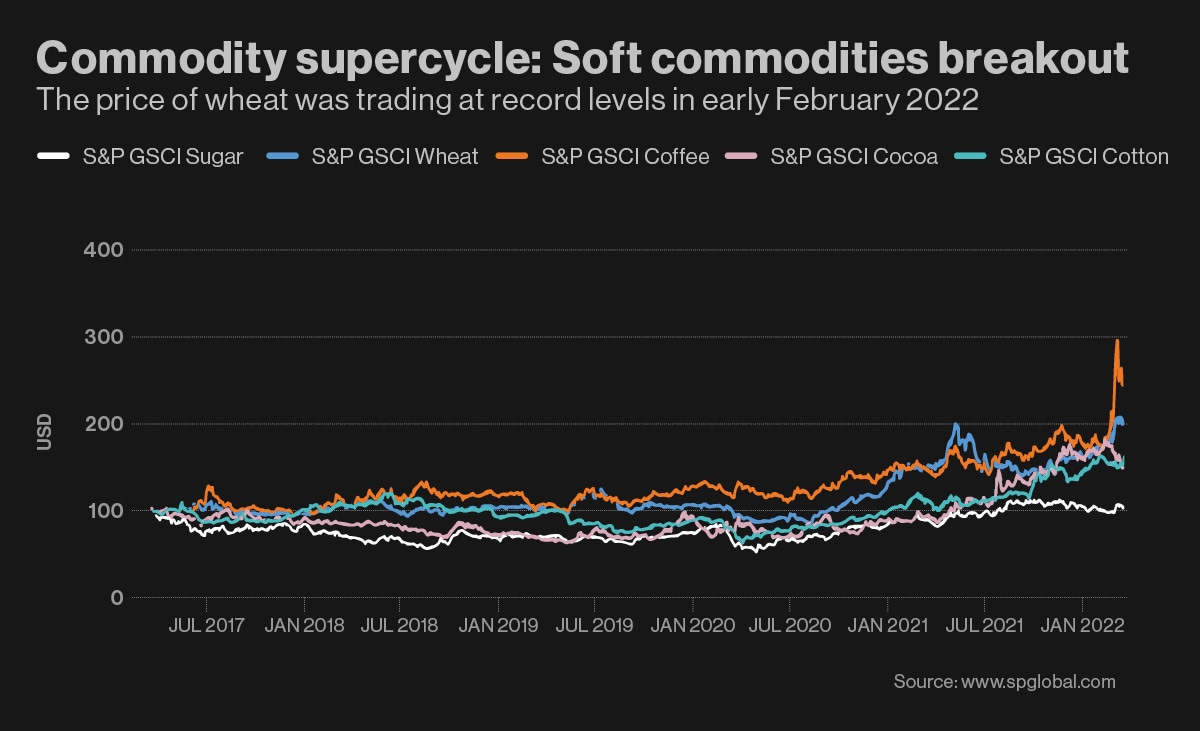

The term ‘soft commodity’ refers to an agricultural good that is grown, rather than mined or extracted. Some examples include cocoa, coffee, cotton, rice, soybeans, sugar and wheat. These types of goods can also be referred to as tropical or grown commodities, or food and fibre commodities.

These types of products are some of the oldest traded in the world, with commerce roots going back thousands of years. Agricultural goods continue to trade on listed exchanges today and still maintain a significant role in daily trading volume across global markets.

It is important to note that there’s no definitive soft commodities list, and various exchanges where you can trade these products will classify the term ‘soft’ in different ways.

Tropical commodities play a huge part in future markets, where these products can be bought and sold for delivery on a specific date. It’s used by farmers or commercial users who want to lock in future prices of their crop, as well as by speculative investors seeking a profit.

Soft commodity prices tend to fluctuate more or have higher volatility than other assets since production can be impacted by weather uncertainties and other risks that come with farming.

While an agricultural commodity may carry higher risk, owning just a small percentage of these assets is one way to diversify your portfolio without exposing yourself to too much risk.