Lockheed Martin [LMT] chart

Medium-term technical analysis (1 to 3 months)

Time-stamped: 16 August 2022 as at 3:30pm (SGT)

Source: CMC Markets & TradingView

The share price of Lockheed Martin (LMT), a major US global aerospace, arms and information security system corporation with worldwide interest, staged a bullish breakout on 15 August, from its former medium-term descending trendline resistance in place since 19 April 2022 high.

This positive price movement has come on the rising backdrop of an impending increase in geopolitical risk due to the rising US-China tensions reinforced by the recent repeated visit of US officials to Taiwan.

Integrated technical analysis (graphical, momentum, Elliot Wave/fractals) suggests that LMT may see an extension of the current 17.50% up move from its 16 Aug 2022 low of 374.38.

Key levels (1-3 months/LMT)

Intermediate support: 428.40

Pivot (key support): 400.80

Resistances: 474.40 & 511.40

Next support: 377.00/369.40

Directional bias (1-3 months/LMT)

Watch the 400.80 key medium-term pivotal support for a further potential up move for a retest on 474.40 range resistance since its 7 March 2022 all-time swing high.

However, a break with a daily close below 400.80 invalidates the bullish tone for a drop to retest the 16 August 2022 swing low area of 377.00/369.40.

Key elements (LMT)

- The recent plunge of -22% from its 7 March 2022 all-time high to 16 August 2022 low has managed to stall at the pull-back support of the former major descending resistance from the 8 June 2020 high and the 61.8% Fibonacci retracement of the up move from 3 November 2021 low to 7 March 2022 high which indicates a significant inflection zone for LMT to stage a potential substantial recovery after that.

- The daily RSI oscillator has continued to shape favourable configurations (higher highs) since the bullish breakout of its former descending corresponding resistance at the 55% level. It has yet to reach an extreme overbought level of 79%. These observations suggest medium-term upside momentum remains intact.

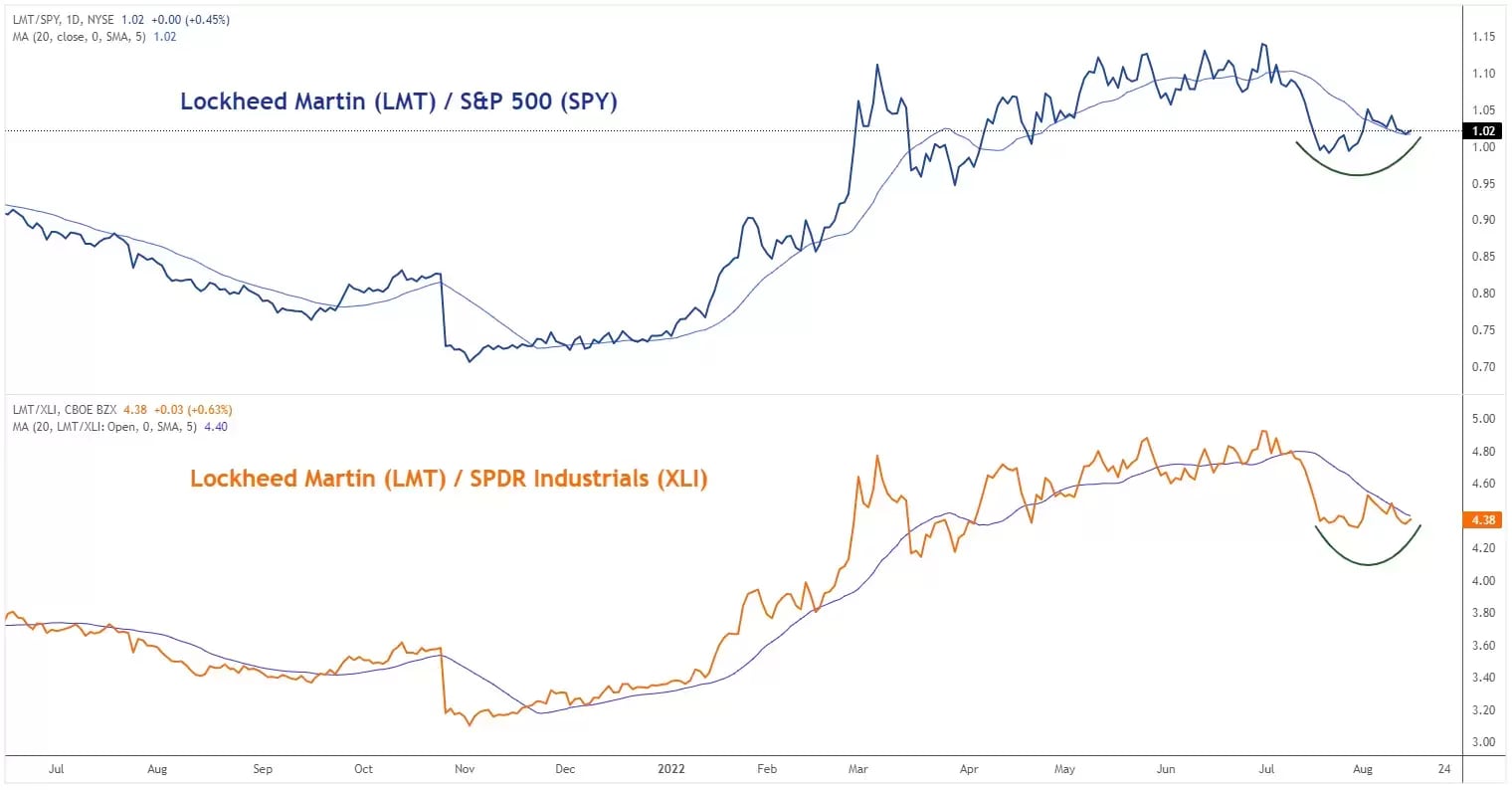

- Relative strength analysis of LMT against the benchmark S&P 500 and its Industrials sector shows potential outperformance of LMT.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.