Discover the costs associated with trading CFDs across all 12,000 products, including spreads, margins, and overnight holding fees.

Spreads | Holding cost | Margins

When trading on leverage, you will need to consider various costs, including the spread, margin, and overnight fees. Additionally, you will need to take into account other potential charges and factors that may affect your trading costs, as detailed below.

- Forex

- Indices

- Commodities

- Shares

- Treasuries

- Cryptocurrencies

Product |

|---|

- |

- |

- |

- |

- |

Min spread | Holding cost (buy) | Holding cost (sell) | Margin rate |

|---|---|---|---|

- | -% | -% | -% |

- | -% | -% | -% |

- | -% | -% | -% |

- | -% | -% | -% |

- | -% | -% | -% |

Share CFD commissions

Share CFDs attract a commission charge each time you enter and exit a trade. This charge varies depending on the country where the share product originates.

Country/market | Commission charge | Minimum commission charge |

|---|---|---|

UK | 0.08% | GBP 9.00 |

US | 2 cents per unit | USD 10.00 |

Australia | 0.09% | AUD 7.00 |

Austria | 0.10% | EUR 9.00 |

Belgium | 0.10% | EUR 9.00 |

Canada | 2 cents per unit | CAD 10.00 |

Denmark | 0.10% | DKK 90.00 |

Finland | 0.10% | EUR 9.00 |

France | 0.10% | EUR 9.00 |

Germany | 0.10% | EUR 9.00 |

Hong Kong | 0.18% | HKD 50.00 |

Ireland | 0.10% | EUR 9.00 |

Italy | 0.10% | EUR 9.00 |

Japan | 0.15% | JPY 1,000 |

Netherlands | 0.10% | EUR 9.00 |

Norway | 0.10% | NOK 79.00 |

Portugal | 0.10% | EUR 9.00 |

Singapore (SGD) | 0.10% | SGD 10.00 |

Singapore (USD) | 0.10% | USD 10.00 |

Spain | 0.10% | EUR 9.00 |

Sweden | 0.10% | SEK 89.00 |

Switzerland | 0.10% | CHF 9.00 |

Our costs explained

- Holding costs

- Commissions

- Market data fees

- Guaranteed stop-loss order charges

- Dormant account charges

- Currency conversions

Holding costs

At the end of each day (5pm New York time), open CFD trading positions may be subject to a charge called a holding cost. The holding cost can be positive or negative depending on whether you are long or short. Forward contracts on indices, forex, commodities and treasuries are not subject to holding costs.

Holding costs for indices are based on the underlying risk-free or interbank rate of the index: plus 2.5% on buy positions and minus 2.5% on sell positions.

For share CFDs, holding costs are based on the underlying risk-free or interbank rate for the currency of the relevant share (see table) plus 2.5% on buy positions and minus 2.5% on sell positions.

FX holding costs are based on the tom-next (tomorrow to next day) rate in the underlying market for the currency pair.

Holding rates for cash commodities and treasuries are based on the inferred holding costs built into the underlying futures contracts, from which the prices of our cash commodity and treasury products are derived.

Holdings costs for share baskets, forex indices and commodity indices are calculated via a weighted sum of the constituents' holding cost rates, plus CMC's fee on buy positions or minus CMC's fee on sell positions.

Learn more about holding cost.

Please note this information has been provided for reference, and the rates may not match exactly if recalculated. If you have any questions, please contact our client services team.

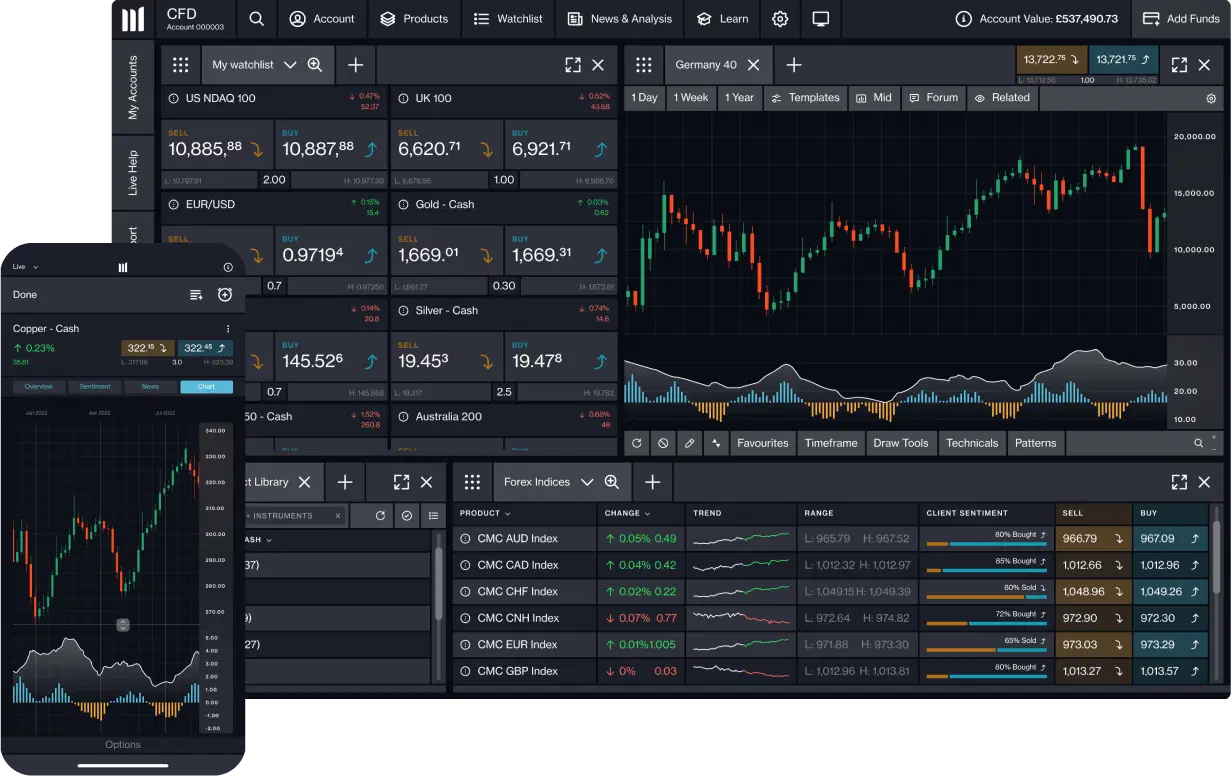

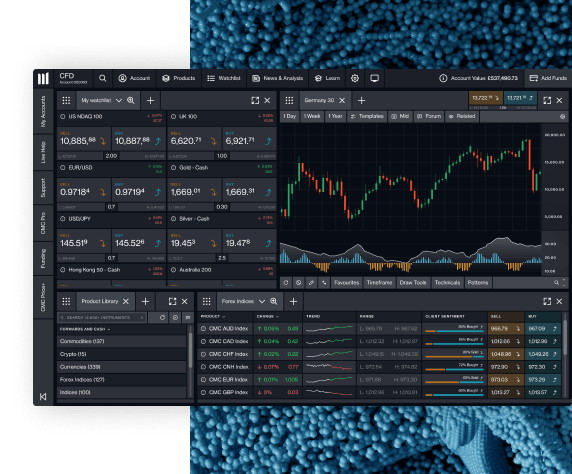

Explore all of our CFD trading platforms

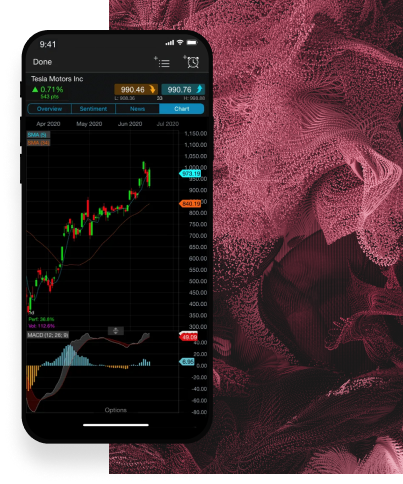

- CMC web platform

- CMC mobile app

- MetaTrader 4 (MT4)

- MetaTrader 4 (MT4) WebTrader

- TradingView

Discover an award-winning CFD trading experience on our CMC Markets Platform.

Trade CFDs with tight spreads on over 12,000 instruments

Minimal slippage with ultra-fast execution speed

100% automated execution

Join over 1 million global traders and investors

Charges

Frequently asked questions

The GSLO premium can be calculated in the following way: premium rate x trade size (units). Amounts are automatically converted into your account currency using the prevailing CMC Markets conversion rate.

Please see our GSLO guide for a more comprehensive explanation.

CMC Markets products are priced with reference to underlying assets. Investing directly in such assets carries an associated cost of physically holding those assets for a period of time. For instance, if you buy futures on crude oil, someone has to store that oil until the delivery date. The carrying cost represents the cost involved in holding an asset. The carrying cost is only applicable to trades on the following product types: Commodities and currencies.

The holding rate used when calculating the applicable holding costs on FX comes from the tom-next rate, which is based on the difference between the two currencies’ interest rates, with an additional 1% CMC Markets charge added. Learn more about holding costs.

Commission is only applicable for share trading on a CFD account. It's taken out of the cash balance on your account at the open and the close of a position. Learn more about our commission charges.

The list of costs and charges below is not exhaustive. Please see our CFD holdings costs page for a more comprehensive explanation or refer to our FSG.

GSLO premium costs: works in the same way as a stop-loss order, except that it guarantees you to close out of a trade at the price specified regardless of market volatility or gapping, for a premium. If the GSLO is not triggered, then we'll refund 100% of the original premium. It can be calculated in the following way: premium rate x trade size (units). Amounts are automatically converted into your account currency using the prevailing CMC Markets conversion rate. Learn more about GSLOs here.

Overnight holding costs: at the end of each trading day at 5pm (New York time), any cash positions held in your account may be subject to a charge called a 'holding cost'. The holding cost can be positive or negative depending on the direction of your position. Historical holding rates, expressed as an annual percentage rate, are visible on our platform within the overview section of each product. This annual percentage is applied to the notional value of your trade when it was opened and divided by 365 for the one-night cost. Learn how we calculate CFD holdings costs.

Commission charges: when trading CFD shares on our platform, a commission will be charged to your account upon execution of any order. See our commission rates.

Market data feeds: in order to view share prices on our platform, you will need to activate the relevant market data feed for the region in which the products you wish to see are traded.

Monthly subscription charges: may apply depending on your market data classification and the type of account you hold; details of the charges can be found on the platform in the ‘market data’ section in ‘user preferences’.

Please make sure you have taken into account any additional costs, such as overnight holding costs, the premium for guaranteed stop-loss orders, or commissions on share CFD trades.

Profit and loss on CFD trading accounts is calculated in the currency where the product is domiciled and then converted into your account currency.

We will be charging a dormancy fee if there has been no trading activity for a continuous period of 12 months.

The fee charged is based on your account currency as follows:

Account currency | Monthly inactivity fee |

AUD | 15 |

USD | 15 |

HKD | 100 |

The dormant account fee will normally be charged within three business days of the following calendar month after 12 months of no trade activity.

No, you will not go into a negative balance if you do not have enough funds. Your account balance will go to zero.

The overnight holding rate used when calculating the applicable holding costs on FX comes from the tom-next rate, which is the difference between the two currencies’ interest rates. Learn more about CFD holding cost.

Please note, you'll be charged holding costs for three days on either a Wednesday or a Thursday, depending on the currency pair, as shown in the table below.

USD/CAD, USD/TRY, TRY/CAD, CAD/TRY | All other FX pairs, FX indices, Gold, Silver, Precious Metals Index | |

|---|---|---|

Monday 5pm EST | x1 Holding Cost rate | x1 Holding Cost rate |

Tuesday 5pm EST | x1 Holding Cost rate | x1 Holding Cost rate |

Wednesday 5pm EST | x1 Holding Cost rate | x3 Holding Cost rate |

Thursday 5pm EST | x3 Holding Cost rate | x1 Holding Cost rate |

Friday 5pm EST | x1 Holding Cost rate | x1 Holding Cost rate |