Mish Schneider notes that once gold begins to outperform the SPDR S&P 500 ETF Trust [SPY], the chance of a rally in commodities increases, as does the likelihood of gold outperforming.

Commodities versus SPDR S&P 500 ETF Trust [SPY]

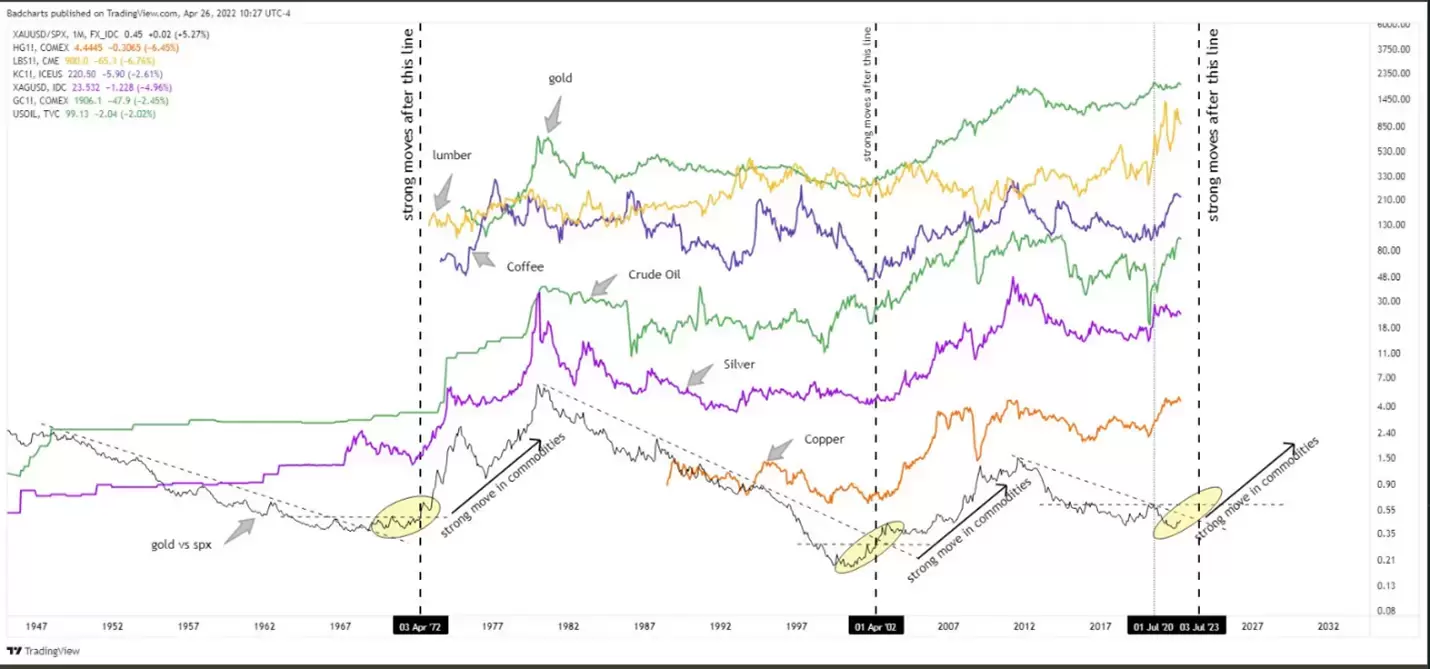

This chart, one of my favourites, goes back to 1947 and highlights an interesting story about how commodities move relative to the S&P 500.

During the great expansion of the US economy post World War II, until the 1970s, gold underperformed the SPY. Then, in 1972, commodities and gold began to outperform the SPY (represented by the dotted line.) In 1982, commodities peaked. From 2002 until 2012, commodities ran hotter than equities, before equities took back the centre stage over the last decade or so.

So, what do we learn from history? Once gold begins to outperform the SPY, the chance of a fuelled rally in all commodities increases. Plus, the likelihood of gold outperforming all other commodities also increases.

Gold miners versus SPY

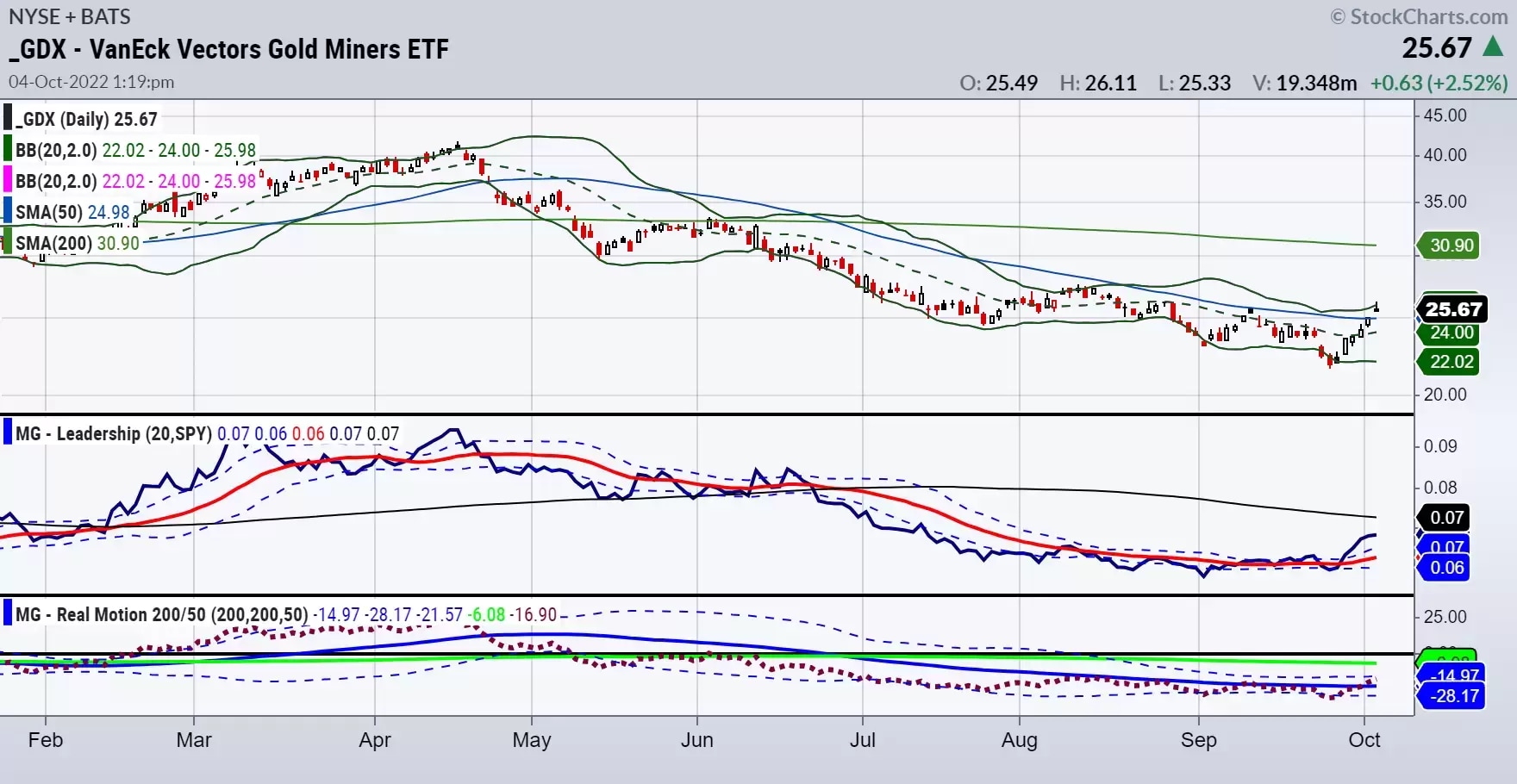

Last week, when indices and many equities took a swan dive, miners, as seen through VanEck Vectors Gold miners ETF [GDX] chart (below), had already bottomed out on 26 September.

The next day, MarketGauge’s Real Motion indicator signalled a mean reversion ‘buy’, while the price held the prior day’s low. Looking at our Leadership indicator, GDX also began to outperform the SPY on 27 September.

On 28 September, the market crashed, ending the week with calls for doom and gloom, though GDX gained 7.8% on the same day – and has not looked back since.

Is another supercycle in commodities about to begin?

While many analysts call the peak in inflation based on number crunching things like shipping rates, cost of wood, copper, and the decline in brent crude oil, we believe they miss insight.

If miners are telling us anything, and if history repeats, it’s not the number crunchers we should focus on. It’s the anti-globalist, chaotic geopolitics, food shortages, and global scepticism concerning monetary policy we should be looking at. After all, there is nothing metals like more than chaos.

Do gold miners lead?

Historically, the answer is not totally clear. In January 1980, after gold prices peaked, gold miners did not peak until September 1980. In other times, gold rallied first, such as in 1985, and then finally in July 1986, miners reached their bottom.

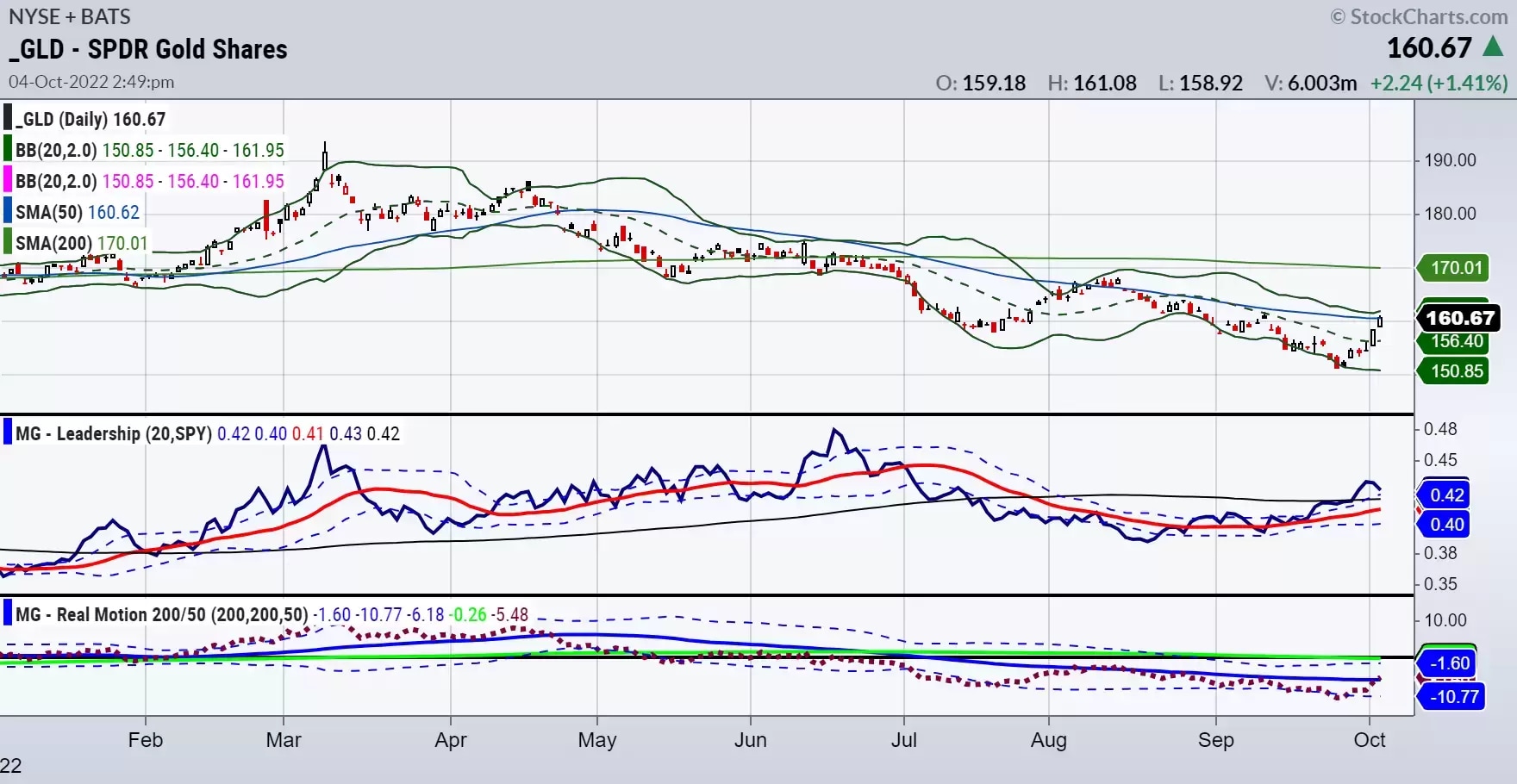

The point is that right now, we’re seeing both miners and precious metals rallying. Plus, we’re also seeing both outperform the benchmark SPY. However, before we metal bulls jump up and down for joy, we’re also now seeing the SPY rally.

Where could you look to invest?

If chaos ensues, metals are likely to go higher. One aspect of this past year to note, is that when gold, silver or miners looked strongest, they actually stalled and fell. And conversely, when all looked like ‘game over’ , they rallied. So buying weakness and selling strength seemed to work better.

When that trend breaks, or when strength is bought and shallow dips become buy opportunities, then assume metals will ‘shock and awe’.

The SPDR Gold Shares ETF [GLD] pierces the 50-day moving average (DMA) as I write. In my recent webinar hosted by CMC Markets, you learned that phase changes are an opportune time to enter a trade with the least amount of risk. Hence, should GLD confirm the move over the 50-DMA, there may be a move back up to 170, before we would then reassess.

Another way to take a view on mining stocks is with Kinross Gold Corp [KGC], a Canadian mining company with exposure to silver and gold.

Well above its 50-DMA, impressively outperforming SPY and with momentum clearing the 200-DMA (green line), the stock looks strong. Should the price action stabilise between $3.90 and $4.00, we believe this stock could head towards the $5.25 area.

In March 2008, KGC reached its zenith at $27.40. The stock broke below $10.00 per share in 2012. It has been a decade of poor performance, but we believe it could now have a very good chance of reversing some of this decline.

The real test will be when indices turn back down. Should metals continue to outperform in the face of the US Federal Reserve’s quantitative tightening policy, the energy crisis, and a global recession, it may be positive for your position, but maybe not so much for world order.

Mish’s ETF support and resistance levels

S&P 500 [SPY] 370 support and 380 resistance

Russell 2000 [IWM] 173 support and 176 resistance

Dow [DIA] 297 support and 303 resistance

Nasdaq [QQQ] 279 support and 283 resistance

Regional Banks [KRE] 61.40 support and 64.00 resistance

Semiconductors [SMH] 194 support 200-201 resistance

Transportation [IYT] 206 support and 212 resistance

Biotechnology [IBB] 121.00 support and 124.25 resistance

Retail [XRT] 58.70 support and 62.75 resistance

Mish Schneider is MarketGauge’s director of trading education and research. Read more of MarketGauge’s market analysis here, and subscribe to their YouTube channel here. Mish Schneider's and MarketGauge's views and findings are their own, and should not be relied upon as the basis of a trading or investment decision. Pricing is indicative. Past performance is not a reliable indicator of future results.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.