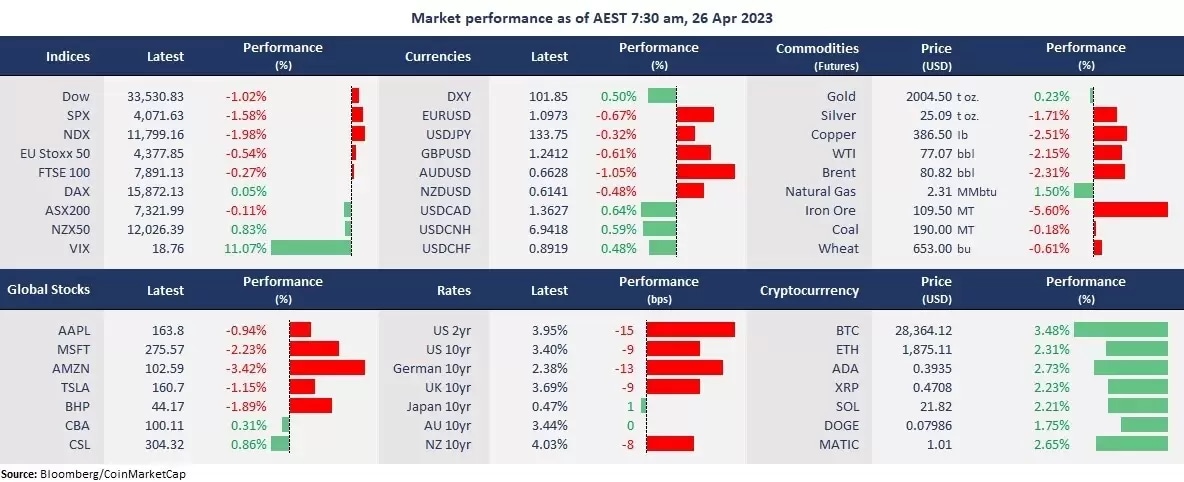

US stocks fell following First Republic Bank's awful earnings, which showed the bank's deposit level fell by $104 billion from a year ago, causing a 40% plunge in its share price. The disappointing reports renewed recession fears and sent risk assets down, with three benchmark US indices finishing in the red. Risk-off prevailed in broad markets, lifting haven assets, such as gold, bonds, and the Japanese Yen, while Oil prices slumped on darkened demand outlooks. The US dollar moved higher against most other major currencies, with the dollar index up 0.5% to 101.86. And the fear gauge, the volatility index, jumped 11% to 18.76, suggesting sentiment soured amid the looming US earnings season.

On a positive note, both Alphabet’s and Microsoft’s earnings beat the market’s expectations in their EPS and revenue growth. The shares of both tech giants were up 4% in after-hours trading. The positive results shed light on the upcoming Meta Platforms and Amazon’s earnings reports on Thursday and Friday. If the results are strong, it may buffer the current selloff in stocks, particularly in tech shares.

Asian markets are set to open lower. The ASX 200 futures were down 0.52%, the Hang Seng Index futures fell 0.94%, and Nikkei 225 futures slipped 0.63%.

Price movers:

- All the 11 sectors in the S&P 500 finished lower, with the growth sectors, including consumer discretionary and technology, leading losses, both down more than 2% The materials sector was also hit by economic concerns, down 2.15%. Defensive sectors, such as consumer staples and utilities, outperformed and were down slightly as being seen as safety destinations.

- Alphabet’s shares rose 3.9% in after-hours trading after the company’s first-quarter earnings beat expectations, along with a $70 billion share buyback plan. The earnings per share were at $1.17 vs. an estimated $1.07. And its revenue came as $69.79 billion vs. $68.9 billion expected. The Google Cloud segment also had its first profitable quarter after three-year losses, a significant milestone in the competition with Microsoft’s Azure and Amazon’s AWS.

- Microsoft’s shares were up 4.8% in after-hours trading amid its Q3 FY23 positive earnings results. The earnings per share came as $2.45 vs. $2.23 expected. And its revenue was at 52.86 billion vs. $51.02 billion expected. The revenue growth was at 7%, well above analysts’ estimate of 1%. Microsoft’s cloud business generated $22.08 billion in revenue, about 16% higher than an estimated $21.94 billion, or 27% up annually.

- The US-listed Chinese shares were hit by intensifying US-China tensions, with Alibaba slumping for the 5th consecutive trading day to a one-month-low of just under $83. The uncertainty about China’s economic recovery has also pressed on the Chinese stock market. Chinese Yuan declined to the lowest level since 10 March.

- The WTI crude oil futures snapped a two-day winning streak as recession fears again overtook sentiment. The WTI futures, however, are still seen pivotal technical support of around the 100-day moving average, or 76 dollars per barrel.

- Cryptocurrencies were resilient despite a broad selloff in risk assets. Bitcoin rose to above 28,000, while Ethereum climbed to above 1,870.

ASX and NZX announcements/news:

- Synlait lowered its FY23 earnings expectations due to reduced demand, higher financing, and supply chain costs, which is expected to slash the net profit by A$20 million.

- A2 Milk maintained its outlook for FY23 of low-double-digit percentage growth, noting that strong demand in China infant milk formula may offset weakened expectations from the English label.

Today’s agenda:

- Australian Q1 CPI data. Australian fourth-quarter CPI printed at 7.8% year on year, higher than expected. However, the monthly CPI eased to 6.8% in February from 7.4% in January, suggesting inflation may have peaked in December last year.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.