From a trading perspective, emerging markets are simply another place to seek out opportunities. Emerging economies tend to be more volatile because of instabilities in the financial or political climate, but these can also offer high rates of returns on associated investments.

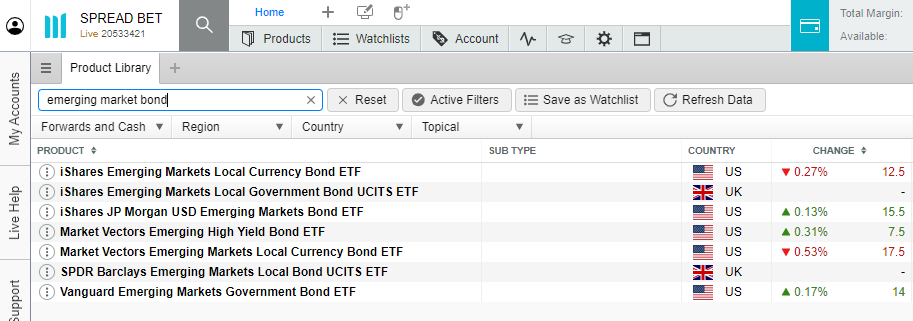

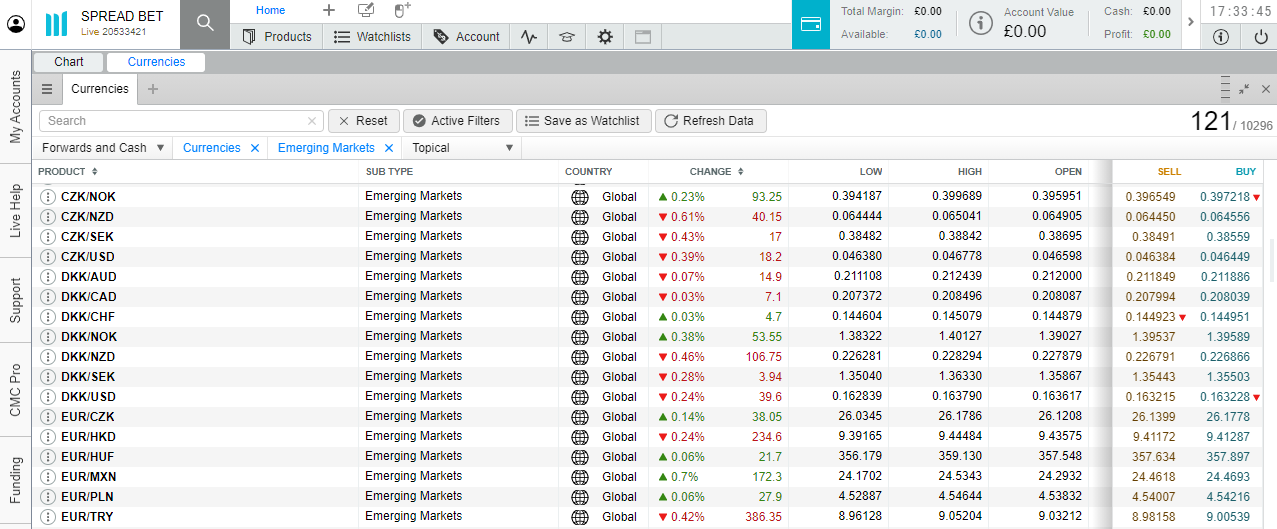

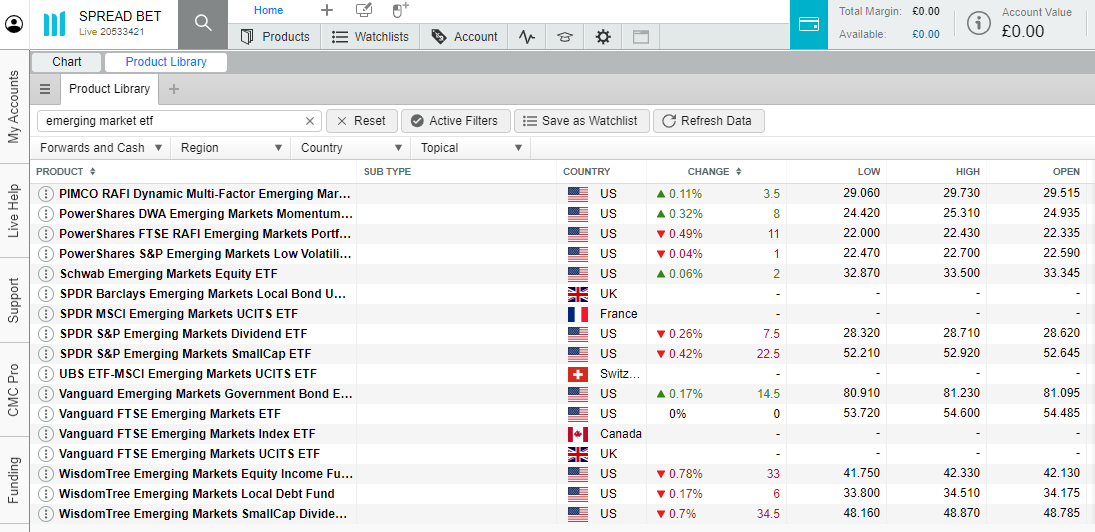

Traders can seek out various opportunities, such as investing in individual companies within an emerging market, buying basket stocks (such as an exchange-traded fund (ETF) or a stock index) from a specific country or group of countries, trading in the currencies of an emerging market, or trading the corporate or government bonds available in these markets.

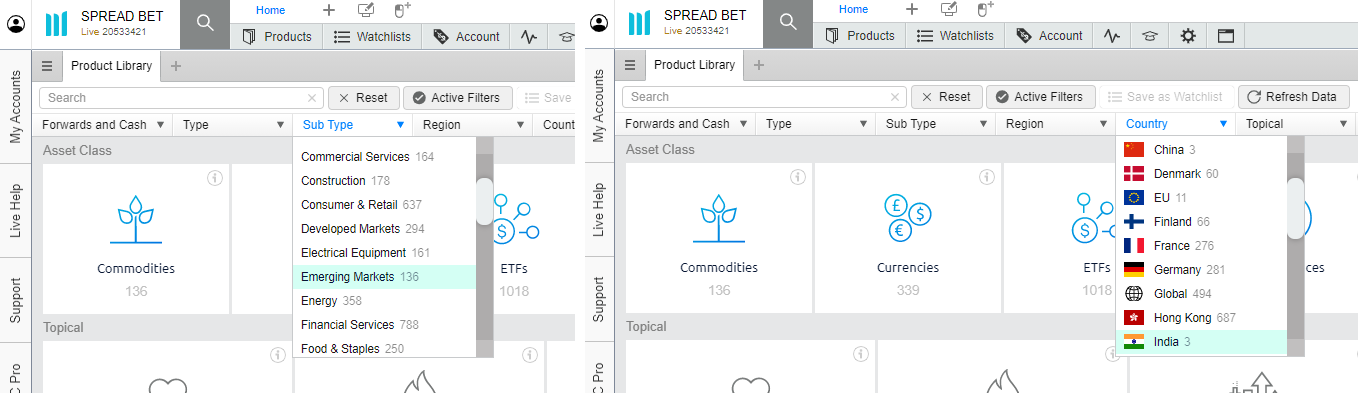

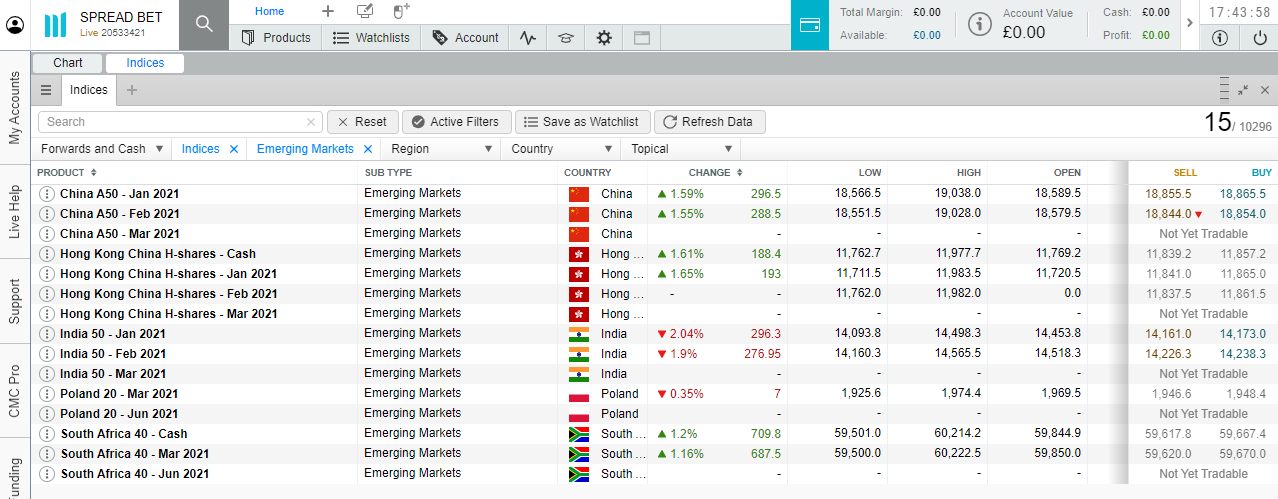

For example, when browsing the Product Library on our online trading platform, you can filter your selection by market type, sub-type (where you can select emerging economies), region or country (where you can select emerging countries, such as China and India, for example).