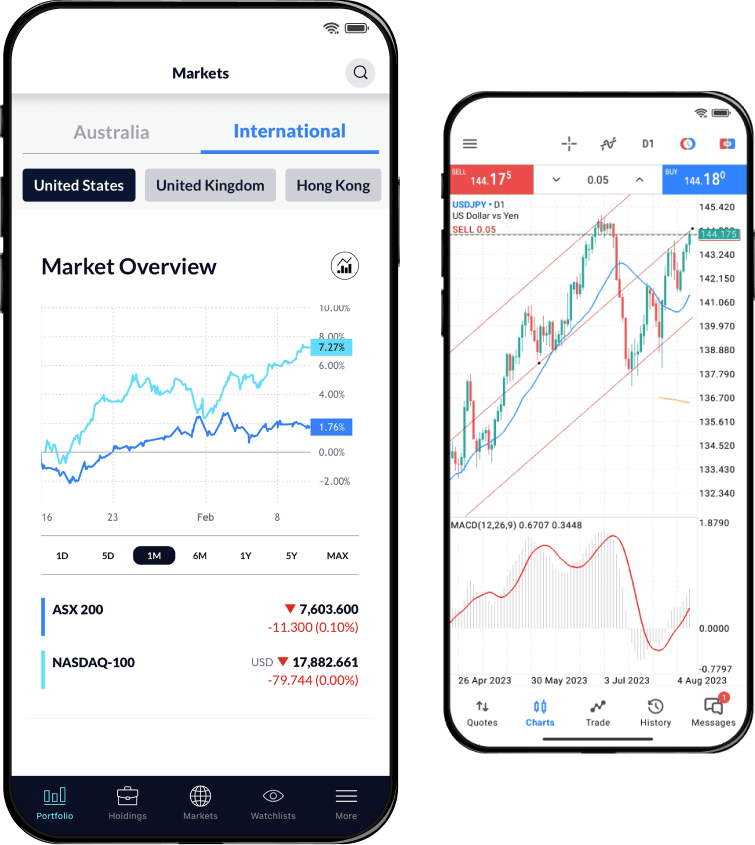

React early to market movements, breaking news and global events that impact the world's most influential companies.

Go long or short on 250+ US stocks*, nearly 24 hours a day, 5 days a week:

Manage your existing positions between trading sessions

Access our full range of order types for a seamless trading experience

Get extended access to 250+ stocks, including the Magnificent Seven

* Spreads may widen dependent on liquidity and market volatility