Spread betting holding costs explained

At the end of each day (5pm, EST/New York time), positions held in your account may be subject to a charge called a 'holding cost'. The holding cost can be positive or negative depending on the direction of your position and the applicable holding rate.

When spread betting, historical holding rates, expressed as an annual percentage rate, are visible on our platform within the overview section for each instrument. Learn more about our trading fees

Holding cost calculations

On a buy position (long):

Daily holding costs = (stake x point multiplier x current bet mid-price x annual holding rate buy) / 365

A point multiplier is the change in price that results in a profit or loss change equal to your stake size. This is shown as the last large digit in the price shown on the platform.

On a sell position (short):

Daily holding costs = (stake x –1 x point multiplier x current bet mid-price x annual holding rate sell) / 365

The current trade price uses the mid-price at 5pm (New York time) or the last CMC mid-price, if the market is already closed. For New Zealand shares, the closing mid-price of the previous day will be used.

The resulting sum of all holding costs will be credited to or debited from your account as applicable, and will be visible within your account history on the platform.

Commodities and treasuries

Holding (or carry/swap) payments are made each night (at 5pm EST, 10pm UK time) for all open spread bets on treasury and commodity cash (or spot) products. Example products include UK Gilt - Cash and Natural Gas - Cash.

Cash commodity and treasury products are derivatives, with the prices derived from a scaled futures price. This is updated each night to ensure that the cash price converges to the current primary (most liquid) futures price, by the time the futures contract expires. This scaling update results in an adjustment to the cash price, which is the basis of the holding rate cost.

The holding payments offset the price adjustment, ensuring that our clients pay a fair rate on both buy and sell bets, with neither side benefiting or being disadvantaged by the price adjustment. In addition to the price adjustment, the holding rate also includes a ‘CMC charge’ to fund the provision of these products. The CMC charge will be whichever is larger of 3% and a proportion of the price adjustment.

Since the holding rates are based on the current primary futures price, they are subject to change as the primary futures contract approaches expiry and is replaced by the next futures contract. However, the price adjustment will also be updated as the primary future is replaced, resulting in no change to the impact on clients’ account value.

Examples

Determining the price adjustment rate

The annualised price adjustment rate can be found as the average of the buy and sell holding rates.

Price adjustment rate = (buy holding rate + sell holding rate) / 2

The buy holding rate is then given by subtracting the CMC charge*.

Buy holding rate = price adjustment rate - 3%

The sell holding rate is then given by adding the CMC charge*.

Sell holding rate = price adjustment rate + 3%

*The CMC charge is shown as 3% for simplicity.

Impact on account value

To demonstrate that holding payments offset the price adjustment and that the price adjustment rate doesn’t impact the account value, consider this example where the CMC charge is applied separately to the price adjustment rate.

Alice has an account value consisting of £1,000.10 cash, and 1 pound/euro per point (£/€pt) of a commodity with a price of £1.230 (1,230 points).

Her total account value before the holding payment is therefore:

£1,000.10 + 1 £/pt x 1,230 = £2,230.10

At 5pm (EST) the holding payment is due, and the CMC charge on Alice’s position is automatically applied. This incurs a cash charge of 3% / 365 of £1,230 (0.03 x £1230 / 365 = £0.10), resulting in a new account value of

£1,000 + (1 x £1,230) = £2,230.00

At the same time, the cash price is adjusted up towards the futures contract, by 5% / 365 to £1.23017, artificially increasing the value of Alice’s position by 5% / 365 of £1,230 (0.05 x 1,230 / 365 = £0.17) to £1,230.17. To offset this increase, Alice is simultaneously required to pay the price adjustment on her position which is also £0.17.

Her total account value after the holding payment is therefore equal to her account value prior to the price adjustment payment.

£999.83 + (1 x 1,230.17) = £2,230.00

Note that if Alice had placed a short (sell) bet, the direction of the price adjustment payments would be reversed, and she would receive the price adjustment payment, as the value of her position would have decreased.

Short (sell) bet

Initial cash: £1,000.10

Initial position value: 1 £/pt short at a price of 1,230 = £1,230

Initial account value: £1,000.10 + £1,230.00 = £2,230.10

CMC charge: 3% / 365 of position = 0.03 x 1,000 x 1.23 / 365 = £0.10

Price adjustment: 5% / 365 results in an increase from £1.23 to £1.23017

Corresponding position value change: -£0.17

Final cash: £1,000.10 - £0.10 + £0.17 = £1,000.17

Final position value: 1 £/pt short at a price of 1,229.83 = 1,000 x (£1.23 - (£1.23017 - £1.23)) = £1,229.83

Final account value: £1,000.17 + £1,229.83 = £2,230

Long position with higher price adjustment rate

Initial cash: £1,000.10

Initial position value: 1 £/pt long at a price of 1,230 = £1,230

Initial account value: £1,000.10 + £1,230.00 = £2,230.10

CMC charge: 3% / 365 of position = 0.03 x 1,000 x 1.23 / 365 = £0.10

Price adjustment: 15% / 365 results in an increase from £1.23 to £1.23051

Corresponding position value change: +£0.51

Final cash position: £1,000.10 - £0.10 - £0.51 = £999.49

Final position value: 1 £/pt long at a price of 1,230.51 = 1,000 x £1.23051 = £1,230.51

Final account value: £999.49 + £1,230.51 = £2,230

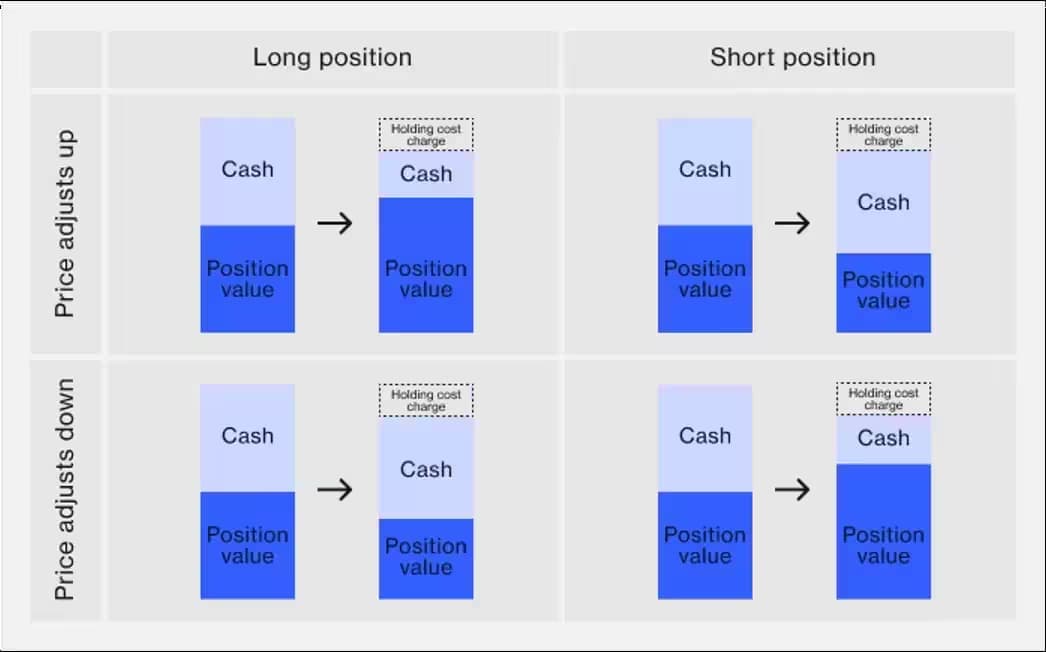

Holding costs visual representation

The graphic below represents the four possible holding cost scenarios. The height of each column represents the total account value, calculated from the position value and cash balance in the account. In every scenario, the account value is only reduced by the CMC charge, regardless of the value of the price adjustment rate.

Shares

Overnight fees for spread bets on shares are based on the underlying interbank rate for the currency of the relevant share (see table below) plus 0.0082% on buy positions and minus 0.0082% on sell positions.

Holding costs are charged for buy positions and credited for sell positions, unless the underlying interbank rate is equal to or less than 0.0082%, in which case sell positions may incur a holding cost charge that will be deducted from the cash in your account. Holding rates for sell trades may also include an additional adjustment for borrowing fees on shares that attract a higher borrowing cost in the underlying market. These borrowing fees can be significant and are subject to large changes as short interest in a stock increases. Please be aware of this additional risk/charge when holding sell trades in individual shares.

Indices

Overnight holding rates for indices are based on the underlying interbank rate of the index (see table below) plus 0.0082% on buy positions and minus 0.0082% on sell positions.

Holding costs are charged for buy positions and credited for sell positions, unless the underlying interbank rate is equal to or less than 0.0082%, in which case sell positions may incur a holding cost charge.

Risk-free and interbank rates for shares, share baskets & 'cash' indices

Foreign exchange

Overnight holding rates for FX are based on the tom-next (tomorrow to next day) rate in the underlying market for the currency pair and are expressed as an annual percentage.

Buy position holding rate = tom-next rate % + 0.0027%

Sell position holding rate = tom-next rate % - 0.0027%

Different rates are quoted for buy and sell positions and are actively traded between banks. Tom-next rates in the underlying market are based on the interest rate differential between the two currencies. As a general rule, if the interest rate of the first named currency is higher than the second named currency in the pair (subject to the adjustment detailed above), and you hold a buy position, the holding cost will be credited to your account. Conversely, if you hold a sell position in this scenario, the holding cost will be debited from your account.

Calculation for the annual holding cost rate price for cash commodities and treasuries

Subtract the mid-price of the current cash price from the mid-price of the next primary contract to get the price difference;

Calculate the number of days to expiry between the next primary contract and now;

Divide the price difference by the number of days to expiry and multiply by 365 to get the annualised difference in price terms;

Divide the annualised price difference by the cash price to work out the percentage mid-rate, and;

Bid or long position = (Percentage mid-rate + (maximum of (absolute of the percentage mid-rate x the CMC charge) or 3%)) x –1

Ask or short position = (Percentage mid-rate – (maximum of (absolute of the percentage mid-rate x the CMC charge) or 3%)) x –1

Example (illustrative purposes only)

The UK Crude primary contract moved from June to July on 28 April at approximately 9.30pm (UK time).

UK Crude July Future mid-price 47.48 – UK Crude Cash mid-price 47.79 = –0.31

Expiry of July contract 30 May-28 April = 33 days

–0.31 / 33 x 365 = –3.42879

–3.42879 / 47.79 = –7.175%

Bid or long position = (–7.175% + 3%) x –1 = 4.175%

Ask or short position = (–7.175% - 3%) x –1 = 10.175%

Share baskets, forex & commodity indices

Holding costs for share baskets, forex indices and commodity indices are calculated via a weighted sum of the constituents' holding cost rates, plus CMC's charge on buy positions or minus CMC's charge on sell positions.

Forward contracts

A forward contract is a product with a fixed expiration or settlement date, on which open positions will be settled at the closing price. Index, FX, commodity and treasury forward contracts are not subject to holding costs.

Learn more about spread betting with our spread betting articles and resources.

You can hold spread bets from anywhere between a few seconds to several months. There is an overnight holding cost for buy and sell positions which can be positive or negative depending on the instrument, size and direction of the position. Learn more about spread betting.

Overnight fees in trading are the fees that you pay to cover any leveraged positions overnight, also referred to as holding costs. This daily fee will be charged to your account and applies to financial markets including forex, indices and shares. The amount, and whether the cost is positive or negative, will depend on the size and direction of your position. Read about our trading fees for more information.

CFD costs are calculated in a slightly different way to spread betting holding costs, as they are represented by lots or units, rather than the spread. However, they differ according to the instruments you’re trading and the direction of the trade, like spread betting. Learn more about CFD costs.

When spread betting ‘cash’ instruments, for example in the commodities market, holding rates are based on the costs of futures, or forward contracts. Our cash price doesn’t have a fixed expiry or settlement date, unlike forwards. Please see our Cost Disclosure for more information.

Our clients can spread bet tax-free in the UK, as well as being exempt from stamp duty and commission charges, which is a major advantage of spread betting over contracts for difference. However, tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK. Read more about spread betting costs.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.