Government bonds in the UK (gilts)

Government bonds or gilts are an investment product in the UK that are positioned somewhere between shares and cash in terms of risk. Known to be less risky than the often-volatile share market, treasury bonds can be an attractive investment or trading opportunity for customers who are less risk-tolerant.

If you are looking for a fixed-income product within the treasuries market, which can yield higher returns than a bank account, then government bonds may be the product for you. However, if you are looking for returns beyond cash or saving accounts, you must be willing to take on the associated risks, such as those associated with high-yield or "junk" bonds.

What are government bonds?

Government bonds are known as gilts in the UK and are an investment vehicle that provides a fixed rate of return until their expiry. Gilts are a loan from the bondholder to the government. The issuing government pays a fixed interest rate to the investor until the bond reaches its maturity date. When the maturity date is reached, the government pays the bondholder the face value of the bond.

Government bonds pay a steady income from the gilt's coupon rate (the fixed payment of interest) to the investor. They also provide insight into the market sentiment for the issuing country, as interest rates, inflation rates and currency strength all impact bond prices.

Why does the government sell bonds?

Government bonds are sold in order to raise money for government spending, whether this be for infrastructure or daily community projects. In the UK, gilts are used to help with future developments for pensions and life insurance markets.

Types of gilts

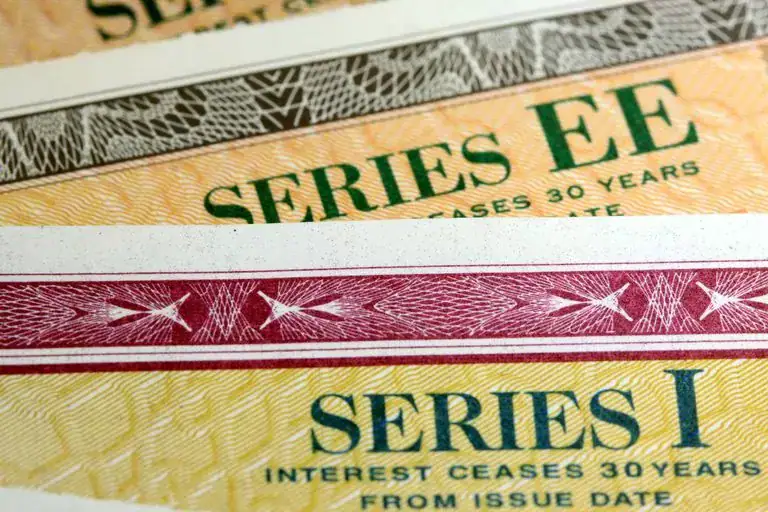

Bonds may seem somewhat confusing on the surface, as they are referred to in different terms across countries. From bunds in Germany to OATs in France, gilts in the United Kingdom to treasuries in the US. However, they work in a similar way regardless of their name or country of origin. The most common types of bonds available in the UK include the following:

Conventional gilts. Gilts are the most common form of bond available in the UK. As above, a standard gilt issued by the UK government pays a fixed coupon yield every 6 months until the gilt’s maturity date. At this point, the gilt holder receives their final coupon payment and the capital invested.

Index-linked gilts. Index-linked gilts differ from conventional gilts. Instead of paying a fixed coupon rate, the rate is variable and based on the UK’s primary measure of inflation, the Retail Price Index (RPI). This type of gilt is specifically aimed to shelter your capital against inflation.

How do government bonds work?

Government bonds have different names depending on which country they are issued by. However, there are some key features that all government bonds have in common:

Maturity

Maturity represents the bond’s expiry date. Once the bond expires, the original capital invested is returned to the bondholder. The maturity dates of a bond usually vary from 5 years up to 30 years. However, the UK’s DMO (Debt Management Office) recently released a 55-year maturity gilt.

Coupon

A bond’s coupon code is a fixed payment rate of interest from the bond issuer to the bondholder. Bonds on the open market will have varying coupon rates, as they would have been released to the market at different times.

How to trade government bonds

Choose your product. Decide whether you want to spread bet or trade CFDs.

Narrow down your instrument. We offer UK gilts, as well as US T-Bonds and German Euro Bunds.

Find out what affects the market. Fundamental factors such as interest rates, yields, credit risk, and credit rating changes can have an effect on prices.

Pick a strategy. Decide whether you want to buy (go long) or sell (go short) on your position.

Don't forget about risk-management. Read about the different types of stop-loss orders that can help cap losses to a minimum.

Open a live account to get started or open a demo account to practise first with virtual funds.

Example of an investment over time

Say, for example, the bondholder decided to invest £1,000 into the following bond in the year 2020:

Treasury 5% 2030

The coupon rate is 5%, and the maturity date is 2030, 10 years from the 2020 purchase date.

This means that the bondholder would receive 5% of the bond’s value, annually.

In this case, £50.5% of 1000 = £50

If the bondholder were to hold the bond until maturity, they would receive:

Initial investment: £1,000Coupon: £50 x 10 years = £500

Total: £1,500

Therefore, they received a 50% profit over 10 years, assuming that the coupon’s yield was not reinvested.

What factors influence the price of gilts?

Gilt prices in the UK fluctuate differently to stocks. The market sentiment of government bonds in the UK is largely affected by interest rates and economic policies, whereas a stock’s value is largely determined by a company’s fundamental values. Government bonds are seen as a safe-haven asset, they act as a portfolio diversifier whilst sheltering against stocks volatility and paying a fixed rate coupon.

Interest rates

A government bond’s value is largely dictated by its inverse relationship with interest rates. If interest rates fall, bonds prices generally rise and vice versa. A bond’s value is determined by its coupon yield relative to the UK’s rates of interest.

This follows the logic that if interest rates rise past the initial bond’s coupon rate, new bonds will be released with better-yielding coupon rates. As the new bonds have a more attractive coupon rate, the initial bond’s demand will fall, followed by its value.

However, the same can happen when interest rates fall further. The new bonds on the market will have a lower coupon rate in comparison to the initial bond. This causes the price of the initial bond to rise, as the demand rises for coupons with higher interest rates.

For example, if you own a 5% coupon worth £100 and interest rates change, it could impact your initial investment in two ways:

If interest rates rise… the cost of borrowing increases. Government bonds in the UK are now being released with an 8% coupon. As your coupon is only 5%, demand falls for your bond, reducing its value to £95.

If interest rates fall… the cost of borrowing reduces. Government bonds in the UK are now being issued with a 3% coupon. Our 5% coupon is now worth more than the new coupons. Most investors looking to buy a bond would rather purchase one with a higher coupon rate than the current interest rate. The value of our coupon increases to £105.

Coupon rate

Gilts with a higher coupon rate are usually worth more than similar but lower-yielding bonds. However, this can also be influenced by the maturity of the bond, its credit rating and other factors. This is because traders will usually favour bonds that provide them with a larger coupon, and thus, more income.

Maturity

A gilt’s maturity date can influence its value if it is due to expire soon. When a gilt heads closer to its maturity date, the value of the bond will move towards the bond’s initial face value. This is due to the fact that at the end of a bond’s maturity, its original value will be returned.

Credit rating

A credit rating is an estimate of the government’s ability to pay its financial obligations, in this case, a bond’s annual coupon and face value after maturity. Any downgrade in a country’s credit rating from the main agencies will cause the value of a country’s bond to decrease and vice versa. This follows the general logic that a country with a higher credit rating is more trustworthy, and it will be more likely to pay creditors.

What are the risks?

So, are government bonds safe? Risk-management is a key aspect to consider when trading and investing. Risk generally correlates positively with reward, which is known as a risk/reward ratio. That is, the higher the risk an investment product is, the higher the opportunity for profits and losses. Traders should understand their risk tolerance and the risks present in the gilt market before trading. Any trader who wishes to trade bonds should consider the following risks:

Interest rate risk

As interest rates predominantly influence the price of a bond, these therefore pose the biggest risks to bond traders. Rising interest rates would cause the bond market to fall in value. It is recommended that traders assess both the duration of a bond and its interest rate projections when looking to purchase or trade bonds.

Inflation risk

Inflation reduces the purchasing power on a bond’s face value and any coupon payments. When inflation rises, it can cause interests rates to rise, in turn reducing the value of the bond. However, traders can opt for an interest-linked bond that increases in value with the rate of inflation.

Liquidity risk

Like any market, liquidity can affect your ability to buy and sell bonds effectively. However, government bonds are less likely to carry liquidity risks when compared to corporate bonds. However, if liquidity risks are present, the seller may struggle to sell their bond at its expected price. Sellers may be forced to accept a lower-than-expected price, causing the market’s value to fall.

Buying government bonds in the UK

When a government decides it wants to issue bonds, this is usually carried out at an auction. Banks and large financial institutions are usually the first to access government bonds. These bonds can then be sold on to smaller financial institutions and individuals investors and traders. However, there may be cases where the government will sell directly to the individual investors.

Similar to other assets, bonds can be held as an investment, and bought and sold from traders on the open market.

Buying bonds in the UK is commonplace on the open market. Bonds operate in a similar fashion to shares: they can be held as an investment, traded over the short term, and bought or sold from traders. Additionally, their price is determined by variables such as supply and demand, interest rates and other factors.

What are UK gilts prices?

View for instruments page for UK Gilts - Cash to find out our margin rates, trading hours and spot prices to buy and sell UK government bonds.

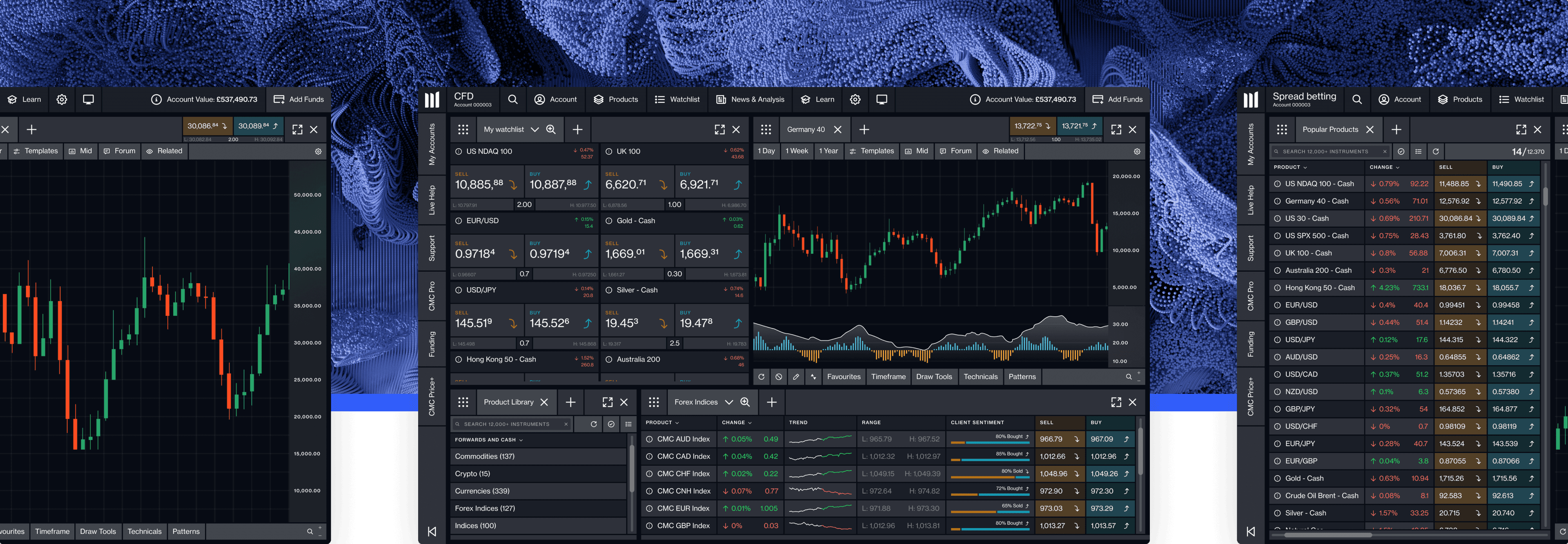

Try our trading platform

Our online trading platform allows you to spread bet bonds or trade CFDs across many UK gilts. Additional to these, we also offer Euro bunds, Euro schatzs, Euro OATs and US treasury notes. Our online trading platform comes with an award-winning charting package* and can be adapted to your specific trading needs.

You can use also trade using our award-winning mobile trading application**, which can be used to trade on the go. Available for most mobile devices and tablets, our mobile app has been purposely built to ensure a seamless trading experience.

Summary

In summary, UK gilts or government bonds can offer a great opportunity for investors and traders alike. They are an important element to a balanced investment portfolio as they help to diversify away from the corporate market. UK bonds are considered a low to medium risk product and can help to reduce a portfolio’s overall risk exposure. View spreads and margins for our treasuries market.

*Ranked highest for Charting, based on highest user satisfaction among spread betters, CFD and FX traders, Investment Trends 2019 UK Leverage Trading Report.

**Awarded Best Mobile/Tablet App, based on highest user satisfaction among spread betters, CFD and FX traders, Investment Trends 2019 UK Leverage Trading Report.

Gilts can be a good investment in terms of average returns versus the risks. Government bonds are seen as more risk-averse than corporate or high-yield bonds, which tend to have lower credit ratings, but can provide higher returns. Learn more about high-yield or “junk bonds”.

According to research, on average, the annual return for long-term government bonds is around 5-6%. This is in comparison with the share market, which provides a slightly higher return average of 10%. Compare these asset classes in our article on bonds versus stocks.

Government bonds are usually issued through bond auctions, which can be bought by large financial institutions such as banks. These are then sold to smaller financial institutions and individual investors and traders.

Government bonds are generally seen as more risk-averse than other securities such as stocks and indices, but there are still risks relating to interest rates, inflation and liquidity. Therefore, you should always have risk-management controls in place.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.