AI Shares: The Best AI Stocks in 2025

What is an artificial intelligence (AI) company?

Artificial intelligence is one of the biggest developments in the tech sector right now. The global AI market is projected to rise from a global valuation of $200 billion in 2024 to one of $1.8 trillion by 2030.

This growth trajectory is creating a growing category of AI-powered investment opportunities, from:

AI-focused companies developing their large language models

AI chip makers powering the future of AI performance

Established technology firms are racing to integrate AI across their existing operations.

As with any major technological development, investors are navigating a ‘hype cycle’ in AI, making it harder to cut through the noise and identify stocks truly positioned for long-term AI-driven growth.

Some companies represent genuine AI innovation with sustainable competitive advantages, while others may simply be benefiting from market enthusiasm without substantial AI integration themselves. For investors, understanding the difference between the two is key.

The Best Artificial Intelligence Stocks to watch in 2025

AI tools like ChatGPT, Claude, and Perplexity might feel like household names, but these AI technologies are still in their infancy, and many of the companies behind them haven’t yet IPO’d.

That means retail investors won’t be able to invest in Perplexity, OpenAI (the company behind ChatGPT), or Anthropic (the company that owns Claude) yet.

Still, some large, publicly listed technology companies are positioning themselves as true frontrunners in the artificial intelligence space, which means it's still possible to invest in many of the best AI stocks if you’re a retail investor.

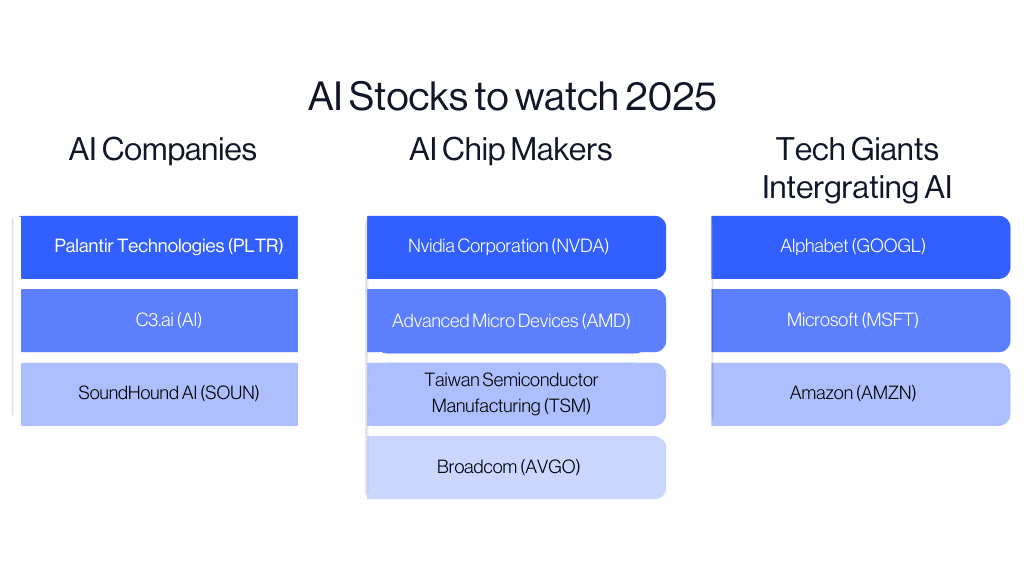

AI Companies

1. Palantir Technologies (PLTR)

Palantir specialises in AI-powered data analytics for government and enterprise customers. The company's platforms help organisations integrate and analyse vast datasets to improve decision-making and operational efficiency.

Investment Case: Palantir's government contracts and expanding commercial business demonstrate the value of its AI analytics platform. The company's unique position in sensitive government work and growing enterprise adoption support long-term growth prospects.

Key Metrics:

Market cap: £85 billion

Revenue growth 27%, expanding commercial customer base

Risks:

Government contract dependence

High valuation

Competitive enterprise software market

2. C3.ai (AI)

C3.ai provides enterprise AI software platforms that enable organisations to develop and deploy AI applications across various business functions. The company serves clients in the energy, manufacturing, and financial services sectors.

Investment Case: C3.ai's comprehensive AI platform and experienced management team position it well for enterprise AI adoption. The company's focus on specific verticals and proven customer success stories supports its growth strategy.

Key Metrics:

Market cap: £8 billion

Customer growth 25%

Expanding platform capabilities

Risks:

Customer concentration

Competitive enterprise AI market

Path to profitability.

3. SoundHound AI (SOUN)

SoundHound develops voice AI technology for automotive, hospitality, and consumer applications. The company's conversational AI platform enables natural language interactions across various devices and services.

Investment Case: SoundHound's voice AI technology addresses the growing demand for conversational interfaces. The company's automotive partnerships and expanding application ecosystem demonstrate market traction.

Key Metrics:

Market cap £2.8 billion

Revenue growth of 45%

Growing partner ecosystem

Risks:

Competition from larger technology companies

Market development pace

Customer acquisition costs.

Best AI chip makers

1. Nvidia Corporation (NVDA)

Nvidia currently holds c. 7 % share of the AI chip market, mostly because of its industry-leading graphics processing units (GPUs), which power the vast majority of AI training and inference workloads globally, and its CUDA software, which is pretty much the industry standard for AI development.

Investment Case: Nvidia's CUDA software ecosystem creates powerful switching costs for AI developers, and its technological leadership in AI chip manufacturing gives it major competitive advantages. The company's data centre revenue has grown over 200% year-on-year, driven primarily by AI demand.

Key Metrics:

Market cap of: £2.6 trillion

Year-on-Year revenue growth of 69% in Q1 2025

Gross margins of more than 70%

Risks:

High valuation

Potential competition from custom chips

China trade restrictions

2, Advanced Micro Devices (AMD)

AMD is the main alternative to Nvidia if you’re hoping to invest in AI microchip companies. The company's EPYC processors, Instinct accelerators, and MI450 AI chips are gaining traction with cloud providers seeking alternatives to Nvidia.

Investment Case: AMD's data centre and AI revenue grew 80% year-on-year, demonstrating success in penetrating Nvidia's market dominance. The company's competitive pricing and strong relationships with major cloud providers position it well for continued growth.

Key Metrics:

Market cap: £180 billion

Overall revenue growth of 30.2% in Q1 2025

Data centre revenue growth of 80%

Expanding gross margins

Risks:

Nvidia's technological leadership

Execution challenges in AI software ecosystem

3. Taiwan Semiconductor Manufacturing (TSM)

TSMC manufactures the advanced semiconductors that power AI applications, including chips for Nvidia, Apple, and AMD. The company's leading-edge manufacturing capabilities are essential for AI hardware advancement.

Investment Case: TSMC's advanced node capacity is sold for years to come, driven primarily by AI demand. The company's technological moat in semiconductor manufacturing and strategic importance to the AI ecosystem provide sustainable competitive advantages.

Key Metrics:

Market cap: £840 billion

Advanced node revenue growth of 35%

Very strong margins

Risks:

Geopolitical tensions with China

Capital-intensive manufacturing

Cyclical semiconductor markets.

4. Broadcom (AVGO)

Broadcom designs custom AI chips for major cloud providers and networking equipment essential for AI infrastructure. The company's diversified portfolio includes both AI-specific products and broader technology solutions.

Investment Case: Broadcom's AI revenue exceeded £8 billion in 2024, driven by custom chip designs for hyperscale customers. The company's strong customer relationships and diverse technology portfolio provide stability and growth opportunities.

Key Metrics:

Market cap: £908 billion

AI revenue growth 150%

Consistent dividend payments

Risks:

Customer concentration

Competitive pressure in networking

Acquisition integration challenges

Tech giants integrating AI

1. Alphabet (GOOGL)

Alphabet is widely cited by analysts as a leading AI innovator, with the tech firm moving fast to integrate artificial intelligence across its search, cloud computing, autonomous vehicles, and consumer products. The company's DeepMind subsidiary leads AI research while Google Cloud competes directly with Microsoft and Amazon in enterprise AI.

Investment Case: Alphabet's vast data resources, advanced AI research capabilities, and multiple monetisation avenues create a diversified AI investment. Google's search improvements through AI, Cloud AI services growth, and emerging opportunities in autonomous driving all contribute to the investment thesis.

Key Metrics:

Market cap: £1.5 trillion

Cloud revenue growth 35%

Leading AI research output

Risks:

Regulatory scrutiny

Competition in cloud AI

Autonomous vehicle development challenges

2. Microsoft (MSFT)

Microsoft's partnership with OpenAI and integration of artificial intelligence across its own software portfolio increasingly positions the company as a leader in enterprise AI adoption. The company's Azure cloud platform and Microsoft 365 productivity suite both benefit significantly from AI enhancements.

Investment Case: Microsoft's early investment in OpenAI and rapid integration of AI capabilities across its product portfolio demonstrate strategic foresight. Azure AI services and Microsoft 365 Copilot represent significant growth drivers with expanding addressable markets.

Key Metrics:

Market cap: £2.6 trillion

Azure revenue growth of 30%

Office 365 AI integration driving upgrades

Risks:

OpenAI partnership risks

Competitive pressure from Google and Amazon

Enterprise adoption pace.

3. Amazon (AMZN)

Amazon's AI investments span ecommerce personalisation, cloud computing services, and consumer devices. The company's Amazon Web Services (AWS) division leads in cloud AI services, while Alexa is one of the most successful consumer AI applications.

Investment Case: AWS's comprehensive AI service portfolio and Amazon's massive e-commerce data create multiple AI monetisation opportunities. The company's logistics optimisation, recommendation engines, and cloud AI services all demonstrate successful AI implementation.

Key Metrics:

Market cap: £1.6 trillion

AWS revenue growth of 19%

Expanding AI service portfolio

Risks:

Cloud competition intensifying

Regulatory scrutiny

Capital requirements for AI infrastructure.

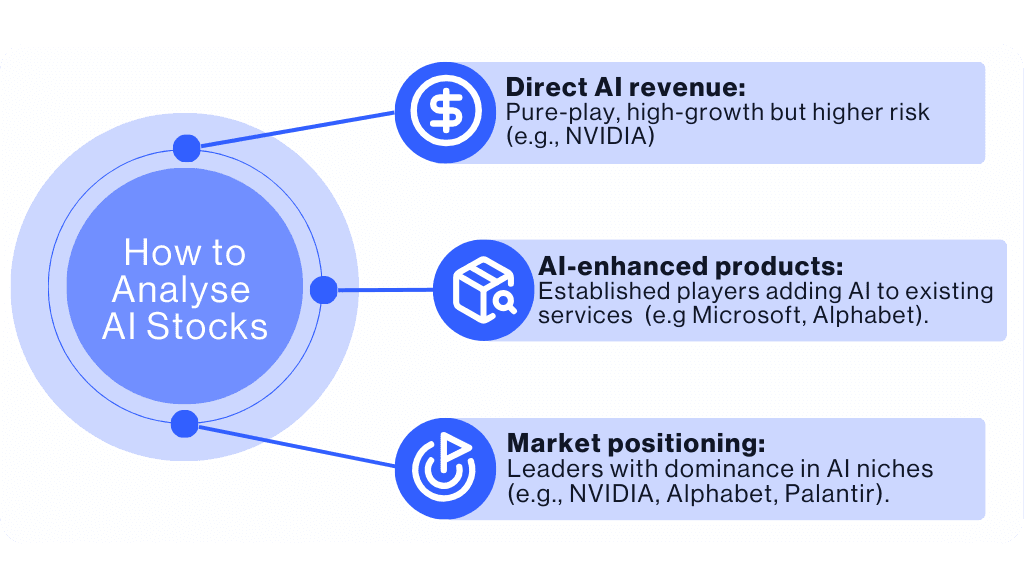

How to Analyse AI Stocks

The key to successfully investing in AI stocks is cutting through the noise and media hype and identifying public companies that are genuinely leveraging AI technologies for growth rather than applying an “AI gloss” to a more traditional business model.

The best way to do that is to zero in on that company’s AI-specific revenue:

Direct AI revenue: Companies like Nvidia derive the majority of their growth from AI-specific products, making their performance directly tied to AI adoption. These pure-play opportunities often offer the highest growth potential but carry corresponding risks.

Revenue from AI-enhanced products: Established companies like Microsoft and Alphabet integrate AI to improve existing services, creating more sustainable but potentially slower growth. These investments often provide better risk-adjusted returns.

Market positioning: Leading AI companies typically possess significant market share in their respective niches. Nvidia's dominance in AI chips, Alphabet's leadership in search and cloud AI, and Palantir's government contracts all represent strong competitive positions.

Ways to invest in or trade AI Stocks

Many AI companies trade at big premiums because the market is pricing future growth expectations into their share prices.

In addition, some AI companies are sacrificing profitability to capture more market share, and both of these factors can make artificial intelligence stocks harder to value and more risky to invest in.

It’s important to consider the following factors when you’re assessing their current share prices:

The sustainability of the company’s revenue growth: Consider whether AI revenue growth can maintain its current trajectory. Look for expanding total addressable markets, increasing customer adoption rates, and growing use cases for AI technology.

The company’s path to profitability: Although many AI companies prioritise growth over profitability, that can’t go on forever. Look at things like gross margins, operating leverage potential, and capital requirements for scaling in order to figure out if the company has a path to profitability.

The company’s valuation relative to its closest peers: Compare valuations within AI sub-sectors rather than against the broader market. For example, AI infrastructure companies, software providers, and applications companies all warrant different valuation frameworks.

Ways to invest in or trade AI Stocks

The AI sector's volatility and rapidly changing competitive landscape mean retail investors and traders need to have a firm grasp of the sector (and its sub-sectors), so that they can understand the different ways to gain exposure to AI. Whether a trader is interested in individual AI stocks, established tech giants integrating AI, or AI-focused ETFs, they’ll need to ensure that the product they choose to trade or invest in aligns with their risk appetite and overall trading or investment strategy.

Pure-Play AI vs Tech giants integrating AI

Pure-play AI offers investors the most direct exposure to AI growth, but also brings higher risks. Companies like Nvidia, Palantir, and C3.ai derive substantial portions of their revenue from AI-specific products and services.

On the other hand, AI-enhanced companies like Alphabet, Microsoft and Amazon integrate artificial intelligence to improve existing products and services, offering more diversified exposure. Since these technology giants use AI to enhance core businesses, they aren’t as reliant on continued AI adoption as they’re still able to maintain revenue diversification

AI ETFs vs Individual AI Stocks

Investors also need to decide between directly investing in individual AI stocks or using AI-focused Exchange Traded Funds (ETFs) to gain exposure to the growth of AI without limiting themselves to one company.

Investing in individual artificial intelligence stocks suits investors with:

Strong analytical skills and sector knowledge

An appetite for active portfolio management

Higher risk tolerance to take on less diversified positions

Conviction in specific AI technologies or companies.

On the other hand, AI-focused ETFs could appeal to investors who want to diversify their holdings:

Instant diversification across AI companies and sub-sectors

Lower individual company risk exposure

Simplified investment management.

Leaders of the cloud industry that use artificial intelligence within their products and services include Amazon, IBM, Microsoft, and Alphabet. These companies are known as tech giants, which you can also trade on via our Big Tech share basket using a single position.

Deep learning is a sub-field of machine learning and AI based on artificial neural networks. This imitates the way humans process and extract higher levels of knowledge from data. Some examples of deep learning in real-life products include virtual assistants, face recognition tools and driverless cars.

Nvidia [NVDA] is a world leader for chip-making, producing the largest number of GPUs in the market. Following suit is Intel [INTC] and Qualcomm [QCOM], which also operate a small share of the market.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.