Trading the news

Many short-term traders base their trading decisions solely on technical analysis. They study charts, track price trends and monitor key indicators, such as support and resistance levels, to determine future price action. While technical details are important, it's also crucial to bear in mind the bigger picture. How are industry trends, current affairs and global events affecting the markets you trade? That's where trading the news comes in.

Read on as we explore what trading the news means and how to integrate an awareness of macroeconomic factors into your trading strategy.

What is trading the news?

Trading the news is all about keeping up to date with business and economic news, announcements, and data releases, and reacting to the fast-moving financial landscape in your trading. Staying abreast of financial news plays a key role in fundamental analysis, which is about evaluating whether an asset or financial instrument is undervalued or overvalued based on underlying economic conditions, industry trends, financial statements, government policy and other factors.

Breaking news can affect market sentiment in an instant, sometimes causing sudden price swings as traders reassess their understanding of the fundamentals and perhaps adjust or close the positions they've taken up in the market.

When the news signals that the fundamentals have changed, the ensuing market volatility can brings risks as well as potential trading opportunities. That's why it's vitally important to keep an eye on the headlines, consider the impact on your trades, and be ready to react as you trade the news.

How to trade the news

To trade the news, you need to know what to look for. Scheduled announcements including central bank interest rate decisions, official inflation updates, and company earnings reports are among the news events that can impact financial markets. You should familiarise yourself with key economic indicators, such as country-level employment data and retail sales figures, that can have an impact on financial markets from forex to shares and indices.

Data releases can affect market sentiment, especially if the readings aren't in line with estimates or market expectations. Unexpected news events, such as unscheduled press conferences, coups and wars, can also upend the assumptions that traders have made about the world, sometimes resulting in particularly sudden and dramatic market volatility.

News-trading strategy

A news-trading strategy requires flexibility and an ability to think on your feet. Going into a news announcement or data release, you might trade on an instrument based on market expectations. But you also need to be ready after the announcement or release to make quick decisions, potentially adjusting your position as you trade the news itself. The financial markets may be impacted almost immediately as the news breaks, so astute judgement and fast-thinking are likely to be essential as you decide how to trade the news.

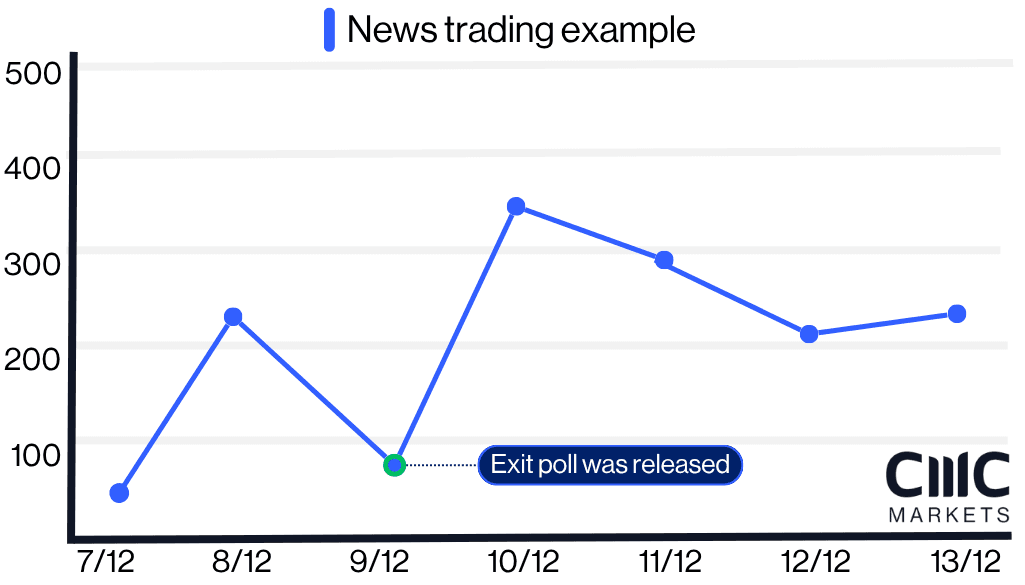

For example, if you were trading on currencies around the time of an election, you might need to decide whether to hold, modify or close your forex positions when news of the exit poll breaks.

When trading the news, it's important to understand how financial markets work. Sometimes news is already 'priced in', meaning the market has already factored the news into a sector’s or instrument's price. This can happen because analysts, economists and traders may have correctly predicted the news or data in advance of the announcement. As a result, the announcement itself may not always impact market prices, particularly if the news or data are in line with predictions.

News-based trading can be especially useful in volatile markets, such as oil trading. Read more about using fundamental analysis as part of your news-trading strategy.

How to get started

Register for an account with CMC Markets. You'll start with a demo account, allowing you to practise trading the news with virtual funds in a risk-free setting. When you're ready to trade for real, you can step up to a live account.

Keep up to date with the financial markets. Our

news and analysis section is updated regularly with articles covering stock indices, forex, commodities, shares, Treasuries and more.

Make the most of our exclusive news and insight tools. Our live account gives you access to Morningstar equity research reports and Reuters news headlines (pictured below), which provide a wealth of information across all asset classes.

Research appropriate trading strategies for your market. Our guide to trading strategies looks at long-term, fundamental approaches and short-term price action strategies.

Look at combining fundamental and

technical analysis. These two methodologies may be more effective when used together, rather than relying on one approach for all trading decisions.

Trading the news: forex

While many asset classes see a spike in trading activity before and immediately after a major economic news event, the forex market can get particularly active. That's because forex markets tend to be sensitive to macroeconomic news, especially to data points that reflect on the health of a country's economy. Generally speaking, forex traders look at economic news to assess its impact on interest rates and monetary policy. News that suggests a more hawkish (rate-rising) central bank tends to push a currency up in value relative to another currency, while news that implies policymakers could become more dovish (rate-cutting) could cause a currency to depreciate.

Currencies of export-led economies, particularly those that export raw materials or commodities, are often impacted by economic news. Commodity prices are influenced by issues of supply and demand. On the supply side, news that suggests a lower supply of a commodity can push up prices for that commodity, while news that suggests higher supply can depress prices. These commodity price swings can then impact the currencies of countries that trade in those commodities.

News that could signal changes in commodity supply and demand may include political tensions, war, terrorism, weather, economic sanctions, labour relations, strikes and more. Commodity inventory reports and outlooks can also affect commodity prices, with potential knock-on effects on related currencies.

Forex news-trading strategy

To come up with a comprehensive forex trading strategy based around news releases, forex traders tend to look out for key forex indicators that can have an impact on interest-rate speculation, including:

Central bank interest rate decisions and speeches

Inflation rates

Gross domestic product (GDP) figures

Employment figures

Trade balances

News that affects market sentiment can be especially impactful on instruments considered to be safe havens, including the USD dollar (USD), the Japanese yen (JPY), the Swiss franc (CHF) and the commodity gold. These instruments tend to attract capital during times of market turmoil. They then often see outflows of capital when the markets settle down.

News stories that can impact risk-on, risk-off trading include tariffs, inflation, political turmoil, elections, treaty negotiations and other general news beyond economic data and central bank announcements. Recent examples include US president Donald Trump's tariffs, Russia's invasion of Ukraine, the coronavirus pandemic and the Greek debt crisis.

Trading the news: seasonality and warning signals

Traders should be aware that demand for many commodities – and therefore their prices – can rise and fall with the seasons. The impact of seasonal factors can be seen clearly in energy and agricultural commodities, but less so in precious metals.

The table below shows some of the key currency pairs that are influenced by commodity prices. News relating to these commodities can be used by traders as a sort of forex news-trading signal, as it can help to determine where the price of the currency may be heading.

Trading the news: shares

Share trading based on news events is a strategy that many long-term investors and short-term traders use. When applying a trade-the-news strategy to shares, the key news events to watch are company earnings announcements. These tend to be issued every three months.

If a company has a strong balance sheet, positive cash flow and solid earnings, then traders may decide to buy and hold shares of that company. However, if a company reports lower-than-expected revenue and earnings, traders might sell or short the stock. Before deciding whether to buy or sell, traders can carry out company analysis, which involves analysing the company's financials, growth potential, and any legal, political or insolvency risks. The company's price/earnings ratio and dividend yield can also indicate whether a stock may be a sound investment.

Morningstar equity research reports, included with our live account, are updated regularly with new information on company fundamentals. These reports are available for a wide range of shares on our platform. Traders use them to gauge whether a company is considered to be overvalued, fairly valued or undervalued by the market. This information may help traders to make a decision on whether to enter a position or not. Register for a live account now to access our Morningstar reports.

News that has an impact on shares, such as earnings updates, management reshuffles and mergers and acquisitions, may impact the stock index that the company is part of, but it would be unlikely to have a major impact on other asset classes, such as currencies or commodities.

News trading signals

Some brokers offer automated news trading signals that can help a trader to make decisions on whether to enter, exit or avoid a trade. These hints are based on price fluctuations after certain types of data release and can prompt traders to either buy or sell an asset. Our platform allows you to set up price alerts, but we are an execution-only provider and do not offer advice or recommendations.

A manual alternative is to monitor upcoming tradeable events using our economic calendar, pictured below. The calendar highlights events such as GDP, CPI and PPI figures, unemployment data, trade balances, sentiment surveys and more. These news events help to shape market sentiment and may cause major price swings in financial markets.

Our market calendar can be customised by date, market impact (low to high) and country, so you can filter the news events that are relevant to you. You can also set alerts for news events that you wish to monitor.

Trading the news: what are the benefits?

The news can cause market volatility

Major economic announcements sometimes unleash a surge in market volatility, even if it is for just a short period of time. In these situations, forex and stock charts may rise or fall sharply. The trigger could be a surprise announcement, such as a sharp jump in unemployment, an unexpected interest rate tweak, or a sudden drop in inflation.

It's important to keep track of the timing of economic and company announcements that may affect your trading strategy. Rather than try to guess the outcome of a scheduled news event, it may be more opportune to wait and open new positions after news events have taken place, and then see if the reason for the trade is still valid.

The news can trigger price action

There is normally a consensus among economists about what level an economic data point is likely to come in at. Changes in non-farm payrolls, GDP or inflation might move the market, but the impact is often limited if the data or announcement align with expectations. For example, low unemployment suggests a strong economy, so many would expect the stock market to rise. Equally, a decision to lower interest rates could make a country’s currency less attractive, causing it to fall against other world currencies.

From time to time, however, economic announcements cause a slight surprise. Perhaps not enough to cause major volatility, but enough to trigger some price action. When a data point differs from what was expected, the market can shift in response. For example, if the monthly non-farm payrolls print shows that the US labour market expanded more than consensus estimates suggested, that could be bullish for the US dollar as many traders choose to act on the supposed 'buy' signal.

The news can indicate that trends are changing

Many traders try to identify trends in the hope of making a profit. Trends can be short-lived, lasting mere minutes. Or they can be long-lasting, spanning days, weeks or even months. However long it lasts, most trends reverse at some point, and a change in the underlying market conditions could be the first sign that a trend is about to change direction. After all, every journey starts with a single step and this is true of trend reversals as well.

An economic announcement or piece of financial news is rarely enough to alter the course of a medium-term trend, but how the market reacts to surprises can give the first clue that sentiment is starting to shift.

Risks of news trading

Of course, there are risks associated with news-based trading as well as benefits. Trading the news requires strong fundamental analysis skills, as you will need to understand how economic announcements affect the market and your positions. Inexperience or a lack of knowledge can therefore pose a risk.

Another danger to be aware of is that news-oriented traders sometimes keep positions open for too long. If the news takes a few days or weeks to materialise or for its impact to become clear, a news trader might keep their positions open for longer than they originally intended. In addition to the market exposure risks that this can bring, the trader may need to pay additional holding costs. Therefore, traders should ensure that they have sufficient funds in their account to cover their costs.

How to get started trading market news

Open an account with CMC Markets to access our news and analysis tools. You can choose to trade on news reports through either a spread betting or CFD trading account.

Read our article about the differences between spread bets and CFDs to learn more.

News-trading software

As mentioned above, our online trading platform features built-in news and analysis from our in-house analysts as well as from Reuters and Morningstar (for live account holders). Keeping up to date with breaking financial news, emerging trends and shifts in market sentiment will help you to make informed trading decisions.

Our award-winning* trading platform is available for desktop, mobile and tablet devices, and is compatible with iOS and Android systems. Complete with advanced charting features, our trading platform and app make it easy to trade and monitor news announcements. You can also set up trading alerts and choose to receive push notifications via the app, email or SMS. Read more about our trading alerts.

*Recent awards include: Best Broker for Active Traders, Professional Trader Awards 2025; Best Mobile Trading Platform and Best Spread Betting & CFD Education Tools, ADVFN International Financial Awards 2025; No.1 for Commissions & Fees & No.1 Most Currency Pairs, ForexBrokers.com Awards 2025; Best-in-class for Overall Excellence, Mobile Trading App, Platform & Tools, and Research, ForexBrokers.com Awards 2025.