There is an old saying that what happens in Vegas, stays in Vegas. It’s certainly likely that few big losers on the gaming tables want to admit exactly how much they have lost.

But as many financial traders are aware, gamblers and traders have two very different mindsets.

The gambler is often looking for one big win that will set them up for life, while the trader is looking for an ‘edge’ that will give them small, consistent and predictable returns over the longer term. Traders are undoubtedly looking to make profits, but the best traders focus on reducing risk exposure and protecting trade capital, while still maintaining the elements that could ensure the opportunity of benefiting from a profitable trade.

New traders can often struggle with this aspect. Traders are looking to make money and because of this, especially as new traders, they can tend to focus on making a profit. But this desire can sometimes push them to take risks that more experienced traders would not. Remember, every loss has to be retrieved with a profitable trade to move you back out of the red and into the black.

“When a beginner wins he feels brilliant and invincible. Then he takes wild risk and loses everything.”

― Alexander Elder,

Strategic options adopted by elite traders

So what are some of the strategies that elite level traders use to ensure the best possible chance of success in the markets?

The ideal approach would be to only risk profits that you have made from your initial investments in the markets. But unless you have an extremely large initial investment, followed by an exceptionally successful run of trades very early on, there won’t be enough profit to use as trading capital and still adhere to appropriate risk-management strategies.

Here are some suggestions of ways you can improve your risk management:

Always trade with a stop-loss. Trading without a stop-loss is one of the cardinal sins in trading and does not allow you to effectively manage your risk. Stop-loss orders allow you to specify a price at which your trade will be closed out by the platform, if the market moves against you. Find out more about the different types of stop-loss orders .

Use a risk-to-reward ratio. Every time you place a trade, you run the risk of making a loss. Successful traders will always assess their potential trade risk and potential reward. Only placing trades that give you a bigger potential profit than risk makes good trading sense.

Managing your money. How much capital are you risking per trade? It’s difficult to know which trades are going to be profitable. So, risking a consistent amount on every trade, along with a decent risk-to-reward ratio, should help to protect your trading account. This could mean risking as little as 1% of your total trading portfolio on each individual trade.

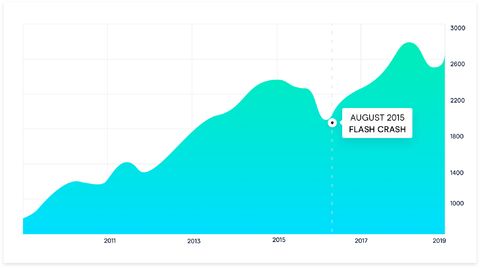

Diversifying trades. Taking long and short positions on differing stocks in different sectors could help protect against any aggressive move that affects the stock market as a whole. In August 2015, the US market experienced a ‘flash crash’1 that impacted the vast majority of stocks listed in the US. If you were holding only long positions during this market event, it would have caused a real dent in your trading account. But if you also had short positions, you would have made some profits to help balance the books.

Some traders may only look at trading one index to limit risk exposure. And this can be a successful strategy – especially in circumstances where the trader has an intimate knowledge of the specific entity being traded. Many people have personal preferences on what suits their trading appetite, style and risk preferences. But generally, as long as the security being traded is not too erratic or unpredictable, then trading a few select markets can be a suitable strategy if risk exposure is kept to a minimum.

One thing is certain in trading: there is no right or wrong way to trade. One trader might find success trading a certain strategy in a specific way on one market, while another trader might experience loss and frustration. If there is one thing all traders can do to try and help their trading strategy, it would be to adopt a consistent approach to risk and money management. It may not be glitzy or glamorous like the Las Vegas Strip, but consistently reducing risk is one way to improve overall profitability.

1https://www.cnbc.com/2015/09/25/what-happened-during-the-aug-24-flash-crash.html

Disclaimer

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.