The main difference between trading and value investing is the time period involved. Value investing is a long-term method that requires you to pay the full value of the share upfront, which you will then own in the long run. Trading allows you to speculate on the price movements of the underlying share, which only requires you to place a fraction of the value, known as a deposit.

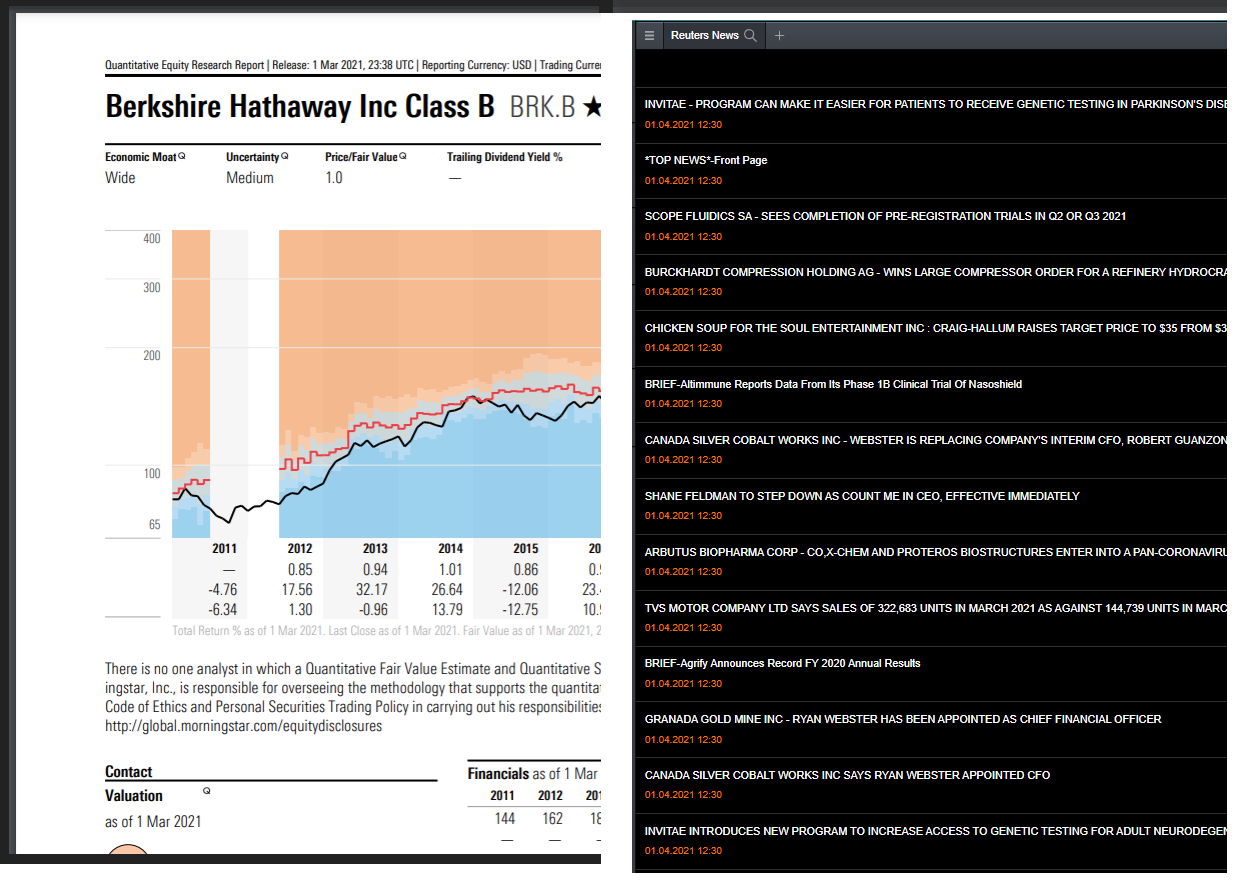

Buying some of the shares mentioned in this article outright could set a trader back by thousands of dollars, and in some cases, the price may not be feasible. For example, Berkshire Hathaway stock currently trades for over $300,000, meaning that many investors will pass on the opportunity.

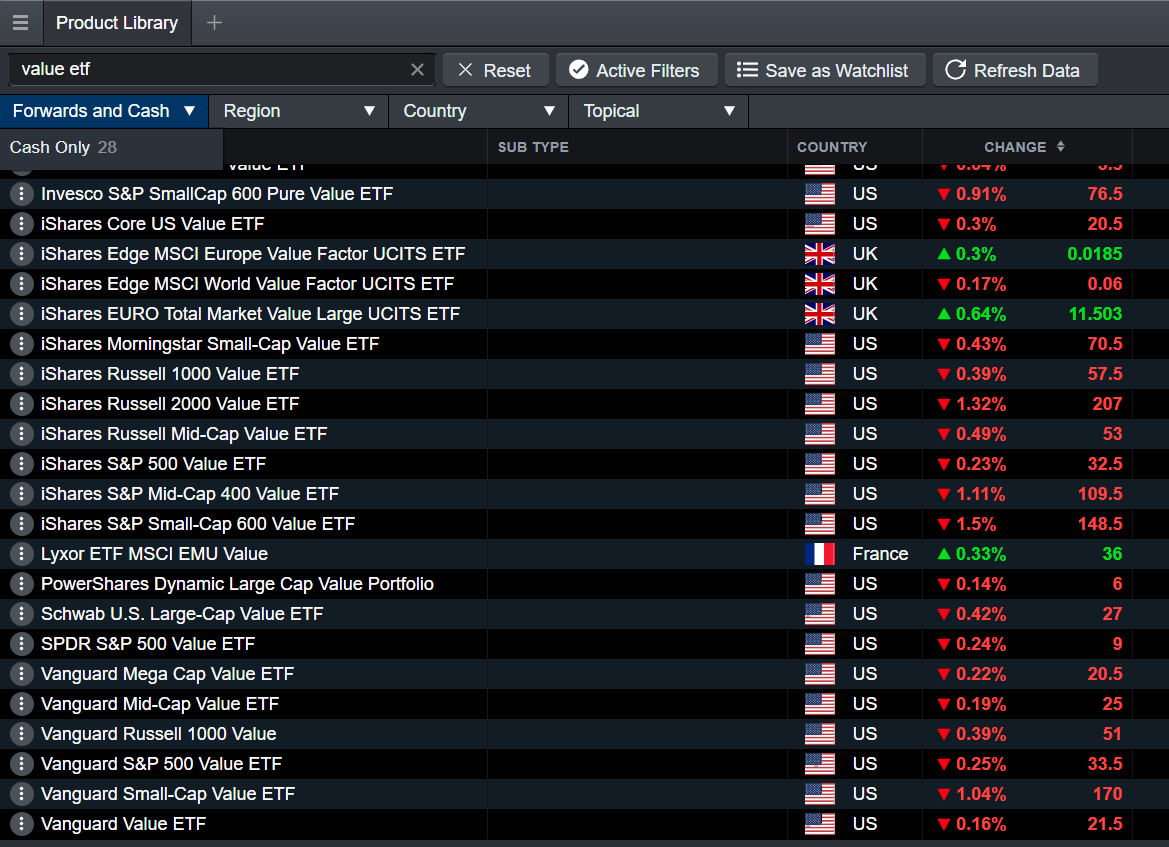

An alternative way of investing in the long-term is to trade with derivatives, such as spread bets or CFDs, which requires leverage. This gives you better exposure to the share market without having to take ownership of the asset, and also allows you to trade both sides of the market. You can either open a buy position (going long) or a sell position (going short), depending on whether you think that the share price will rise or fall. Although this may seem to be an easy alternative, there are many risks involved. Read more about trading with leverage.