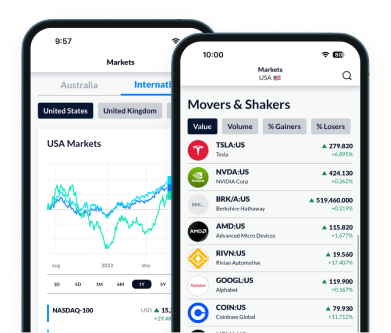

Invest in over 45,000+ stocks and ETFs from the palm of your hand. With advanced charting, expert analysis, and even price predictions, you’ll have all the tools you need to stay ahead of the market.

What are you investing in today?

Invest in over 30,000 international stocks – all from our single trading platform. Plus, get started with $0 brokerage* on all stocks from the US, UK, Canada and Japan.

Our powerful trading platform gives you the edge you’ll need to stay ahead of the markets with Morningstar analysis, TradingView charting and more.

*FX spreads apply

See how we compare

We keep our pricing simple, so you can focus on the markets instead of navigating pricing tables. Start investing with free brokerage on all US, UK, Canadian and Japanese-listed stocks and ETFs*.

That means, you can buy shares in Apple, Tesla, Toyota or Tesco - all for $0 brokerage*.

CMC Invest | CommSec | NabTrade | Stake | Westpac | |

|---|---|---|---|---|---|

ASX Brokerage (on <$1,000 trade) | $0# | $5.00 | $9.95 | $3.00 | $4.95 |

US brokerage | $0* | USD $5.00* | $14.95* | USD $3.00* | USD $19.95* |

Inactivity/holding fees | $0 | $0 | $0 | $0 | USD $63.50 per year |

International markets available | 15 | 13 | 4 | 1 | 1 |

Trade the US market before open and after close^ | ✓ | ✓ | ✕ | ✓ | ✕ |

Data correct as of May 2025. No representation is made for the accuracy or completeness of competitor information. For up-to-date competitor pricing and product offerings, visit their website. See our FSG for fees and charges.

#First buy per security, per day. Excludes margin loan settled trades. *FX spreads apply to international orders. ^There may be higher volatility and lower liquidity during extended trading hours.

The latest market news, curated for you

- Invest BudgetingLearn More

When researching options for your portfolio, there isn’t a one-size-fits-all approach. to getting started. You may end up following different techniques or looking at different information until finding the one that gives you the most valuable insights.

- How share investing worksLearn More

Everyone wants their investment journey to be successful. Defining your goals can be a helpful way to understand what your approach could be.

- International Share TradingLearn More

Once you've become familiar with domestic shares, you might be interested in exploring the wider world of international share trading.