The recent economic backdrop and technical graphs are painting a mixed picture for gold traders. On the one hand, the recent tech rally fuelled the risk-on stock markets, leaving gold to go sideways. And on the other hand, the US dollar’s softness offers a bullish factor, stabilizing gold’s price at near its all-time high level, though the triple-top pattern has induced a light selloff in the last few weeks. Whether gold can have a breakthrough moment and refresh its record high can be a critical gauge for broad markets as gold is usually seen as a haven asset at uncertain times. A gold rush could be triggered by a combination of factors such as the US dollar’s weakness, central banks’ purchase demands, and risk-aversion sentiment.

The USD’s uptrend may have come to an end

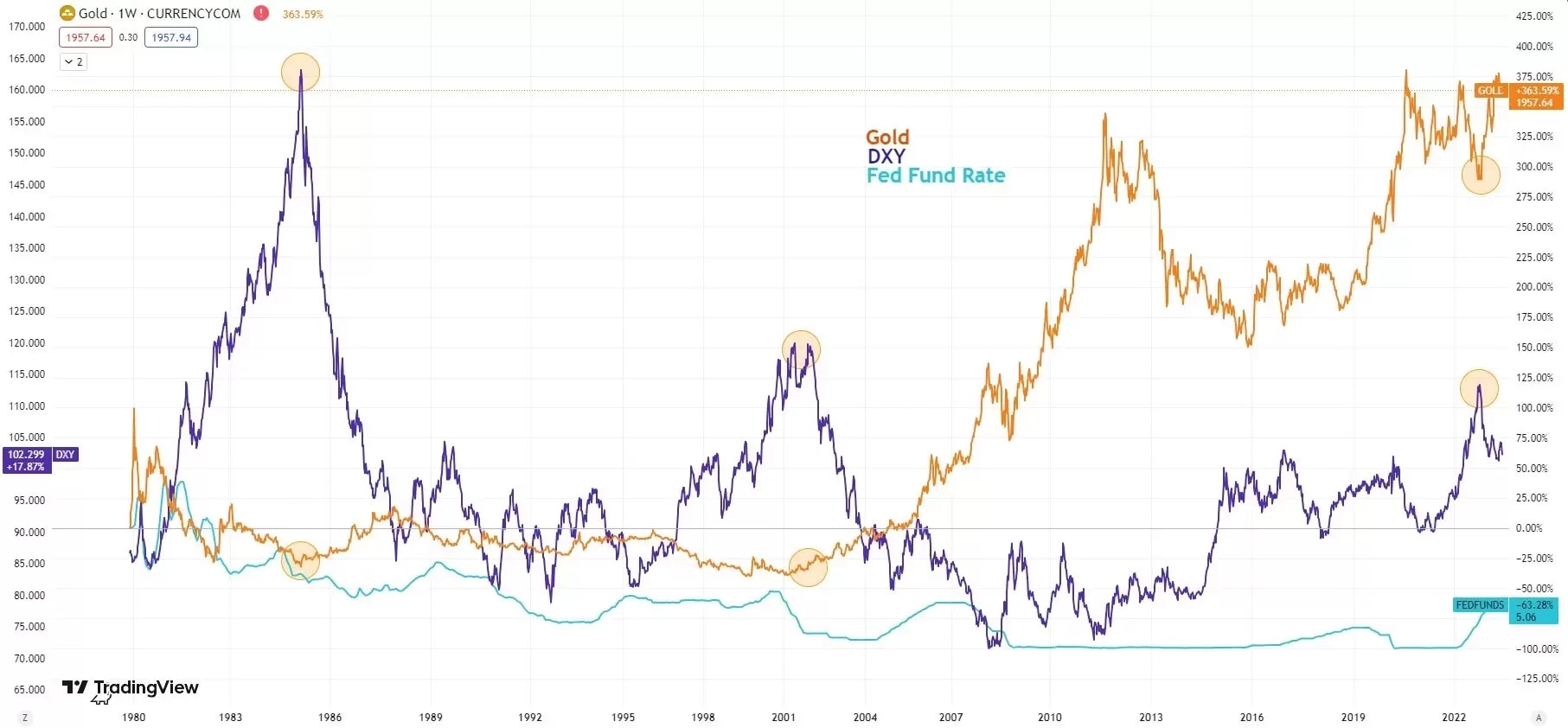

Since the termination of the US dollar convertibility to gold in 1971, gold prices have been moving opposite to the US dollar. As the value of the US dollar increases relative to other currencies, gold prices tend to decrease because it becomes more expensive to purchase gold in foreign currencies. Conversely, when the value of the US dollar decreases relative to other currencies, gold prices tend to increase as it becomes cheaper for foreign investors to purchase gold in their local currency.

The US dollar index (DXY), which measures the strength of the US dollar against other currencies, usually traces the US Fed’s monetary polic stance. The year-long uptrend of the DXY had ended in December of 2022 when the Fed started slowing down its pace on rate hikes to 50 basis points from 75 basis points. The downtrend of the USD mirrored a peak of the Fed’s hawkishness, and the downtrend may continue amid a pause of the hiking cycle in June 2023. Though it may be only a temporary pause in the current hiking cycle, the Fed is unlikely to return to the aggressively tightening measures. Hence, gold has a good chance of taking off again.

Central banks post record high gold reserves demand

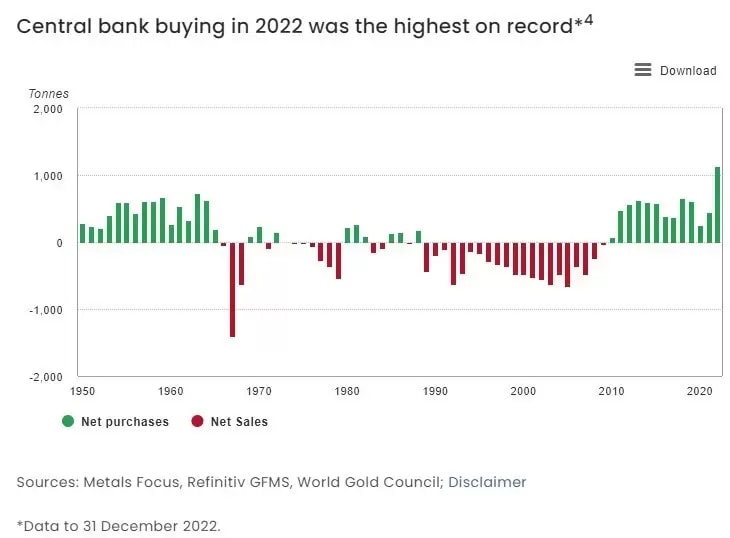

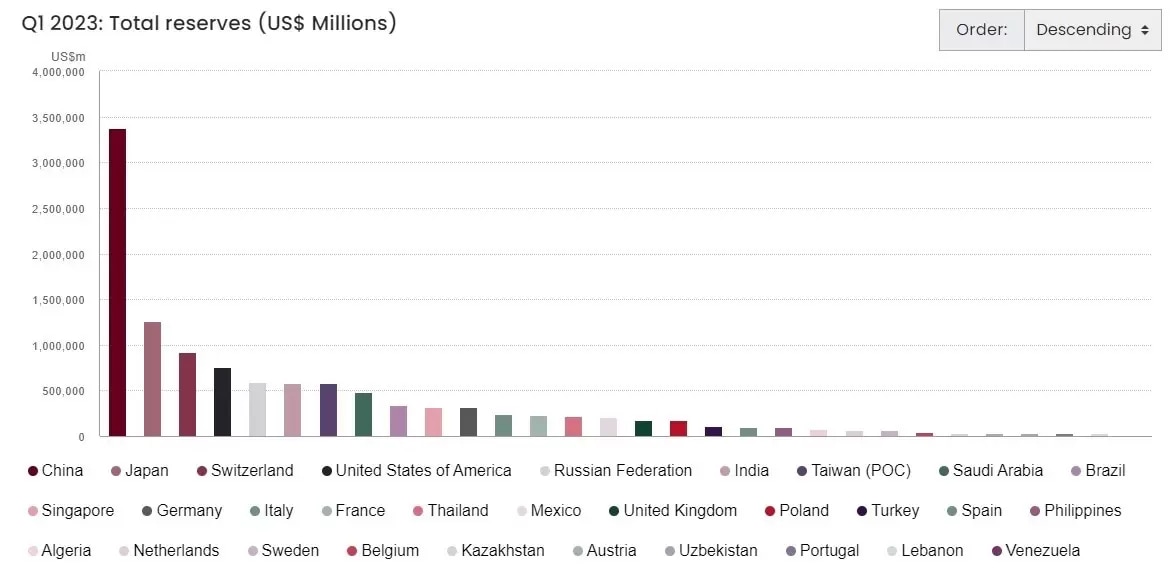

Central banks buy gold reserves as a way to back the value of their currencies. Gold also provides an easy-to-manage hedge against inflation, given that its price tends to move inversely with the dollar’s strength, providing investors with a secure store of value. According to Reuters, central banks bought 1,136 tons in 2022, the highest level on record amid hefty inflation and intensified geopolitical tensions. In the first quarter of 2023, central banks added 228 tons to global reserves, the highest first-quarter purchase since 2000. The World Gold Council expects “central banks to remain net buyers in 2023, supported by their overall positive sentiment towards gold reserves.” The resurgence is particularly seen in China, which held US$3.4 trillion worth of gold reserves in the first quarter, followed by Japan with a total reserve of US$1.3 trillion. China increased raised its gold holdings for a seventh straight month in May, totalling 2,092 tons, according to People’s Bank of China.

A likely global economic recession

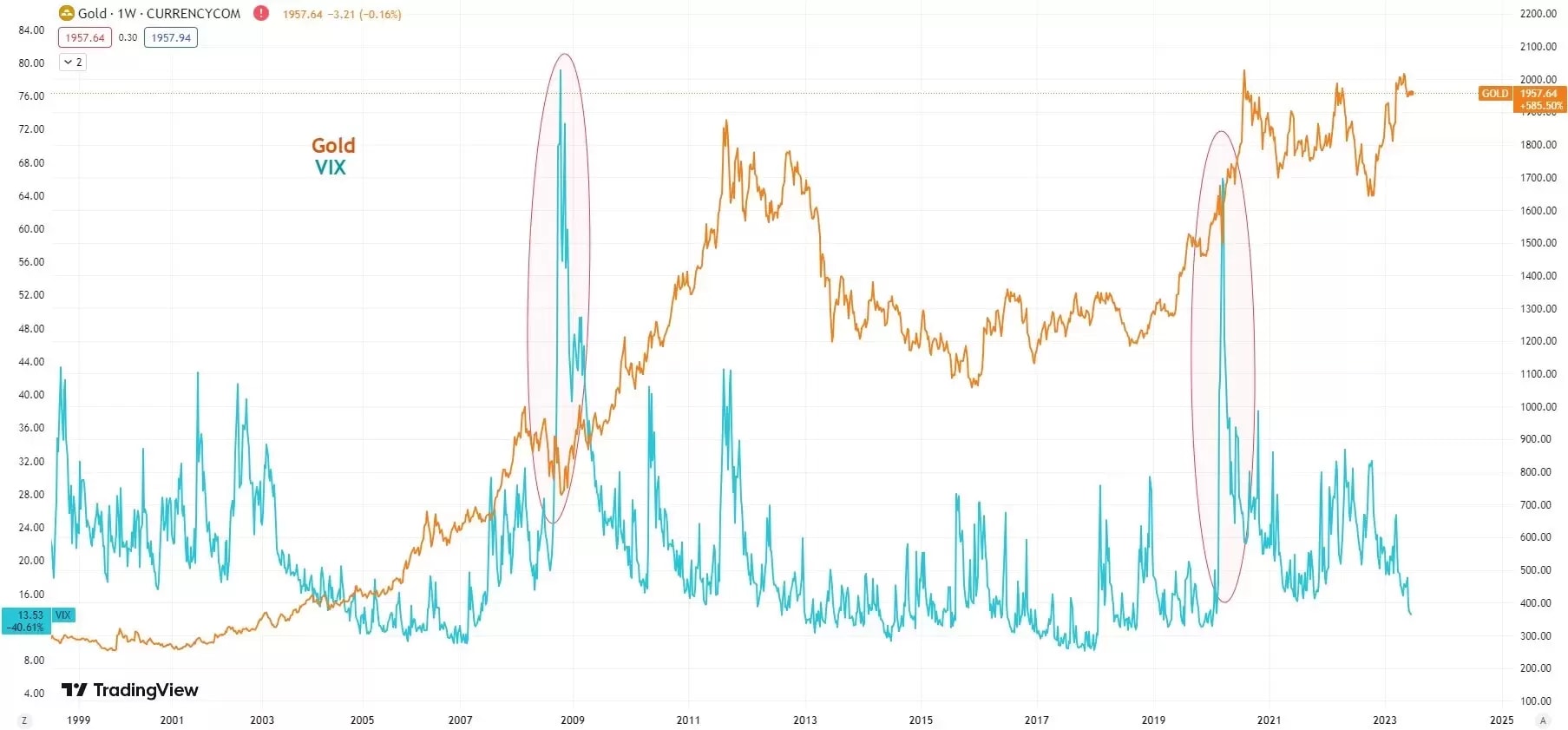

The likelihood of a pending economic recession may continue to hold the gold price at a historically high level. A notable trend is that the CBOE Volatility Index (VIX) fell to its lowest level since the pre-pandemic period, while the yields on US 10-year and 2-year government bonds have been staying inverted since July 2022, coupled with a possible overheated AI hype cycle in the stock markets. These signals may be pointing to a possible near-term correction in risk assets and a surge in the VIX, which is usually followed by a jump in gold prices that can be seen in the last two global economic recessions in 2008 and 2020.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.