Complete guide to coffee trading

Coffee is one of the most popularly traded commodities in the world, with the coffee market having an estimate worth of more than $100bn. The price of coffee is the subject of major speculation, as it can be affected by many different factors, including climate, transportation, and other commodity prices, such as crude oil. Continue reading to discover the history of coffee and learn how you can get involved with coffee trading in the commodities market.

Introduction to online coffee trading

Coffee is known as a “soft commodity” – an agricultural product which is grown rather than mined. These types of commodities have an important role in the futures market in particular and are traded on the Intercontinental Exchange (ICE) in the US, where coffee options can also be traded. With more than 2.25 billion cups of coffee consumed in the world every day, this commodity is one of the most popularly traded across the world.

What are the different types of coffee?

There are two main types of coffee that can be traded on a global level: Arabica and Robusta. These differ in a number of ways and are affected by different triggers, which is important to consider when picking an asset to trade.

Arabica: Arabica is considered the premium and more flavourful option of the two and is therefore more expensive, with beans selling for between $2.60/kg and $3/kg in recent times. Arabica makes up about 60-70% of all coffee production and mainly comes from Brazil and Colombia. View our Arabica price chart >

Robusta: Robusta can thrive in lower altitudes and hotter climates (as the name suggests) and has a more earthy and bitter taste than Arabica, as well as a higher caffeine content. Robusta beans, which are mostly grown in Vietnam, have traded for between $1.50 and $2 in recent times and make up about 30% of the coffee bean market. View our Robusta price chart >

Where is coffee grown?

Coffee is grown in over 50 countries, located within what is known as the “coffee belt”. These are countries with tropical or sub-tropical climates. Depending on the type of coffee bean, these may thrive in different altitudes and temperatures. According to the World Atlas, the top five producers of coffee are

Which countries are the biggest importers of coffee?

Interestingly, the countries that import and consume the largest amount of coffee aren’t located within or near the coffee belt. Total coffee imports instead reflect some of the world’s largest and most prosperous economies:

United States – around 20%

Germany – around 10%

France – around 9%

Italy – around 5%

Japan – around 4%

How to trade coffee

Register for an account. A live account will automatically grant you access to a free demo account, where you can practise safely with virtual funds.

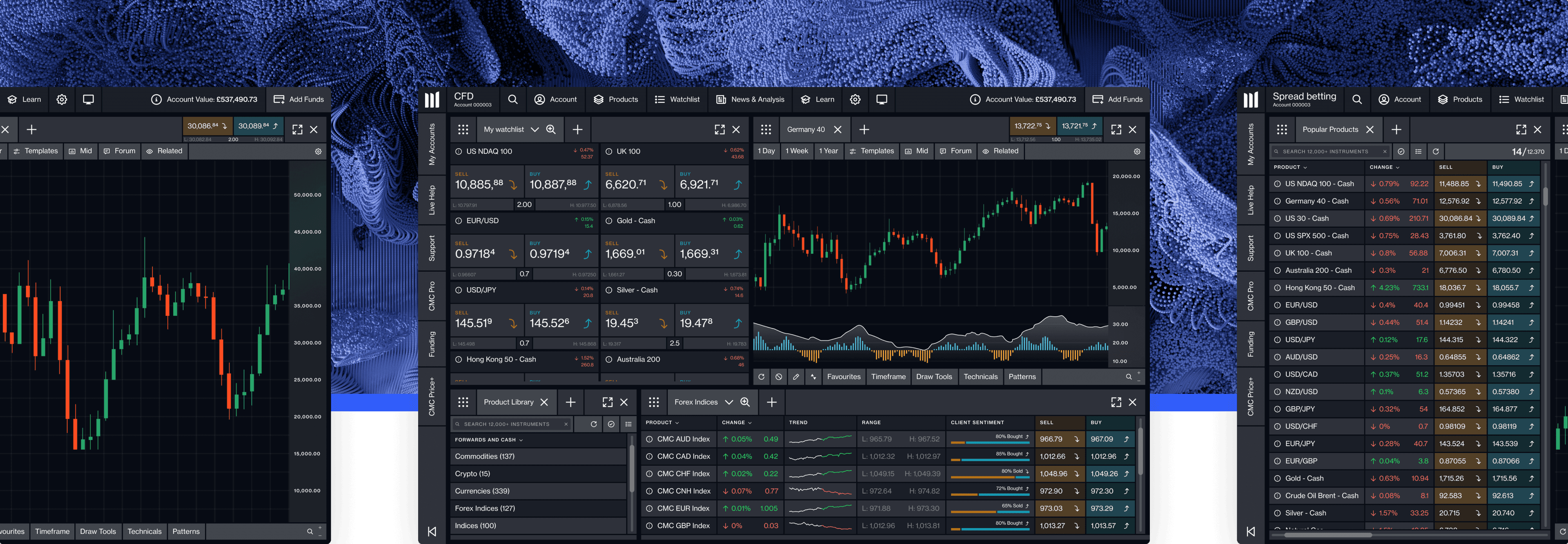

Choose your product between spread betting and CFD trading. You can also trade forward contracts (similar to futures) on the coffee market, which are explained in more detail below.

Decide between Arabica and Robusta. Both types of coffee beans come with benefits and drawbacks, so do some research to find the most suitable coffee type for you.

Stay up to date with global news. Economic announcements and breaking news can have an impact on countries and subsequently, their commodity markets.

Consider risk-management controls. Each coffee type is priced differently, grown in separate locations and may be affected by different factors that carry an element of risk. An example is to set stop-loss orders on your trades, which can help to close out losing trades and minimise capital loss.

Spread betting on coffee

Spread betting is a type of financial derivative that is particularly favoured for short-term trading. Rather than buying and holding physical coffee beans, spread betting allows you to speculate on the asset’s price movements without taking ownership. This means that you can trade both sides of the market, depending on whether you think the price of coffee will rise or fall. Spread betting is also tax-free in the UK*.

Trading coffee CFDs

CFD trading works in a similar way to spread bets. A contract for difference is a short-term contract between a broker and investor that can be opened to speculate on the price movements of coffee, whether these be up or down. At the end of the contract, the parties exchange the difference between the opening and closing prices, resulting in either profit or loss.

Coffee futures & forwards

A standard futures contract is a common way to trade coffee. This is where you agree to exchange a quantity of coffee with another party at a predetermined future date and price. Coffee futures can make wide swings within each trading day, making this an attractive choice for traders who favour volatility. At CMC Markets, our forward contracts are based on the underlying price of a futures contract and are the equivalent product for trading future prices. If you predict that the future delivery price will be greater than the current spot price of coffee, you may choose to opt for a forward contract.

What factors affect the price of coffee?

Coffee trading comes with a degree of volatility. Some key factors that influence supply and demand of both Coffee Arabica and Robusta include:

Climate fluctuations: coffee grows on small trees, where the crop is susceptible to adverse weather conditions such as frost, freeze and prolonged periods of dry weather. If supply decreases as a result of ruined crops, the price of coffee may increase.

Oil prices: the two leading exporters of coffee – Brazil and Vietnam – aren't located in the same area as the world's largest importers. If oil prices go up, this may increase transport costs, which means that coffee prices may rise too. Read more about crude oil trading.

Geopolitics: coffee is mainly grown in developing nations, so any political instability can have an impact on global coffee prices.

Seasonality: coffee consumption tends to peak during colder winter months and dip during warmer summer months. Therefore, this peak will align with the northern hemisphere, where demand is the greatest, between May and September, for example.

Discretionary income: coffee is not a necessary part of a person's diet, therefore, high unemployment in the US and EU can reduce coffee consumption. Non-farm payrolls are an important economic indicator that help to highlight unemployment levels, in particular.

Each of these factors increase the likelihood of coffee being a volatile commodity. Some examples of this occurrence in the past include the following:

Coffee reached an all-time high of 339.86 cents in April 1977 due to one of the most damaging frosts ever to hit in Brazil. Two years before this date, the price was just 45 cents. Six months after, the peak prices had halved to 149 cents.

More recently, in 2011, prices increased partly due to the biennial cycle of lower and higher output for Brazil's Arabica coffee plants, before dropping off again throughout 2012 due to a bumper crop season. This may be useful information if you're are looking to trade over a longer period of time.

What are coffee’s trading hours?

Coffee trading hours are set by the ICE. For trading in the UK, this can change at several points throughout the year, depending on daylight saving hours between March and November.

Coffee Arabica: 09:15 - 18:30 (GMT)

Coffee Robusta: 09:00 - 17:30 (GMT)

Coffee stocks

If you want exposure to the coffee market but without investing directly in the physical commodity, it is possible to trade on coffee shares within the stock market. This involves taking a position on companies that are involved in the production, refining or retailing of coffee-based products. Below are some coffee stocks that you can trade on, on our Next Generation trading platform:

Starbucks

Keurig Dr Pepper

Nestlé

Key Coffee

JM Smucker

Restaurant Brands

Coffee trading news

Given that the coffee market can be volatile at certain points in the year, it may be a good idea to stay up to date with global news and announcements. Non-farm payroll releases, GDP announcements, extreme weather conditions, political unrest and fluctuating oil prices can all have an effect on your open coffee positions, which may lead to losses if they are not monitored efficiently.Our news and analysis section can be located on our award-winning platform** and is updated daily with news on the financial markets, including commodities and shares. This means that you have all the information you need at your fingertips.

Trade coffee online with CMC Markets

Register for an account to start trading on our Coffee Arabica and Robusta commodities and range of shares and ETFs. Opening an account will allow you to trade risk-free first on our demo account before committing to opening positions within the live markets.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

**Awarded No.1 Platform Technology & No.1 Web-Based Platform, ForexBrokers.com Awards 2021; Best Telephone Customer Service, Best Email Customer Service & Best Education Materials/Programmes, based on highest user satisfaction among spread betters, CFD and FX traders, Investment Trends 2020 UK Leverage Trading Report; Best Overall Satisfaction, Best Platform Features, Best Mobile/Tablet App, Rated Highest for Charting, Investment Trends Report 2019; Best In-House Analysts, Professional Trader Awards 2019; No.1 Most Currency Pairs, ForexBrokers.com Awards 2020.

To start trading on Coffee Arabica or Robusta, register for an account. Make sure that you have understood the risks of coffee trading and the many factors that can have an impact on your chosen market.

Read more about trading commodities.

Coffee Arabica and Robusta are both traded on the Intercontinental Exchange (ICE), where options and futures contracts are available.

The main driver of the price of coffee is supply and demand. In peak seasons when demand is the highest, the price of coffee will correlate. However, external events and economic indicators can also have an effect and potentially lower the price, so it’s important to understand these factors.

Coffee is one of the most popularly traded commodities in the world, although it doesn’t supersede the likes of Brent and WTI crude oil, or safe-haven precious metals such as gold and silver. Learn more about how to trade commodities.

A small number of coffee ETFs exist. For example, two exchange-traded funds from iPath track the performance of major coffee-related stock indices by holding coffee futures contracts in the most recent or upcoming months. Explore our range of ETFs.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.