The Biggest UK Companies by Market Cap

The United Kingdom is the sixth-largest economy in the world, and it has produced a number of large-cap and blue-chip stocks, which are listed on the London Stock Exchange and form part of the FTSE 100 stock index. Read on to discover the top 20 largest UK companies by market capitalisation and how you can get involved in spread betting or trading CFDs on their share prices.

Please note that past performance is not a reliable indicator of future results.

What Are the Biggest UK Companies by Market Capitalisation?

The UK stock market remains one of the world’s largest, with a total capitalisation exceeding £4.4trn as of December 2024. The biggest British companies span pharmaceuticals, energy, banking and consumer goods, with many generating the majority of their revenue overseas.

AstraZeneca currently holds the top position among the most valuable UK companies, valued at approximately £210bn. HSBC, Linde and Shell follow closely behind.

For traders and investors, understanding which firms dominate the UK’s largest companies list matters. These companies’ shares are often more liquid than smaller stocks and are widely followed by analysts, but their prices can still be volatile and dividends can change or be cancelled. Share prices can still fall significantly, and past performance does not guarantee future returns.

The rankings shift with market conditions. Energy prices, interest rate decisions and sector-specific news all influence where each company sits in the league table at any given moment.

Top 15 UK Companies by Market Cap

The following table shows the biggest UK companies by market cap, ranked by their current valuations. Data reflects the most recently available figures from the London Stock Exchange and major financial data providers as of January 23, 2026.

Top 15 UK Companies by Market Capitalisation

Data sources: CompaniesMarketCap, Yahoo Finance, January 2026. Market caps rounded. Dividend yields and P/E ratios are trailing 12-month figures and subject to change.

Important: High dividend yields can signal either attractive income or potential business challenges. A low P/E ratio may indicate value or reflect market concerns about future earnings. Share prices can fall as well as rise, and you may receive back less than you invest.

Several observations stand out from this list. Pharmaceuticals, banking and energy dominate the list. The banking and energy sectors each contribute three companies to the top 15. Defence contractor BAE Systems has climbed the rankings following increased government spending commitments across NATO countries.

How to Trade or Invest in the Largest UK Companies

You can gain exposure to the UK’s largest companies through several methods. Each carries different risk profiles and suits different objectives.

Share dealing involves buying actual shares in companies like AstraZeneca or Shell. You own a stake in the business and may receive dividends. This approach suits longer-term investors comfortable with stock market volatility. Your capital is at risk and you could lose money.

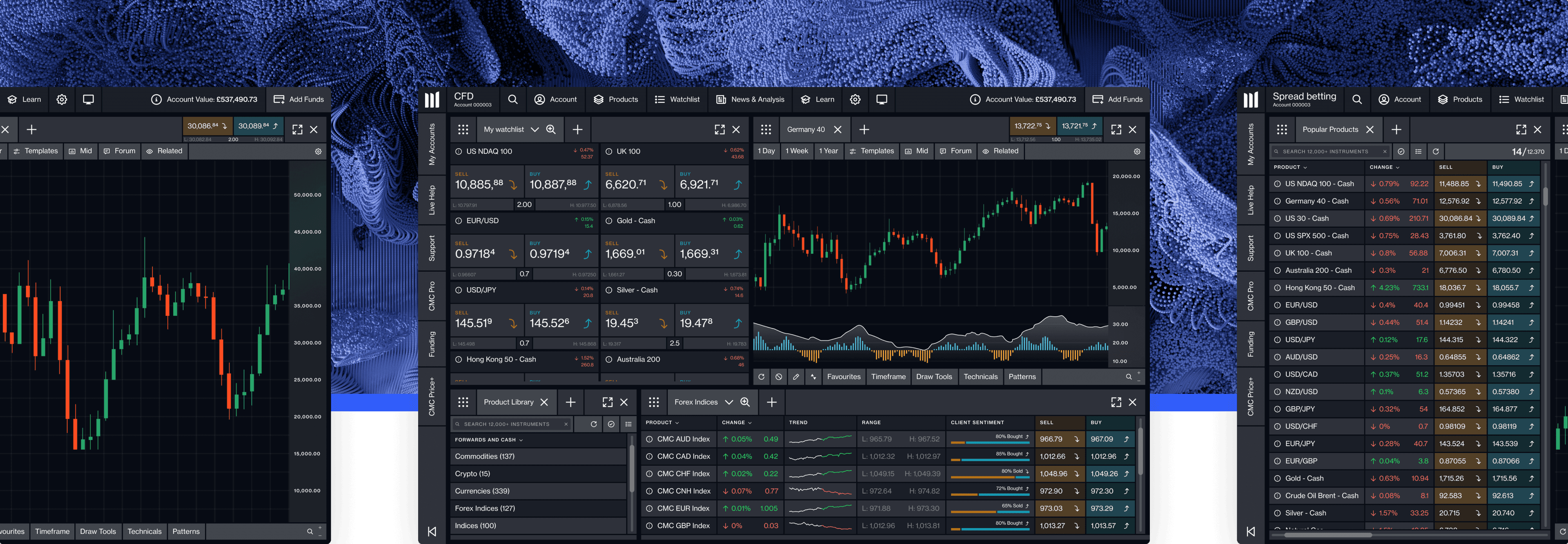

CFD trading allows you to speculate on share price movements without owning the underlying asset. Contracts for difference (CFDs) use leverage, which amplifies both potential gains and potential losses. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The FCA reports that approximately 80% of retail investor accounts lose money when trading CFDs.

Spread betting works similarly to CFD trading but profits are taxed differently for UK residents under certain conditions. Tax treatment can change. The same leverage risks apply. You should not trade with money you cannot afford to lose.

Index funds and ETFs tracking the FTSE 100 provide diversified exposure to the UK’s biggest brands without picking individual stocks. This approach spreads risk across all 100 constituents but does not eliminate market risk entirely.

Before trading or investing, consider your financial goals, time horizon and risk tolerance. If unsure whether a particular approach suits your circumstances, seek independent financial advice.

The Biggest UK Companies by Revenue

Market capitalisation tells one story. Revenue tells another. The UK’s largest companies by turnover look somewhat different from those ranked by market value.

Top 10 UK Companies by Annual Revenue

Data source: Statista, January 2026.

Shell tops the revenue rankings despite sitting fourth by market cap. Energy companies generate enormous revenues but trade at lower valuations relative to sales than pharmaceutical or technology firms.

AstraZeneca ranks sixth by revenue but first by market cap. Investors value its profit margins, growth prospects and drug pipeline more highly than the sheer volume of sales that oil majors produce.

This distinction matters for traders analysing company fundamentals. Revenue growth signals business expansion. Profit margins indicate operational efficiency. Market capitalisation reflects what investors collectively believe a company is worth today based on its future prospects.

UK Companies by Sector

The FTSE 100 spans multiple industries. Understanding sector dynamics helps traders identify opportunities and manage portfolio concentration.

Biggest UK Energy Companies

Shell and BP dominate the UK’s energy sector. Both operate globally across oil exploration, refining, trading and increasingly renewable energy projects.

Shell reported income attributable to shareholders of $13.7bn in the first nine months of 2025, down 10% from the same period in 2024 due to lower LNG and chemicals prices. In December 2025, the company completed its deal with Equinor to form Adura, the North Sea’s largest independent producer of oil and gas.

For the first nine months of 2025, BP reported income attributable to shareholders of $3.48bn, up from $2.34bn reported in the same period of the previous year. In February 2025, the company announced its intention to increase oil and gas investment to approximately $10bn while reducing renewable energy spending to $1.5bn–2bn annually.

Energy stocks remain sensitive to commodity prices, geopolitical developments and the pace of energy transition. Both companies face long-term structural questions about fossil fuel demand even as short-term oil prices support profitability.

Biggest UK Pharmaceutical Companies

AstraZeneca and GSK lead the UK’s pharmaceutical industry. Both rank among the world’s largest drugmakers.

AstraZeneca focuses on oncology, cardiovascular, respiratory and immunology treatments. The Cambridge-based company reported $54.1bn in revenue for the year ending 31 December 2024, up 18% year-over-year.

GSK reported £31.4bn in revenue for 2024, with growth in vaccines, respiratory treatments and oncology.

Pharmaceutical stocks typically carry higher valuations than energy companies but face patent expiration risks, clinical trial uncertainties and regulatory challenges.

Biggest UK Financial Services Companies

HSBC, Barclays, Lloyds and NatWest comprise the ‘Big Four’ UK banks. Together they dominate domestic retail and commercial banking.

HSBC stands apart as the UK’s largest bank and the biggest in Europe by market capitalisation. It serves approximately 41 million customers globally in 57 markets. The bank generates most of its profits from Asia rather than the UK .

UK banks benefited from higher interest rates in 2023–25, which widened net interest margins, helping to boost shares of the Big Four. Future performance depends partly on the interest rate outlook and economic conditions affecting loan defaults.

What Is Market Capitalisation and Why Does It Matter?

Market capitalisation, often shortened to market cap, represents the total value of a company’s outstanding shares. You calculate it by multiplying the current share price by the number of shares in circulation.

Think of it as the price tag the market places on an entire company at any given moment. If AstraZeneca has 1.55 billion shares outstanding and trades at £135 per share, its market cap equals approximately £210 billion.

Market cap matters for several reasons. It determines which index a company joins. The FTSE 100 includes the 100 largest companies by this measure. It influences how institutional investors allocate capital, since many funds have rules about investing in companies above or below certain size thresholds.

For traders, market cap affects liquidity. Larger companies typically see higher trading volumes, tighter bid-ask spreads and lower transaction costs. Smaller companies may offer greater growth potential but often come with higher volatility and thinner markets.

Market cap does not measure a company’s intrinsic value or predict future share price performance. A company valued highly today could decline significantly if earnings disappoint or sector conditions worsen.

Understanding the FTSE 100 and FTSE 250 Indices

The FTSE 100 and FTSE 250 serve as the primary benchmarks for UK equities. Understanding their differences helps traders select appropriate instruments.

FTSE 100

The Financial Times Stock Exchange 100 Index launched in January 1984. It tracks the 100 largest companies listed on the London Stock Exchange by market capitalisation. Despite containing only 100 firms, it represents approximately 80% of the total UK market value.

Key characteristics include global revenue exposure. This international focus means the index often moves inversely to sterling. When the pound weakens, overseas earnings translate into more pounds, potentially lifting share prices.

The FTSE 100 currently yields around 3.1% in dividends. The FTSE 100’s dividend yield is often cited by income-focused investors, but dividends are not guaranteed and companies can reduce or eliminate payments.

FTSE 250

The FTSE 250 comprises the 101st to 350th largest companies. Launched in October 1992, it contains more domestically focused businesses. This index serves as a closer proxy for UK economic health than the internationally oriented FTSE 100.

Over some long periods the FTSE 250 has outperformed the FTSE 100, but results vary widely by timeframe and past performance is not a reliable indicator of future results

Mid-cap stocks may offer stronger growth potential but carry additional risk. Smaller companies face greater challenges during economic downturns and may struggle to access capital during financial stress.

Key Takeaways

The biggest UK companies span diverse sectors including pharmaceuticals, energy, banking and consumer goods. AstraZeneca leads by market capitalisation while Shell tops the revenue rankings.

Understanding market cap, the FTSE indices and sector dynamics helps traders identify opportunities appropriate to their objectives and risk tolerance. The FTSE 100 offers global exposure and dividend income while the FTSE 250 provides closer alignment with the domestic UK economy.

Multiple routes exist for gaining exposure to the UK’s largest companies. Direct share ownership suits long-term investors. CFDs and spread betting enable shorter-term trading but carry high risks, particularly for inexperienced traders.

Share prices fluctuate based on company performance, economic conditions and market sentiment. High dividend yields may signal attractive income or underlying business challenges. Past performance does not predict future returns, and you may receive back less than you invest.

AstraZeneca currently holds the position of the UK’s largest company by market capitalisation, valued at approximately £210 billion as of January 2026. By revenue, Shell ranks as the biggest UK company, generating $283.8 billion in 2025 sales.

The top 100 UK companies form the FTSE 100 index. This includes household names like AstraZeneca, Shell, HSBC, Unilever, Tesco, Vodafone and British Airways owner IAG. The full list is published by the London Stock Exchange and updated quarterly based on market capitalisation rankings.

Membership changes when companies grow large enough to enter or shrink below the threshold for inclusion. Recent years have seen several major firms delist from London entirely, including Ashtead Group and Flutter, which moved their primary listings to New York.

You can invest in FTSE 100 companies through several channels. A share dealing account with a regulated broker allows you to buy individual stocks directly. An ISA wrapper provides tax advantages on any gains or dividends received.

Alternatively, FTSE 100 tracker funds and ETFs provide diversified exposure across all constituents through a single investment. This approach spreads risk but also limits your upside if one company significantly outperforms.

If you prefer to trade rather than invest for the long term, CFDs and spread bets allow speculation on price movements without owning shares. These leveraged products carry substantial risk and most retail accounts lose money.

UK large-cap stocks offer certain advantages including high liquidity, established business models, dividend income potential and professional analyst coverage. These characteristics suit investors seeking relative stability rather than high-growth opportunities.

However, large companies can still lose substantial value. Past performance provides no guarantee of future results.

The UK market trades at lower valuations than US equities on average. Some commentators interpret lower valuations as potential value; others interpret them as reflecting structural risks including Brexit-related uncertainty, fewer technology companies and an ageing corporate base. You should research thoroughly and consider seeking independent advice before investing.

*No1 Web-Based Platform, ForexBrokers.com Awards 2020; Best Telephone & Best Email Customer Service, based on highest user satisfaction among spread betters, CFD & FX traders, Investment Trends 2020 UK Leverage Trading Report; Best Platform Features & Best Mobile/Tablet App, Investment Trends 2019 UK Leverage Trading Report.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.