How to trade commodities: A beginner’s guide to commodity trading in 2025

Commodity trading can feel complex, but it doesn’t need to be. Even if you’ve never traded commodities before, it’s an asset class worth exploring alongside your equity and bond positions. Not only can it help diversify your portfolio, but it also opens up a very different set of growth opportunities.

This guide will explore what commodities are, why people trade them, and how you can access commodity markets in the UK. We’ll also look at popular commodities like gold and oil, and share practical tips on how to get started

What are commodities?

Commodities are raw materials and primary agricultural products that can be bought and sold on global markets, usually in standardised quantities. Unlike stocks or bonds, they’re tangible assets (real things) such as gold, oil, wheat, or copper, that the global economy relies on.

Many commodities are fungible, meaning one unit is the same as another. For example, a bushel of corn is treated as identical to any other bushel of corn.

What are the different types of commodities?

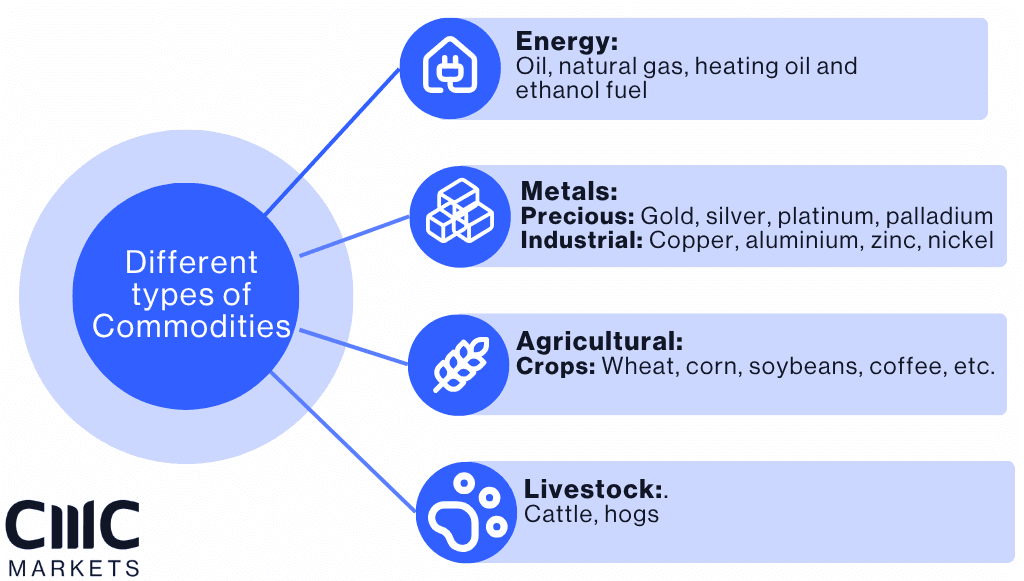

Commodities are usually grouped into four different categories:

Energy: Oil and natural gas

Metals: Precious metals and Industrial metals

Agricultural: Crops

Livestock: Live animals

Energy: Oil, natural gas, heating oil and ethanol fuel the global economy. Prices swing with geopolitics, growth cycles and even the weather. Crude oil, the most traded energy commodity, is especially sensitive to OPEC decisions and global events.

Metals: Split into two groups:

Precious metals: Gold, silver, platinum and palladium act as “safe havens” in uncertain times, but are also important in industries like jewellery, electronics and car manufacturing.

Industrial metals: Copper, aluminium, zinc and nickel are tied closely to construction, infrastructure and manufacturing. Copper, often called “Dr Copper,” is often seen as a signal for economic health.

Agricultural: Crops such as wheat, corn, soybeans, coffee, sugar and cotton. Their prices swing with the weather, harvests and trade policies.

Livestock: Live animals such as cattle and hogs. Prices here depend on feed costs, consumer demand and health risks like disease outbreaks.

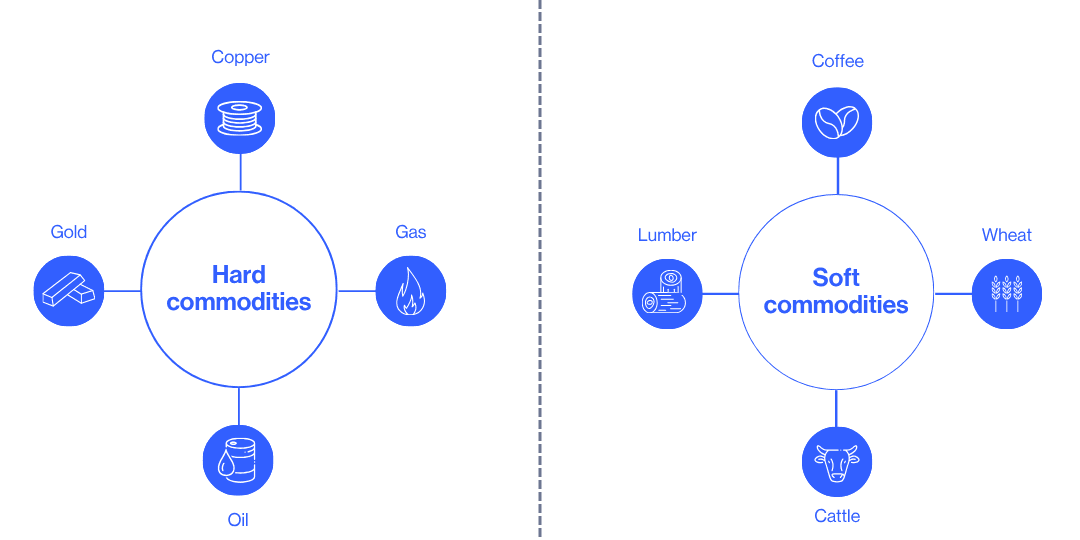

What are hard and soft commodities?

The four main types of commodities (energy, metal, agricultural and livestock) can also be grouped into two broader categories:

Hard commodities: Natural resources that come out of the ground, like oil, gas, and metals. Their prices usually react more to politics and industry demand than to the weather.

Soft commodities: Things that are grown, like crops and livestock. Their prices swing with harvests, weather, and farming conditions.

Should you trade Commodities?

While many traders focus on stocks, there are good reasons to consider commodities too:

Protection against inflation: Commodities often rise in value when everyday prices are going up. For example, during the inflation surge of 2022–23, many commodities outperformed stocks.

Portfolio diversification: Commodities don’t always move in the same direction as stocks and bonds. Adding them can help spread your risk.

Global growth: Fast-growing economies like China and India drive demand for energy, metals and food. Trading commodities lets you tap into these trends.

Geopolitical protection: In times of war or political tension, stock markets often fall while commodities such as gold and oil rise.

What affects commodity prices?

Commodity prices move mainly because of supply and demand. However, they are closely tied to real events happening in the world.

Supply shocks: Bad weather, natural disasters or political conflicts can suddenly cut supply and push prices higher.

Demand shifts: When economies grow, demand for oil, metals and food goes up. In recessions, it usually falls.

Transport and storage costs: Congested shipping routes or limited storage can make commodities more expensive.

Currency moves: Most commodities are priced in US dollars. A strong dollar makes them more expensive for buyers in other countries, which can push prices down.

Market speculation: Speculators and algorithms reacting to news can cause sharp short-term swings.

What are the different ways to trade commodities in the UK?

There are a few main ways people trade commodities in the UK:

Commodities: Directly buying and selling physical commodities or using derivative or spot trading to speculate on price movements without owning the commodity itself.

Exchange-traded funds (ETFs): Funds you can buy and sell on the stock market that track the price of a commodity (like gold) or a group of them. They’re simple and lower cost, and you don’t need to deal with the complex side of futures.

Shares in commodity companies: Instead of trading the raw commodity, you can trade or buy shares in companies that produce it, like oil firms or mining groups. Their prices often move with the commodity, though company performance also matters.

Trading commodities isn’t quite as clear-cut or direct as trading stocks. In most cases, UK traders won’t be able to simply buy a barrel of crude oil or a bushel of corn the way they might purchase shares in an AI company or government bonds.

How to execute commodities trade

Commodity futures contracts: An agreement to trade a set amount of a commodity (like oil or wheat) at a fixed price on a future date. They’re widely used by professionals but harder for beginners, as they require more money and carry bigger risks.

Contracts for difference (CFDs): These let you trade on whether the price of a commodity goes up or down, without ever owning it. They’re widely used in the UK and easy to access, but they can be risky because of leverage, and the fees can stack up if you hold positions for too long AZ Andy Zeguile Include spread betting

Spread betting: Allows you to speculate on commodity price movements by betting on whether the price will rise or fall, without ever owning the commodity itself. Profits are typically tax-free in the UK, but losses can exceed your initial deposit due to leverage.

Spot trading – Buying or selling commodities immediately at the current market price, involving direct ownership of the asset. Suitable if you prefer straightforward transactions without leverage, but consider storage costs and logistics if dealing with physical commodities.

Futures: Best for professionals with large accounts. They’re powerful but risky, and not suited to beginners.

CFDs: Popular with retail traders because you can start with smaller amounts. Good for short-term trading, but leverage makes them risky.

Spread betting: Suitable for UK traders wanting tax-efficient short-term trades. Easy to start small, but carries significant leverage risks.

Spot trading: Ideal for traders who prefer immediate commodity ownership and clearer pricing. Best suited for long-term investors comfortable managing physical commodities.

What are the most commonly traded commodities

Some of the most commonly traded commodities include gold, crude oil, agricultural products like wheat, corn, soybeans, and industrial metals, especially copper.

That said, different types of commodities offer different trading opportunities, mostly due to each commodity’s unique supply and demand factors. You’ll need to have a firm grasp of these differences before you begin trading commodities; otherwise, you risk being caught off guard by sudden price changes.

Here are some of the most actively traded:

Trading Gold

Gold is often called a “safe haven” because people buy it when markets feel shaky.

Inverse to stocks and economy: When equity markets or growth expectations fall, gold prices usually climb (e.g. up 25% during the 2008 crisis, hitting record highs again in 2020).

Currency and rates link: Gold typically rises when the US dollar weakens or real interest rates are low/negative, as holding it becomes more attractive versus cash.

Inflation hedge: Many traders use gold as protection against rising prices and declining purchasing power.

Technical trading: Gold lends itself well to chart-based strategies - support/resistance levels and moving averages are widely respected by traders.

Trading Crude Oil

Crude oil is the world’s most actively traded commodity, underpinning global transport, heating, plastics, and industrial processes. Its deep liquidity makes it attractive to both commercial hedgers and speculative traders.

There are two types of crude oil traded on commodity markets.

Brent crude: global benchmark, produced in the North Sea

West Texas Intermediate (WTI) crude: US benchmark

Brent crude oil tends to trade at a marginally higher price than WTI, but this difference usually only amounts to around $4 or $5 per barrel.

Unlike gold, which tends to perform better during economic stress, crude oil usually rises when economies expand, as higher industrial output, consumer spending, and transport use all drive demand. When economies contract, oil prices tend to weaken.

Several factors can cause sharp price swings in oil markets:

OPEC policy: The Organisation of Petroleum Exporting Countries controls roughly 40% of global output. Changes to production quotas can move markets dramatically, sometimes shifting prices by 5–10% in a single day.

Geopolitical risks: Conflicts in the Middle East, sanctions on major producers such as Russia, or supply bottlenecks in key shipping routes can all push prices higher.

Seasonality: Demand often peaks in winter (heating) and summer (travel). Producers like OPEC may cut or raise supply to smooth seasonal fluctuations, so while patterns exist, they should never be assumed to guarantee outcomes.

Trading Agricultural Commodities

Agricultural products, such as corn, wheat, soybeans, coffee, cotton, and sugar, are some of the most volatile commodities due to being directly tied to weather conditions and seasonal cycles.

A poor harvest caused by drought or storms can send prices soaring, while bumper crops may create oversupply and trigger sharp declines. To trade agriculture effectively, it’s important to understand both planting and harvesting calendars as well as the potential for unexpected weather events.

Beyond weather, other influences include:

Seasonality: Prices often peak before harvest when uncertainty is highest, then decline as new supply enters markets.

Government policy: Agriculture is one of the most heavily subsidised sectors worldwide. New subsidies, reduced support, export restrictions, or trade deals can all have an outsized impact on prices.

Long-term demand trends: Rising coffee consumption in emerging markets or greater demand for plant-based foods can shift prices steadily higher over time.

Trading Industrial Metals

Industrial metals such as copper, aluminium, and zinc are the backbone of modern economies, used in everything from construction and infrastructure to electronics and transport. Because of this, their prices are highly cyclical and often mirror the health of the global economy.

Several factors shape the industrial metals market:

China’s dominance: The country accounts for roughly half of global demand, meaning Chinese economic data on infrastructure and manufacturing has a major effect on prices.

Supply inelasticity: It can take 7–8 years to bring new mines online, so supply is slow to adjust when demand surges, adding volatility.

Technology trends: Electric vehicles, renewable energy, and electronics are fuelling long-term demand growth for copper, lithium, and rare earth metals.

Transport and storage: Metals are costly to store and transport, which often results in futures prices being higher than spot (known as contango). In shortages, this reverses, with spot prices above futures (backwardation).

How do commodities fit into a portfolio?

Commodities often move differently from stocks and bonds. Adding them to your portfolio can spread your risk and smooth out returns.

How do you start trading commodities in the UK?

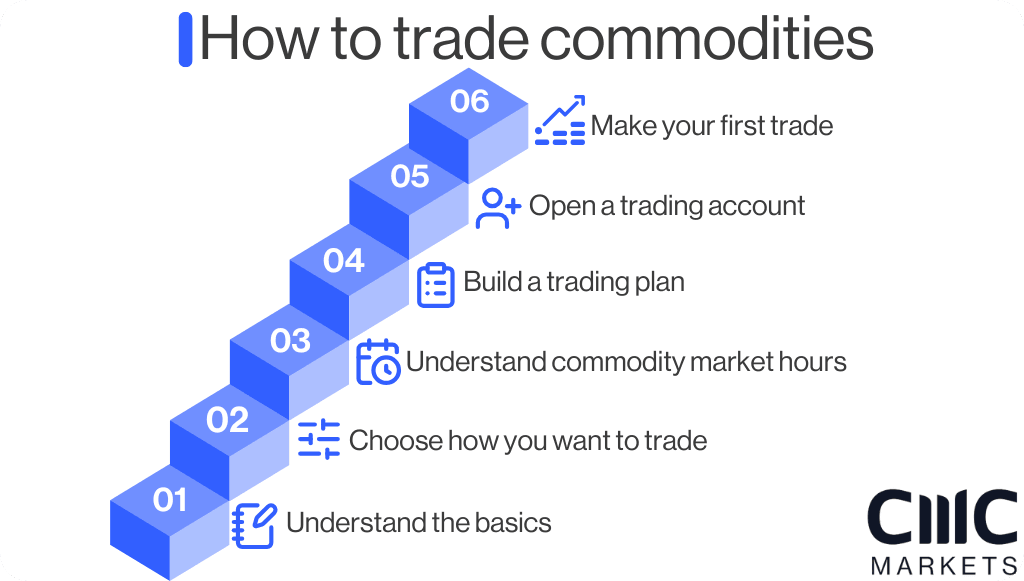

Trading commodities isn’t as straightforward as opening a trading account and buying a few barrels of oil or a bushel of corn. These markets trade differently from stocks or forex, and understanding the basics will help you avoid common pitfalls. Here’s a 6-step guide to getting started:

Understand the basics

Choose how you want to trade

Understand commodity market hours

Build a trading plan

Open a trading account

Make your first trade

Step 1: Understand the basics

What you need to know first

Types of commodities:

Hard commodities: Natural resources extracted from the earth like oil, gold and metals.

Soft commodities: Agricultural products and livestock like wheat, coffee, cotton.

Key influences on commodity prices:

Global supply and demand seasonal cycles

Inventory and production reports

Macroeconomic influences like economic growth, currency fluctuations, inflation

Step 2: Choose how you want to trade

When choosing how you want to trade there’s two areas:

The commodity market you’re interested in

Your personal trading style

Choose your commodity Market: Now you understand basics of commodity markets choose a market you understand, find interesting, aligns with your expertise and you can confidently research and analyse.

Always consider:

Liquidity: how easily and quickly you can buy or sell

Volatility: how much prices typically fluctuate

Risk tolerance: your comfort with potential losses

Initially, its best to focus on one or two commodities to start with to avoid spreading yourself too thin.

Choose your trading style: You need to clearly define your approach to trading commodities

Day trading: Frequent short-term trades opened and closed within a single trading day

Swing trading: Trades that span several days or weeks, capturing medium-term price movements

Long-term investing: Holding positions for weeks, months, or longer focusing on fundamental market drivers

Your trading style directly influences

Timeframes and charts: Short-term traders might use hourly or daily charts; long-term traders typically use weekly or monthly charts.

Risk management tools: Different styles require different tools and strategies (like stop-loss levels or position sizing).

Preferred trading platform and execution style : For example

CFDs: Allow smaller amounts, flexible trades, but higher leverage risk.

Spread betting: Offers tax efficiency in the UK, flexible small-sized trades, but risky with leverage.

Spot trading: Provides direct ownership, suitable for traders avoiding CFDs: Flexible, small starting amounts, but risky with leverage.

Choose the one that works best for you.

Step 3: Understand commodity market hours

Unlike stock exchanges, many commodity markets trade almost 24 hours a day. Liquidity and price action, however, tend to cluster in specific hours: however during different trading sessions volatility varies for instance:

Asian hours: Strong activity in metals and energy as Chinese markets open.

European hours: Active trading in energy and agriculture.

US hours: The busiest period globally, particularly for oil and gold.

It’s also important to check for major holidays in key regions, as these can reduce liquidity and widen spreads. Knowing when markets are most active will help you time your trades for better execution.

Step 4: Build a trading plan

Successful commodity traders rely on more than just price charts. You need to create a plan you can follow that clearly aligns with your trading style that you can consistently follow yet remains flexible enough to adapt to increased market volatility.

Entry Price: Clearly identify the exact price or conditions that signal you to enter a trade. This could be based on technical indicators, news events, or specific price levels (support/resistance).

Stop Loss: Define the maximum amount you're willing to lose on a trade. Set stop-losses strategically based on technical levels or market volatility, rather than arbitrary percentages.

Target Exit Price (Take Profit): Clearly outline the conditions or price levels at which you'll exit the trade profitably. This helps maintain discipline and avoids impulsive decisions based on short-term market noise.

Position Sizing: Decide how much of your capital you’ll allocate to each trade. Base this decision on your risk tolerance, account size, and overall trading goals. Consider using risk management tools like the Average True Range (ATR) to set appropriate trade sizes.

Risk-Reward Ratio: Determine how much you expect to gain compared to your potential loss. A common guideline is to aim for at least a 2:1 risk-reward ratio (e.g., risking £50 to make at least £100), but this can vary depending on market conditions and your strategy.

Record-Keeping and Review: Track your trades carefully. Record entry/exit points, reasons for the trade, and outcome. Regularly reviewing this data helps identify strengths, weaknesses, and areas for improvement.

Keep these tools close at hand to help inform you decisions :

Economic calendars: These highlight important reports (like crop updates or oil supply figures) so you know when big price moves might happen.

Supply and demand data: Monthly Oil Market Report by OPEC, the London Metal Exchange, or the World Agricultural Outlook Board.

Currency tools: Commodities are priced in US dollars, so you need to monitor the dollar index and FX rates.

Volatility indicators: ATR (Average True Range) helps adjust position sizing and manage risk.

Step 5: Choose a commodity trading platform / open a trading account

Your Penultimate step is the account and trading platform you decide to use. In the UK, you should only use a provider that’s authorised and regulated by the Financial Conduct Authority (FCA). This ensures client money protection and transparent trading conditions.

When comparing platforms, focus on four areas:

Instruments available: Some brokers specialise in CFDs, while others offer futures, ETFs, or just commodity-linked stocks. Make sure the platform supports the commodities (and the products) you want to trade.

Trading costs: Spreads on commodities are typically wider than on forex or blue-chip equities. Check commissions, spreads, and overnight financing charges if you plan to hold positions for more than a day.

Features and tools: The best platforms offer advanced charting, economic calendars with commodity-specific events (like OPEC meetings or crop reports), and risk-management tools such as price alerts and automated orders.

Education and research: Look for resources that help you understand supply and demand drivers, seasonal cycles, and market analysis techniques tailored to commodities.

Step 6: Make your first trade

Start small when setting your first trade, trade and review performance. Many platforms allow you to open a demo account so you can practice your trades without risking any capital.

Start small: Use modest trade sizes until you’re confident in your approach.

Use stop-loss and take-profit orders: Base them on technical levels (support/resistance), not arbitrary percentages.

Watch your margin: Commodity volatility can trigger margin calls quickly. Keep a buffer of unused capital in your account so trades aren’t closed out automatically.

That will depend on the financial instruments you use when trading commodities.

CFDs: Most CFD platforms have very low minimum trading amounts, often as low as £100 or £200.

Futures: Commodity futures trading requires a larger account balance, often upwards of £5,000 or £10,000 to account for the risk of higher margin requirements.

ETFs and commodity-linked shares: Since ETFs and the shares of companies operating in the commodity sector can both be traded through stock trading platforms, the minimum amount you’ll need will be based on their minimums. In many cases, this can be as little as £10.

Yes, commodity trading is usually riskier than trading stocks and bonds, particularly when leverage is used on commodity trades.

Commodity prices can sometimes move by as much as 10% in a single day, compared to 2% for a typical share price.

When leverage is applied, this 10% price movement for a commodity could result in as much as a 50% or even a 100% change in the value of your position.

If you have a relatively small amount to trade, then commodity CFDs are likely to be your best bet, unless you want longer-term exposure to commodity markets, in which case ETFs might be suitable.

Commodity futures are generally only an option if you’re a professional trader with a large amount of capital to invest.

Although it’s not always possible to time the commodities market, the time when you’re likely to see the most liquidity and the highest volatility is between 1 pm and 5 pm on weekdays. During this time, London, European and US trading hours all overlap, resulting in much bigger volumes.

Currency prices can have a big impact on your commodity trading returns if you’re based outside the US, since most commodities are priced in US dollars.

It’s important to factor the cost of these currency conversions into your calculations to accurately assess your returns.

Yes, you can trade commodities within a Stocks and Shares ISA or a Self-Invested Personal Pension (SIPP), but only in certain ways. You can usually access commodities through:

Exchange Traded Commodities (ETCs)

Commodity-based Exchange Traded Funds (ETFs)

In some cases, precious metals like gold

However, you won’t be able to trade CFDs and futures contracts inside an ISA or SIPP, since those are classed as higher-risk instruments.

Yes, a regular person can trade commodities typically through derivatives like Contracts for Difference (CFDs), Exchange Traded Commodities (ETCs), or through Exchange Traded Funds (ETFs), which provide investors with exposure to commodity prices without needing to purchase and store physical goods or navigate complex futures contracts directly.