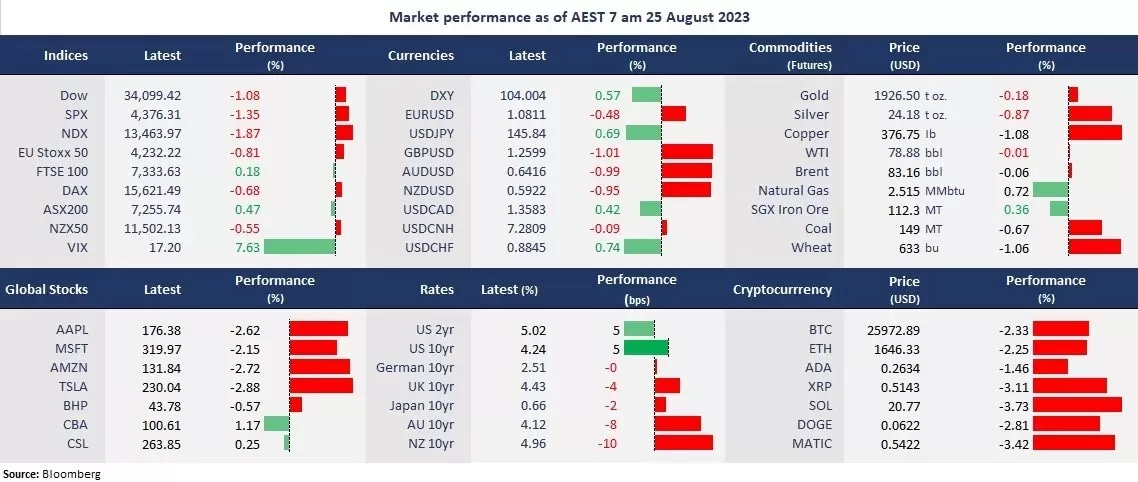

Wall Street retreated sharply as investors switched to the risk-off mode ahead of Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium later today. Selloff resumed in growth stocks, particularly in tech, despite Nvidia’s stellar earnings result. The chipmaker’s shares pulled back from a 6% gain at the open and finished flat, dragging on rivals, such as AMD and Intel, slumping 7% and 4%, respectively.

The US bond yields climbed again, with the yield on the 2-year Treasury finishing above 5% as markets priced in “higher for longer” rates, which sent the US dollar higher, pressing on other G-10 currencies. However, gold held its ground due to risk-aversion sentiment. The Jackson Hole symposium can be a pivotal event for the USD as traders are awaiting clues for the central banks’ policy guidelines. The US Fed is expected to keep a hawkish stance on interest rates due to signs of re-elevated inflation and resilient economic data. However, bets for bond market bottoming could cause “sell the news” in the greenback.

In Asia, the Chinese stock markets eased selloff following insurer AIA’s positive earnings result. BRICS summit may have also added to the rebounding optimism with its expansion to include more members. However, futures point to a lower open across Asia. The Nikkei 225 futures were down 1.79%, the ASX 200 futures fell 1.3%, and the Hang Seng Index futures slid 0.87%.

Price movers:

- All 11 sectors finished lower in the S&P 500, with Technology, Communication Services, and Consumer Discretionary, leading losses, all down more than 2%. Most mega-cap companies were sharply lower, with Apple down 2.66%, Microsoft slumping 2.15%, Amazon falling 2.67%, Meta Platforms sinking 2.55%, and Tesla shedding 2.9%.

- Disney closed at a nearly nine-year low level amid a broad selloff on Wall Street as investors accelerated dumping stocks with gloomy outlooks. The entertainment giant reported disappointing earnings as its streaming business, Disney +, extended user losses in the second quarter. The rally following its price hikes was short-lived early in the month.

- Turkish lira surged on more-than-expected rate hikes by Turkey’s central bank to tame skyrocketed inflation, which printed at 48% in July. The bank raised the interest rate by 750 basis points to 25%, much higher than an expected 20%. USD/TRY fell 5% to 25.95, and EUR/TRY slumped 5.6% to 28.06.

- Bitcoin fell in the last 24 hours but managed to hold above 26,000. The digital coin was oversold last week, which may provide a rebounding opportunity if the Fed paves the way.

ASX and NZX announcements/news:

- Pilbara Minerals (ASX: PLS)’s net profit surged 326% to A$2.4 billion in the full year 2023. The lithium miner delivered a record production of 620.1 thousand tonnes in spodumene concentrate, or a 64% increase in FY22, resulting in a 242% increase in Group revenue to A$.1 billion. Due to strong demand in China. The company declared a dividend of fully franked AUD 14 cents per share.

- Westfarmers Limited (ASX: WES)’s net profit rose 4.8% annually to A$2.465 million on revenue of A$43,550 million, up 18.2% from a year ago in the 2023 full-year results. The conglomerate will pay a dividend of fully franked A$1.03 per share.

Today’s agenda:

- Tokyo Core CPI for August

- Jackson Hole Symposium – Day 1

Maximize your potential gains! Take immediate action and seize the investment opportunities that await you. Login to the platform now!

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.