How to start trading on stocks and shares in the UK

Want to trade on the stock market but unsure how to get started? Like anything else, trading on stocks can seem quite complex, but the basic concept is straightforward – your aim to to buy an asset and then sell it at some stage in the future for a higher price.

This guide to derivative stock trading for beginners shows you in simple terms how to get started, the different methods, the types of stocks you can access, and how to recognise the reasons shares might move up or down.

Trading on stocks can be a manageable way to grow your money

You can speculate on whether an asset’s price will go up or down using different trading strategies, such as buy-and-hold or short-selling

Trading can involve individual stocks or collections encompassing a variety of stocks or sectors (through indices and ETFs)

Success requires a knowledge of the market, an understanding of how trading works, and application of risk-management

- You can trade CFDs on as many 12,000 stocks

Why start trading?

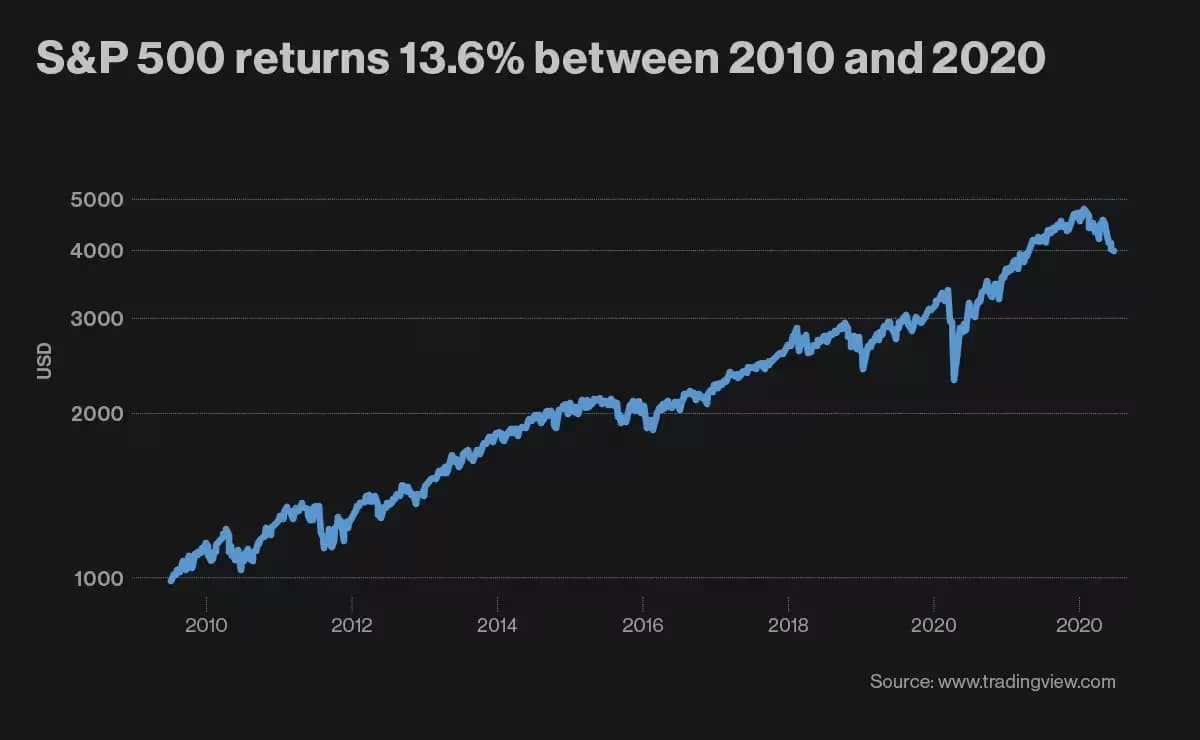

Trading on shares has the potential to grow your money at a greater rate than in a savings account. Since the advent of the first stock exchange, the market has returned an average of 10% per year, while a cash savings account has averaged 2% interest. Between 2010 and 2020, Goldman Sachs noted that the US stock market’s S&P 500 increased its average annual return to 13.6%. You can also trade on prices falling, using stock-shorting strategies.

Naturally, with any form of speculation there’s an element of risk, but there are some ways to mitigate that risk. And ultimately, the more experienced you become at reading the market, the better you’re likely to get at spotting a stock on the up.

Through our award-winning platform¹, it’s a fairly simple process to open a buy or sell position on a stock, you only have to deposit a certain amount of money depending on the share you choose, and you’re not tied into anything. You can exit your position whenever you want when trading derivative products such as spread bets or contracts for difference (CFDs).

So, before you begin, the first thing to understand is what the stock market is and how it works.

What is a stock market?

A stock market or stock exchange is a financial market in which company stocks are bought and sold. The prices of shares listed on these exchanges are not set by individual companies or the exchange, but by the organic forces of supply and demand. As an equity becomes more desirable and more traders buy it, its price will naturally rise.

Stock markets exist in major cities around the world; see here for stock market trading hours. The main ones include:

New York Stock Exchange (NYSE)

National Association of Securities Dealers Automated Quotations System (Nasdaq)

London Stock Exchange (LSE)

Euronext (ENX)

Japanese Exchange Group (JPX)

How does it work?

The stock market works by bringing together buyers and sellers on one platform and enabling them to transfer ownership of stocks and shares. Prices of individual stocks are determined by supply and demand. In stocks and shares trading, traders aim to buy stocks at a low price with the hope that the share price will rise in the future so they can cash out on the price increases. However, they stand to lose money if the stock price falls.

How do stocks come to market?

A company initially lists shares for sale when it wants to raise significant capital to fund its continued growth. In making shares of the company available to outside investors, it transitions from a private (for example, privately owned) company to a public company.

The shares are traditionally put up for sale through a process known as an initial public offering (IPO), although some companies can use a special purpose acquisition company (SPAC) that helps to ‘piggyback’ private companies onto the stock market. However, once the shares become available, they are then bought and sold on the stock market as supply and demand dictates.

What is share trading?

Share trading is the process of opening long and short positions (buying and selling) of company stock using derivative products with the aim of watching and reacting to the market over a relatively short time to gain profitable stock returns. This isn’t the same as share dealing (otherwise known as investing), which involves buying a stock and holding it for long-term gain, possibly over many years. At CMC Markets, our trading platform offers derivative share trading as an alternative to long-term investing. There are benefits and drawbacks to both strategies, so read more in our guide to trading vs investing to see which may be more suitable for you.

Here are the two types of derivatives that you can trade with us:

Spread betting – you do not take physical ownership of the share but instead speculate whether its price will go up or down. This is a tax-free method for traders in the UK and Ireland.²

CFD trading – this works in the same way as spread betting but profits are liable for capital gains tax, as well as commission fees.

As a trader, you agree to exchange the difference in price (positive or negative) between when you open and close your position and the more the price moves, the more you gain or lose, depending on which way you bet.

How to trade stocks in the UK

Research and pick your stocks.

Read up on news, analysis, and market insights from prominent market analysts, as well as company's fundamentals using financial ratios such as P/E and EPS.

Choose your product.

You can either spread bet or trade CFDs on share price movements. Not sure which is for you? Read our article on spread betting versus CFDs.

Determine the direction of your trade

Based on your research, decide if you wish to go long and ‘buy’ the stock or go short and 'sell'. This is a matter of speculating whether the price of the stock will rise or fall based on your research. In the case of short selling, beware of a short squeeze in the stock market.

Choose a trading strategy

Once you know which share you are trading on and the direction of that trade, you can determine your entry and exit points based upon your trading plan. Make sure you don’t forget to implement your risk management guidelines as part of your trading plan.

Determine your position size, then 'buy' or 'sell' the stock

If the trade aligns with your trading plan, open an order ticket to speculate on the asset’s price action. Consider placing stop-loss and take-profit orders to manage the risk of your position size.

Close your trade

Keep an eye on your trade and close it as stated in your trading plan. That is, if it has not already been closed by the risk-management conditions that you previously set.

Evaluate and track

Think about how you performed in your trade, analyse what went well and what could have gone better. Note down your performance as per your trading plan to help you keep track of your results.

What moves market prices?

The price of a stock is ultimately determined by supply and demand. But what drives this? How might you tell if a stock is about to go up or down? As you learn how to trade stocks, here are a few factors that can help you decide which way to bet on an individual stock.

Earnings reports

Major stock exchanges require businesses to release information on their financial performance. If a company exceeds profit and/or revenue expectations, the share price is likely to increase. But if a company misses its targets or underperforms against its forecast, the price will likely go down.

Economics

Macroeconomic forces such as interest rates, inflation and GDP (gross domestic product) can cause shifts in the supply and demand of all industries and therefore all have a knock-on effect on share prices. Traders may keep an eye on the news for events and announcements that may impact the economy as a whole or individual sectors.

Politics

Elections, trade wars, law changes, strikes and other politically motivated events can cause major disruptions and changes in markets. For example, if legislation is about to loosen around a certain industry, it could improve profitability in companies in that sector, and therefore their share prices. Conversely, a trade war might drive a stock price down. If a company is working in an industry that is closely related to political agendas, an event such as a trade war can cause a stock to decrease in price.

What are the different types of equities I can trade?

Analysts and market commentators often split stocks into different categories, dependent on the type of company, value or what they offer, including the following.

Blue-chip stocks: These are the top-performing stocks in a particular industry and often act as a benchmark for their respective industry. Examples of blue-chip stocks include Shell, Visa and Procter & Gamble.

Growth stocks: Companies suspected to grow faster than its competitors. These firms tend to have a sharp focus on innovation, and the stocks tend to do well in a confidence-fuelled bull market, but they are also risky as their ultimate performance sometimes doesn’t live up to the hype. Examples include Tesla, Netflix and Amazon.

Value stocks: These trade for a cheaper price than predicted by the company’s financial performance. Value stocks tend to be venerable companies with slow but steady, consistent growth, such as Johnson & Johnson, JP Morgan Chase and Berkshire Hathaway.

Penny stocks: Cheap shares trading at less than £1 (or $5 in the US). They are highly risky, tempting buyers with an illusion of potential for exponential growth. This can pay off – many multi-billion companies once traded for such a low price – but not all are legitimate, and the offer of such cheap stock can leave traders vulnerable to scams. UK penny stocks include Hammerson, Ryanair and Rolls-Royce.

Dividend stocks: As the name suggests, this offers a high dividend yield to shareholders, either in the form of further shares or cash. By definition, dividend stocks tend to be more attractive to long-term investors than traders. Examples of the UK’s high-dividend stocks include Imperial Brands, M&G and British American Tobacco.

Index: This is a selection of chosen stocks that are grouped together with their average price, giving a representative view of individual sectors or the market as a whole. The world’s leading indices include the S&P 500, FTSE 100 and the Nikkei 225.

Exchange-traded funds (ETFs): This is not one stock but a basket of equities that tracks a specific index, so all the stocks in it might, for instance, be renewable energy stocks, or tech stocks. These can be traded like shares and many traders prefer ETFs for their instant diversification spread over a number of companies.

Pricing is indicative. Past performance is not a reliable indicator of future results.

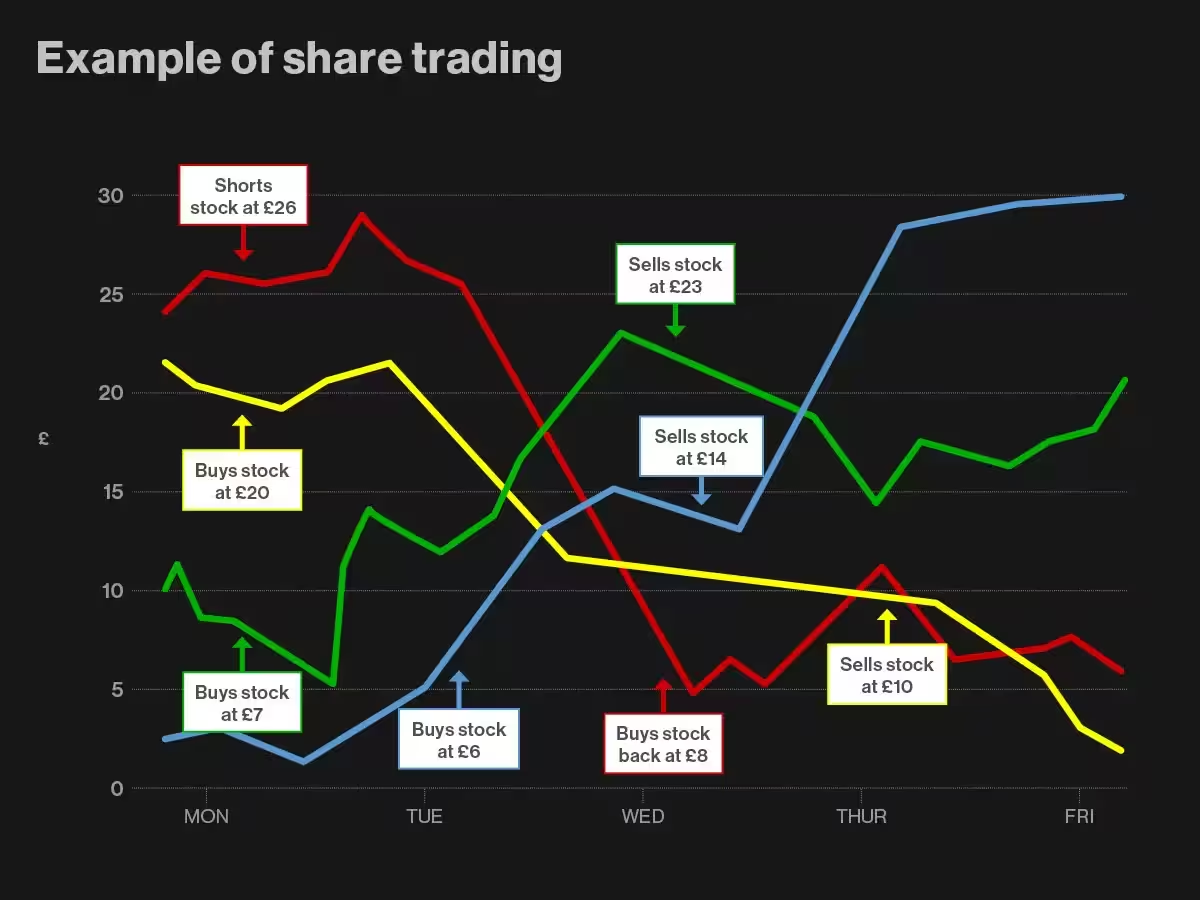

Example of share trading

If you think the price of a particular stock will rise, you can ‘buy’ or go long. However, if you sell too early, you risk losing potential gains. Wait too long and the price might fall, even below what you paid for it.

If you think the price will go down, you can 'sell' or go short, which is when you borrow shares from a broker, at a defined interest rate, and then sell them. Then, if the price goes down, you can buy them back at that lower price, making a profit.

As an example of derivative share trading during a five-day week, say a trader 'buys' the green stock in the chart at its lowest point of £7 on Monday and then sees it rise to £23. The stock then starts to fall, and the trader decides to exit at £23. Similarly, the trader shorts the red stock, borrowing it to sell at £26 and then sees its value fall to £8.

However, although the trader buys the blue stock at a low price of £6 and cashes out at £14, the trader exits too soon because the stock then soars to £30, which would have meant a substantially larger profit.

The trader makes a costlier judgment with the yellow stock, buying it at £20 believing it will go up. The stock plummets, leaving the trader with a choice of whether to wait for it to rebound or lose money by bailing before it drops any further. The trader ultimately sells for £10, making a £10 loss – but had they waited longer, they could have lost even more money.

Where and how can you get started?

When spread betting or trading CFDs, you can trade on over 10,000 shares and ETFs on our award-winning platform that is available on both desktop and mobile devices, Next Generation. Designed to be adaptable to your specific trading needs and suitable for traders of all levels, our platform facilitates online share trading by combining the latest innovations with an easy-to-use interface.

Learn more about our trading platform >

Managing your risk

Share trading, like all speculation, carries risk. Even though, with us, you're learning how to speculate on shares rather than investing, you're still exposed to the same dangers – stock prices going down, a company suddenly going out of business, or the entire market crashing, such as in the financial crisis of 2008, when global stock markets plunged, or in March 2020 when the Covid-19 pandemic wiped billions of dollars off share prices in a couple of days.

Diversification across multiple companies and sectors is one way you can manage risk, which prevents you putting all your traded eggs in one basket. Certain types of stock tend also to carry less risk than others – blue-chips are statistically more likely to be reliable. Read our risk-management guide before placing a trade.

Does it cost to trade?

Yes there are costs, some of which depend on how you trade. The main fees applicable include the following:

See our trading fees in further detail.

We also offer share baskets which come with zero commission and lower holding costs compared with trading on individual shares. They can also help to diversify your portfolio, while spreading risk across multiple assets using a single position.