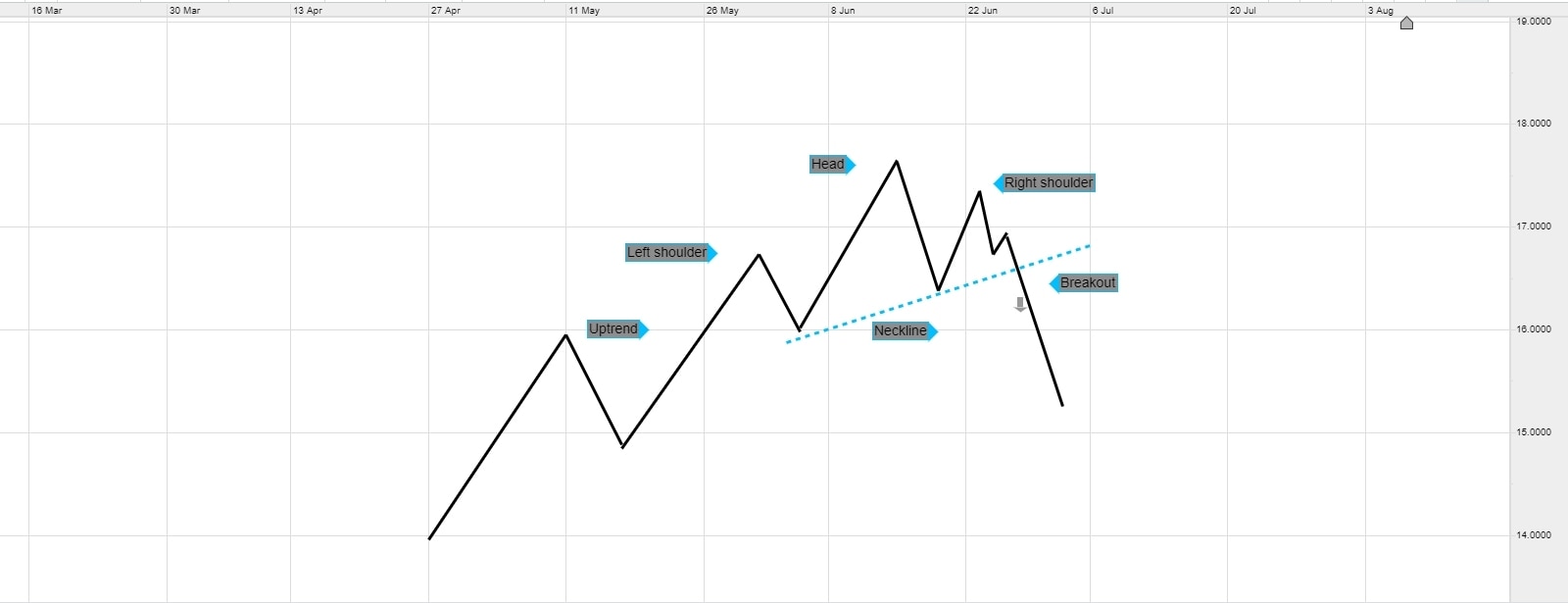

The head and shoulders pattern can mark the end of an uptrend or downtrend, but you should wait for the price to break through the neckline before acting, as this is the point where the price reversal is often confirmed. It is typical to measure the distance or height of the pattern for an estimated profit target, use the right shoulder for stop loss placement, and the neckline for an entry point (or possibly an exit signal).

As with all advanced technical analysis patterns, there are both advantages and drawbacks when it comes to trading head and shoulders chart patterns. The profit target is an estimate, meaning that not only will the price not necessarily go that far, but it could also run much further.

Some traders will opt to focus on patterns with certain characteristics. For example, a small right shoulder means a smaller stop loss, compared with a large right shoulder. This improves the risk-to-reward ratio of the trade, because while the profit estimate is based on the entire height of the pattern, the stop loss is only based on the much smaller distance between the neckline and the right shoulder. Looking for similar characteristics can move the odds more in a trader’s favour, over multiple trades. However, on a single trade, anything can happen.