enables you to speculate on rising or falling prices across a range of fast-moving global financial markets, such as forex, indices, commodities, shares, ETFs, and treasuries.

What are CFDs?

Contracts for difference (CFDs) are financial derivatives that allow traders to speculate on the price movements of various assets, such as forex, stocks and commodities, without owning the underlying asset.

What is CFD trading?

A CFD is a contract between a trader and a broker. The broker agrees to pay the difference in the price of an asset between the open and closing trade. The contract doesn’t involve ownership of the underlying asset, which means CFD trades are exempt from stamp duty in the UK1. Traders can open ‘buy’ or ‘sell’ positions when they trade CFDs based on which way they think the market might move.

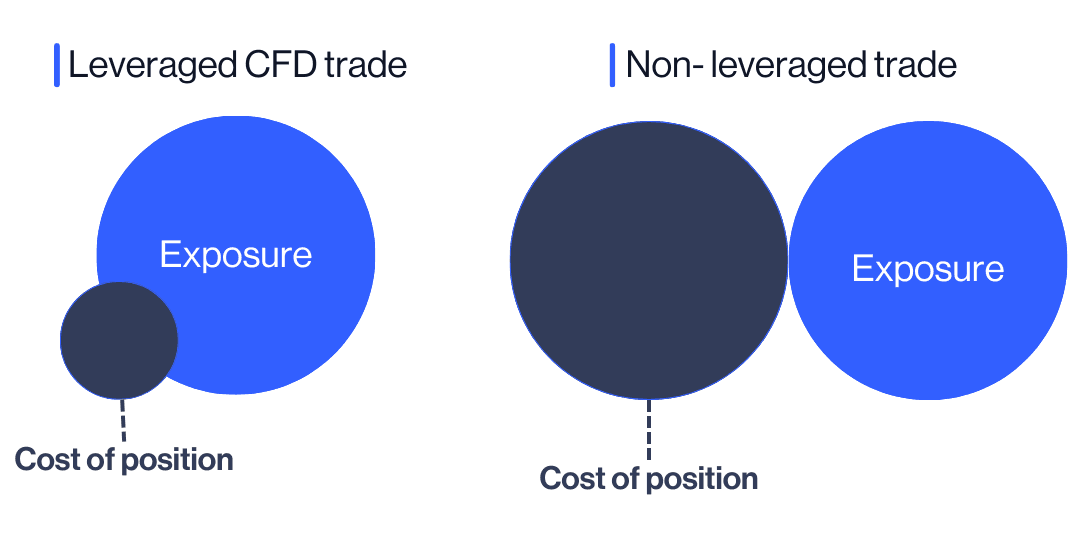

Another key feature of CFDs is the use of leverage. Trading with leverage, also known as trading on margin, allows traders to put up only a small proportion of the full value of the trade to open a position. Trading on margin amplifies potential profits and losses equally, so it’s essential that traders understand and manage risk.

How does CFD trading work?

With CFD trading, you buy or sell units of a financial instrument, depending on whether you think the price will go up or down.

To illustrate this idea, let’s take as an example one of our most popular instruments, the UK 100, which is based on the price movements of all the stocks listed on the UK’s FTSE 100 index.

Imagine that you’ve carried out some research and you expect the index to rise in value. You therefore place a ‘buy’ trade on the UK 100. For every point that the price of the UK 100 moves in your favour, you gain multiples of the number of CFD units that you bought. For every point the price moves against you, you make a loss.

What is leverage?

Leverage is the use of borrowed money to increase the potential return of an investment. One characteristic of CFD trading is that you can trade on margin – a type of leverage that allows you to trade using only a fraction of the full value of your position.

When you open a CFD trade with a broker, you deposit the margin while the broker provides the rest of the notional value of the position. While leverage gives you greater exposure to financial markets, it also increases your risk as your profit or loss is based on the full notional value of your position.

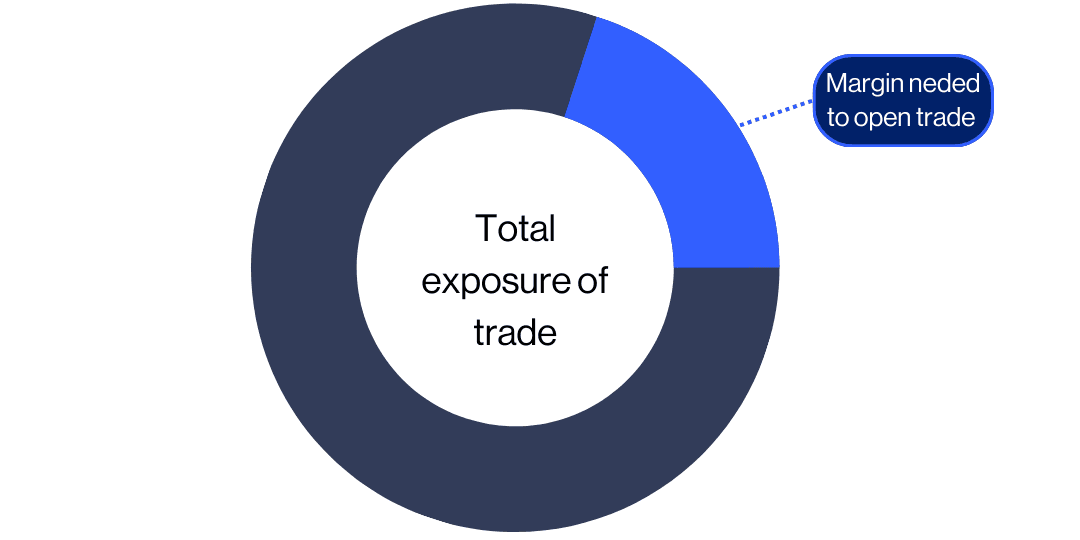

How do CFD margins work?

The question of how margins work is perhaps best answered with an example. Let’s imagine that a trader wants to go long on – or 'buy' – 10 shares of Vodafone stock. For the purposes of this example, let's say the stock is trading at £1 a share. The full value of this position would be £10. However, the margin required to open this CFD trade is 20%, so a CFD trader would need only £2 to enter the trade.

Learn more about CFD margins .

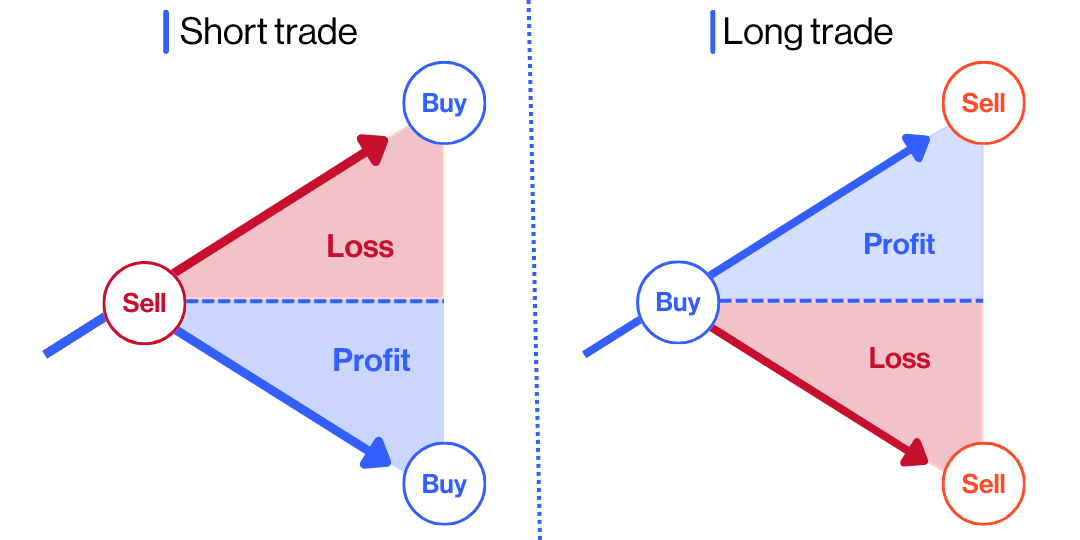

What’s the difference between going long and going short?

With CFD trading, you can choose to buy or sell a financial instrument. Buy (go long) if you think the price will rise, or sell (go short) if you think the price will go down.

Example of a CFD trade

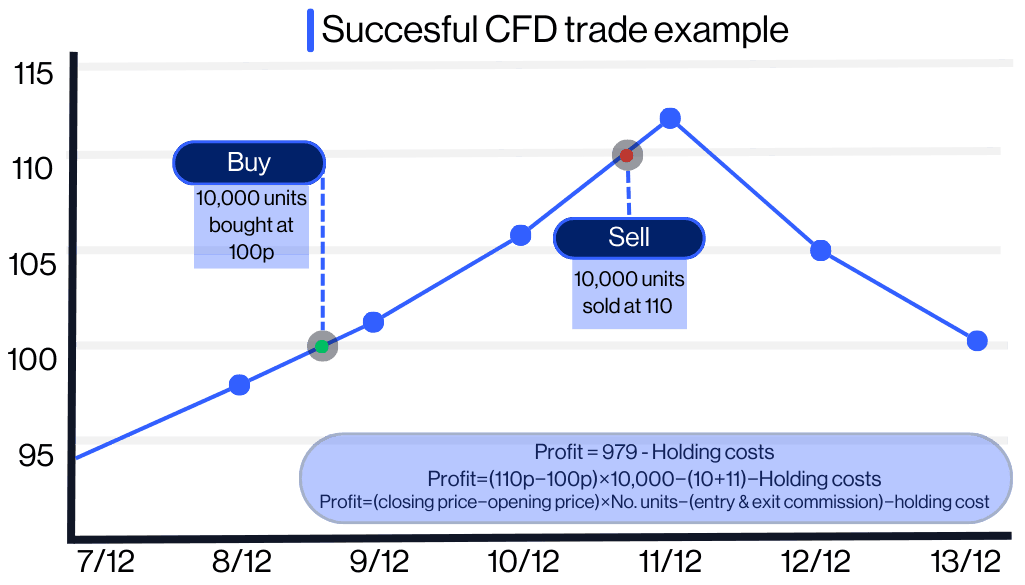

Going long on a company 'share' via a CFD

Now let’s look at a more detailed example. Imagine that you want to speculate on the price movement of a (fictional) UK-listed company called ABC. It’s trading at a sell price of 98p and a buy price of 100p. This means that the spread is 2p.

Based on your research of the market and ABC’s fundamentals, you think the company’s share price is going to rise, so you open a long position by buying 10,000 CFDs, or ‘units’, at 100p each. A commission charge of £10 is applied when you open the trade as the commission rate for UK-listed companies is 0.1% (with a minimum fee of £9):

(10,000 units x 100p = £10,000) x 0.1% = £10

ABC has a margin rate of 20%, which means you need to deposit only 20% of the full value of the trade to open a position. Therefore, opening the position requires £2,000:

(10,000 units x 100p = £10,000) x 20% = £2,000

⚠ Remember, if the instrument's price moves against you, you could lose more than £2,000, as losses are always based on the full value of the position.

Because CFD trading uses leverage, the amount of money needed to open this position is less than the amount needed to open the equivalent non-leveraged deal, as this table illustrates:

Next, let’s continue this example by looking at two potential outcomes of this trade.

A profitable trade

Let's assume your prediction was correct. ABC rises over the next week to a sell price of 110p and a buy price of 112p. You close your buy trade by selling at 110p. Commission is charged at 0.1% (or £9, whichever is greater) when you exit a trade too, so a charge of £11 is applied at this point:

(10,000 units x 110p = £11,000) x 0.1% = £11

The price has moved 10p in your favour, from 100p (the initial buy price or opening price) to 110p (the current sell price or closing price). Multiply this price rise by the number of units you bought (10,000) to calculate your profit (£1,000), then subtract the total commission charge (£10 at entry + £11 at exit = £21). The result is a total profit of £979, minus overnight holding costs. More information about holding costs can be found here.

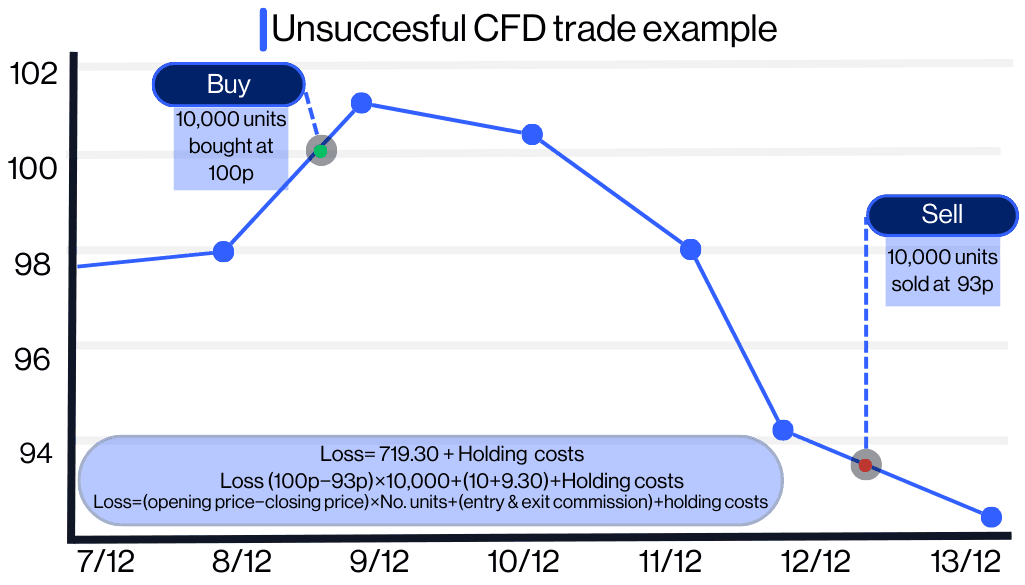

A losing trade

In this scenario, let’s assume you were wrong, and the price of ABC drops over the next week to a sell price of 93p and a buy price of 95p. You think the price is likely to continue dropping, so to limit your losses, you sell at 93p to close the trade. A commission fee of 0.1% is payable when you exit a trade, so a charge of £9.30 is applied:

(10,000 units x 93p = £9,300) x 0.1% = £9.30

The price has moved 7p against you, from 100p (the initial buy price) to 93p (the current sell price). Multiply this price movement by the number of units you bought (10,000) to calculate your loss (£700), then add the total commission charge (£10 at entry + £9.30 at exit = £19.30). The result is a total loss of £719.30, plus overnight holding costs.

How do you hedge an existing portfolio with CFD trading?

If an investor thinks their share portfolio may lose value in the near term, they could use a CFD hedging strategy to offset their losses. Let’s say an investor holds £5,000 worth of Tesla shares and is worried that the Tesla share price may fall. The investor could short, or sell, the equivalent number of units of Tesla via CFDs. Then, if Tesla’s share price falls in the underlying market, the loss in the value of the investor’s share portfolio could potentially be offset by the profit made on the short-selling CFD trade.

Trading CFDs to hedge a share portfolio is a popular strategy among investors, especially during periods of market volatility. It’s important to bear in mind that applicable fees, such as overnight holding costs, could impact this strategy, potentially lowering the expected return.

Why trade CFDs?

Tax efficiency: In the UK, CFDs are free of stamp duty, although they are subject to capital gains tax. An alternative, tax-free product is spread betting1.

Flexibility: You can trade CFDs on a wide range of financial markets, including stocks, indices, commodities and currencies, enabling you to diversify your portfolio and seize potential opportunities in various markets.

Leverage: CFDs use leverage, so you deposit only a fraction of the full value of the trade to open a position. Leverage magnifies potential gains and losses equally.

Hedging: Trading CFDs as part of a hedging strategy may help you to offset the negative impact of a market downturn on your investment portfolio.

Versatility: CFD trading can accommodate various trading strategies. Whether you favour day trading, scalping, or swing trading, you may be able to implement your preferred approach and react quickly to changing market conditions with CFDs.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.