This video refers to the CMC Markets Platform, formerly known as the Next Generation platform.

What are CFDs?

A contract for difference is a financial derivative product that pays the difference in settlement price between the opening and closing of a trade. CFD trading enables you to speculate on the rising or falling prices of fast-moving global financial markets (or instruments) such as shares, indices, commodities, currencies, and treasuries. Trading CFDs means that you can either make a profit or a loss, depending on which direction your chosen asset moves.

Key features:

Speculate on rising or falling prices (go long or short).

No ownership of the underlying asset.

Leveraged product, amplifying both profits and losses.

CFDs vs stocks

CFDs and stocks differ fundamentally in their structure and purpose. When you buy a stock, you own a share of the company, giving you rights such as dividends and voting power. By contrast, CFDs are derivative instruments that let you speculate on price movements without owning the underlying asset.

Moreover, CFDs offer leverage, which means you can control a larger position with a smaller capital outlay, unlike stocks, where you need to pay the full value upfront. CFDs are also bidirectional, which means traders can profit from both rising and falling prices, whereas stock investors traditionally benefit only when prices rise.

The costs and fees also vary when considering CFDs vs stocks: stock trading tends to incur brokerage fees and potential dividend taxes, while CFDs can involve spreads, overnight financing and commission. Finally, some CFDs can be traded outside regular market hours, which offers greater flexibility than just trading stocks during periods when the exchange markets are open.

Advantages of CFD trading

Leverage: Gain greater market exposure with a smaller deposit. This can magnify potential gains and losses, requiring careful risk management.

Bidirectional trading: Profit from rising (long) or falling (short) markets.

Hedging: Offset losses in a physical portfolio by short-selling CFDs.

Diverse markets: Trade forex, indices, commodities, and cryptocurrencies from one account.

Flexible timeframes: Use for short-term or long-term strategies, depending on goals and market outlook.

Learn more about CFD advantages and risks.

How does CFD trading work?

When you trade CFDs, you don’t buy or sell the underlying asset (e.g. a physical share, currency pair or commodity). You buy (go long) if you expect prices to rise or sell (go short) if you expect them to fall. Profits or losses depend on the price difference between opening and closing the trade.

Wondering how CFDs work? For every point the price of the instrument moves in your favour, you gain multiples of the number of units you have bought or sold. For every point the price moves against you, you will make a loss.

Example: If you buy 5 CFD contracts on a share at $100 (each contract worth $10 per point) and the price rises to $105, your profit is (5 x $10) x (105 - 100) = $250. If the price falls to $95, your loss is $250.

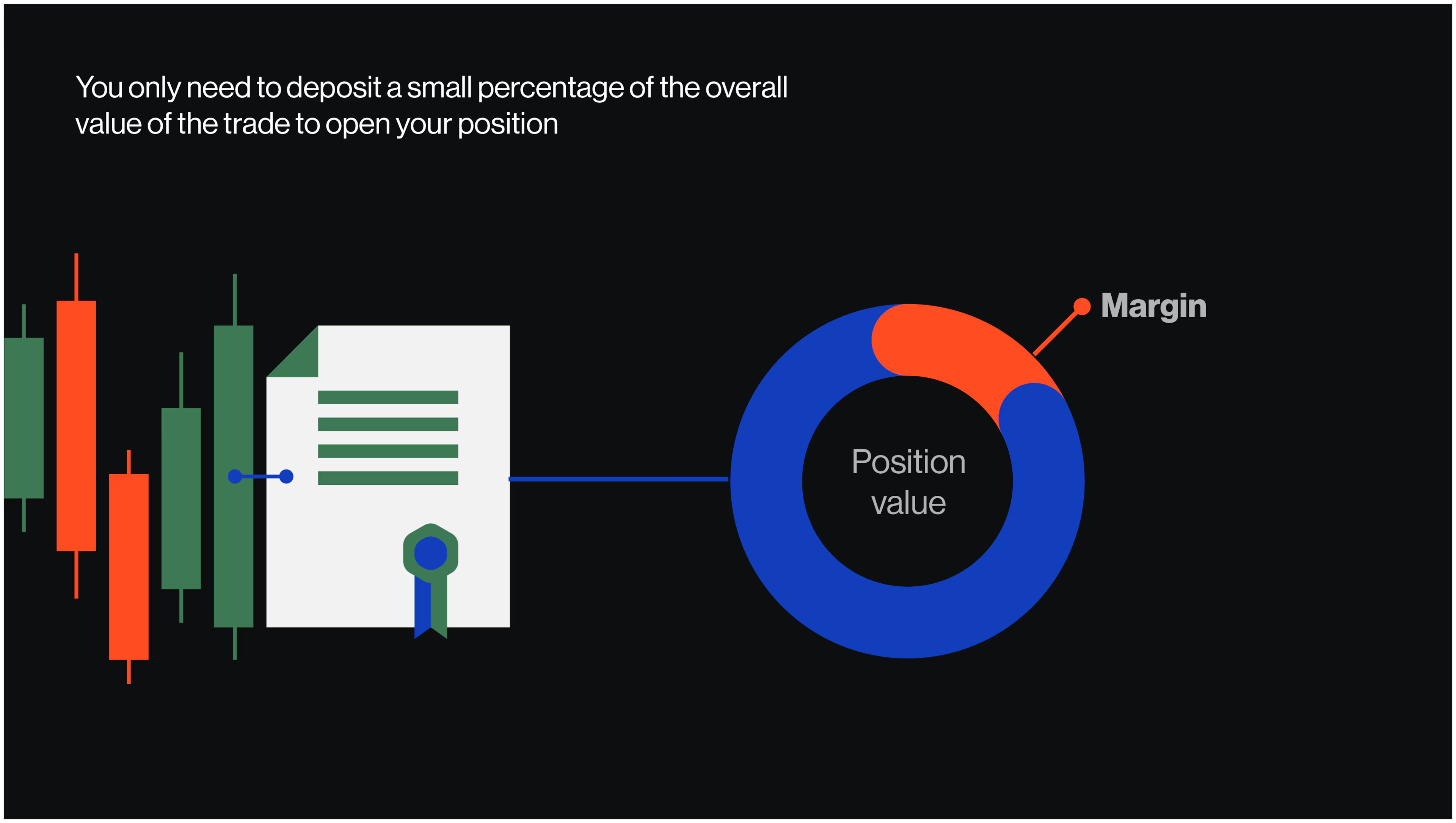

Margin and leverage

CFDs are a leveraged product, which means that you only need to deposit a small percentage of the full value of the trade to open a position. This is called ‘trading on margin’ (or margin requirement). While trading on margin allows you to magnify your returns, your losses will also be magnified as they are based on the full value of the position. This means that you could lose all of the funds in your account, but as retail CFD accounts have negative balance protection, you cannot lose more than the value of your account.

For example, a 5% margin on a $10,000 position requires only $500. This amplifies both profits and losses, as returns are based on the full position value.

Margin: A deposit, typically 5–20% of the position size.

Leverage: Magnifies exposure but increases risk of loss.

Negative Balance Protection: Ensures retail clients cannot lose more than their deposit.

Learn more about CFD margins and how to calculate them.