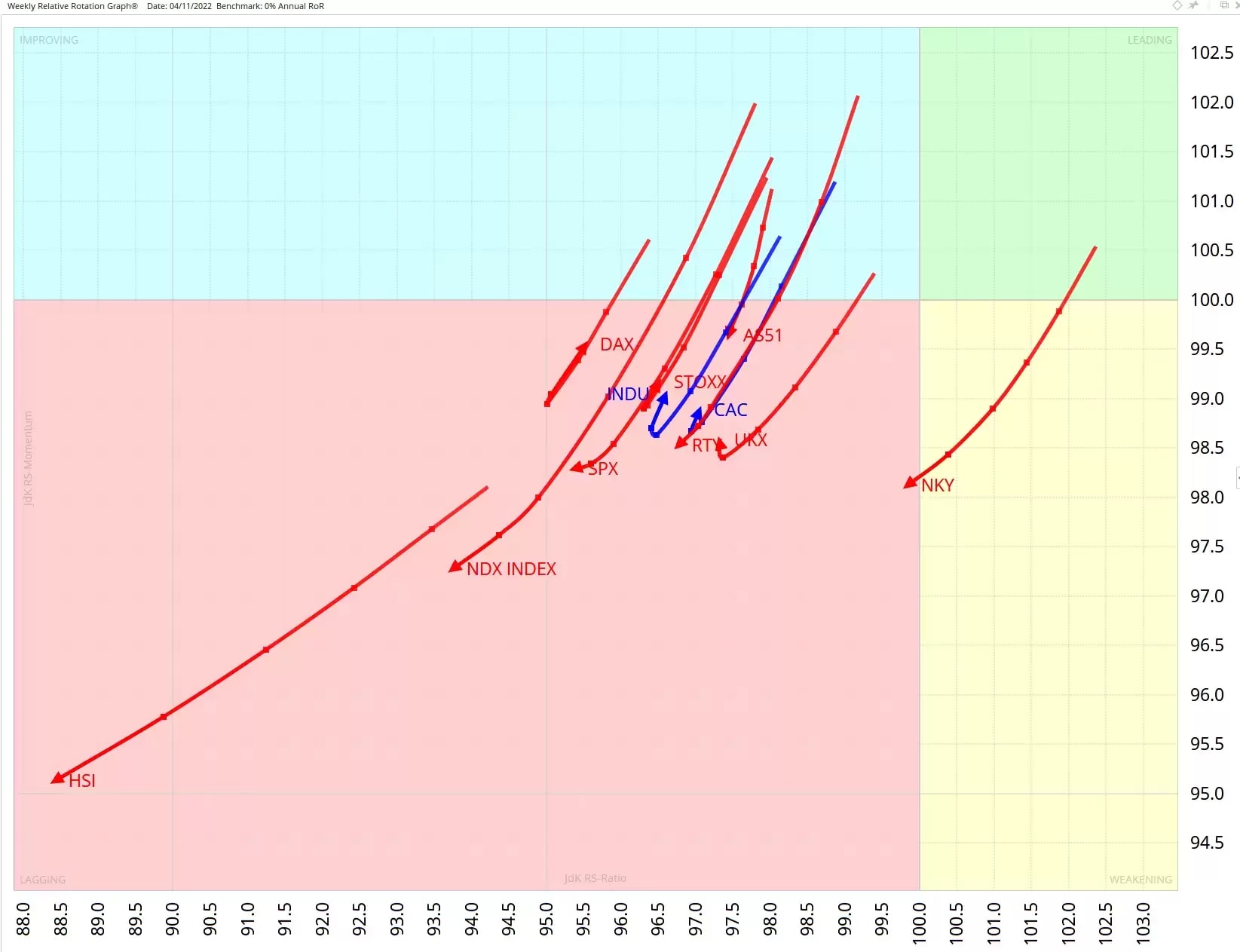

Stocks have weakened but could be set to bounce. The Relative Rotation Graph (RRG) below is a weekly sample of major stock indices versus cash (usually, we compare the major indices to the MSCI World Index – an index of major stock indices – but this week we are comparing them on an absolute basis). So, how are they doing versus zero-yielding cash?

This chart sends a strong and clear message. All indices’ arrowheads are in the lagging quadrant, and most are heading deeper in to our chart’s south-west corner. Movement to the west means declining JdeK RS-Ratio, signalling underperformance. Movement towards the southerly indicates declining JdeK RS-Momentum, signalling a fall in positive relative momentum.

The worst performers are Hong Kong’s Hang Seng Index (HSI) and the tech-heavy Nasdaq 100 (NDX). Tech stocks have led the recent US stock market fall. The HSI has been the weakest major index by far for the past few weeks. At the time of writing – Friday morning – this seems unlikely to change in the near term.

That said, a lot could change in the coming hours and days. A day is a long time in the markets, and we may see some volatility following the Fed’s 0.75-point rate rise on Wednesday and the Bank of England’s equally aggressive rate hike on Thursday. Some indices in the above chart are already beginning to hook around, including Germany’s Dax, Europe’s Stoxx, France’s Cac, the Dow (INDU) and, to a lesser extent, the FTSE 100 (UKX).

Next, let’s drill down to a daily timeframe to study the picture in greater detail.

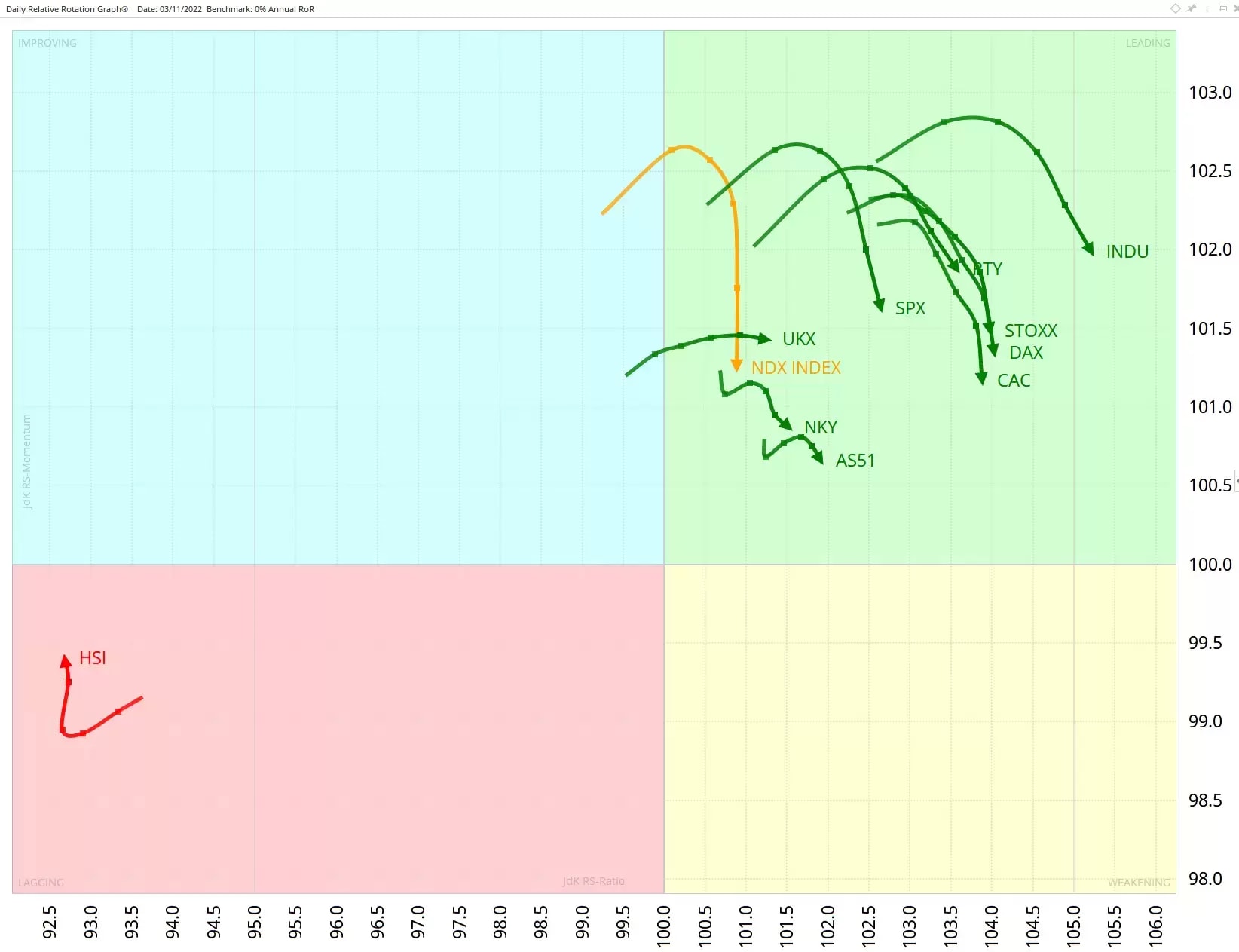

Signs of a bounce

The chart below shows that the HSI continues to lag, but other major indices are in the leading quadrant. Although they are generally turning lower, indicating weakness, their position in the leading quadrant highlights that they have bounced.

The index furthest to the right is the Dow. Let’s take a closer look at its recent performance.

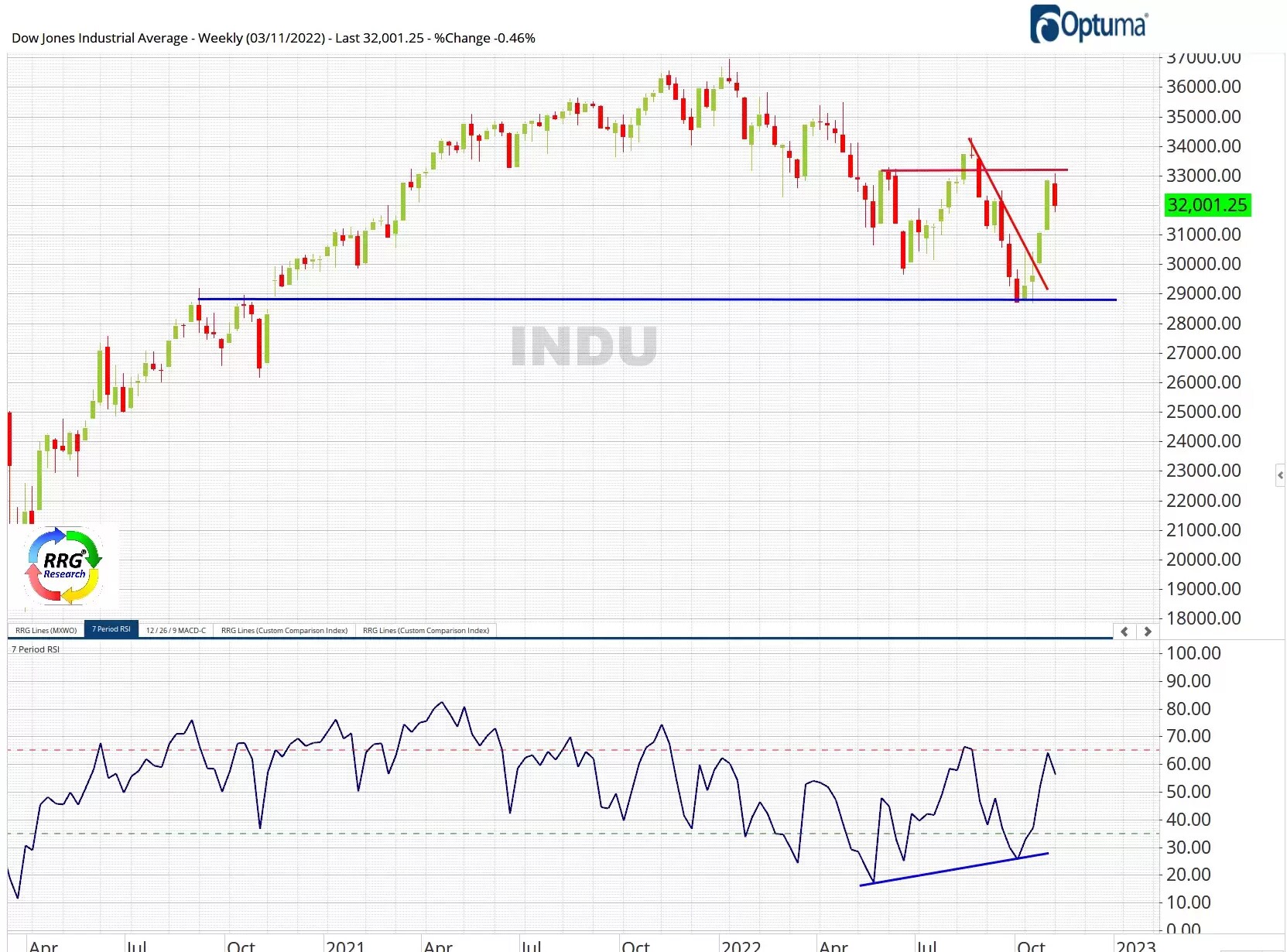

Is the Dow at a turning point?

The chart below shows that the Dow Jones Industrial Average fell from a high of roughly 37,000 a year ago to just under 29,000 in September. It found support from the consolidation in October 2020. Then last month, the Dow bounced strongly after breaking its one-month downtrend line. Now it has hit resistance at around 33,000. The lower highs since it reached 37,000 are still intact.

The above RRGs support the view that, although the Dow is down over the long term, it has made a blunted advance in the past month.

Where might the Dow be heading?

Zooming in on the September dip, the chart below shows that as the Dow bottomed at 29,000, there was a bullish divergence in the relative strength index (RSI). The rising low in the RSI told us that the second low had lower downside momentum than the first, suggesting that a bottom might be in place at a long-term support level.

After breaking the downtrend line from the July high, the Dow soared. As our daily RRG shows, it soared in the context of a longer-term downtrend. So far, the move has been blunted by resistance at 33,000.

If the Dow can break up through 33,150, it could challenge the 34,300 high. But if the downward hook in our daily RRG and the stall at 33,000 mean that the rally has finished, we could be at the start of a return to the downtrend. The move lower might be led by other global indices, such as the Nasdaq and Hang Seng, perhaps followed later by the Dow.

Pricing is indicative. Past performance is not a reliable indicator of future results. RRG’s views and findings are their own and should not be relied upon as the basis of a trading or investment decision.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.