Opportunities and Diversification

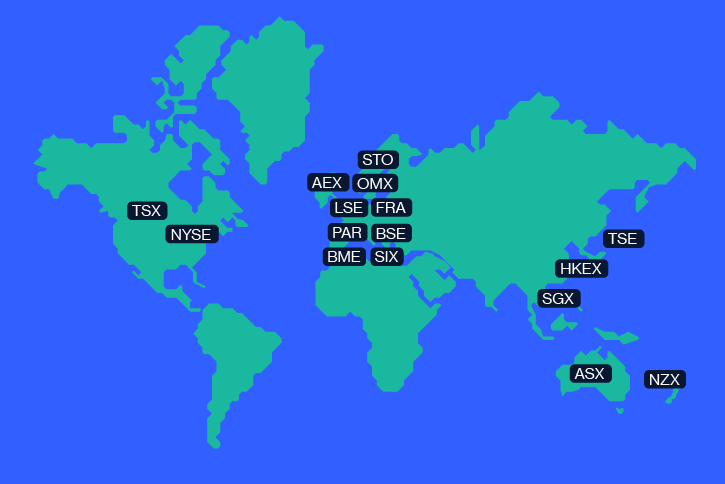

The Australian Stock Exchange (ASX) represents less than two per cent of the global market and is dominated by a few sectors, including financials, mining and healthcare. While it provides access to many great companies, including household names and even a few major global businesses, it goes without saying that many more investment opportunities lie abroad.

If you are looking to invest in major tech stocks like Facebook and Google or big entertainment businesses like Disney or Netflix, you’ll have to look to the major US exchanges. If you want greater access to the fast growing Chinese market, meanwhile, you might want to look to Hong Kong and if you’re looking to invest in major global banks the London Stock Exchange could be a good option.

Ultimately, having the option to invest in overseas-listed companies opens up more opportunities and allows for greater diversification. An investor focused only on the ASX can miss out on many investment opportunities, and is unable to invest in a major automaker and has relatively limited (though growing) opportunities in the tech space.

Investing or trading internationally allows for access to different sectors and different markets. This can be important from a risk management point of view. Devoting some of your portfolio to internationally listed stocks will mean you are less exposed to a downturn in Australian stocks (though global markets are increasingly intertwined).