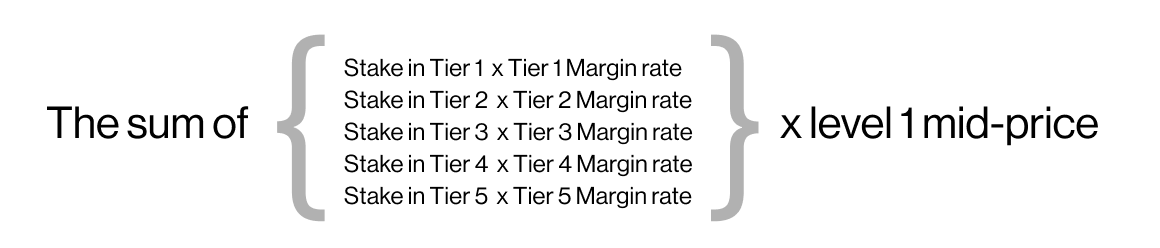

Based on the margin rates in the table below for Company XYZ ($AU), if a position of 6500 units used the level 1 mid-price of $2.75, the margin would be $5,225.

CFD margin calculator

Your position margin requirement is calculated as follows:

Tier | Position size | Margin rate | Calculation |

|---|

1 | 1,000 | 20% | 1,000 x 2.75 x 20% = $550 |

2 | 2,000 | 25% | 2,000 x 2.75 x 25% = $1,375 |

3 | 2,000 | 30% | 2,000 x 2.75 x 30% = $1,650 |

4 | 1,500 | 35% | 1,500 x 2.75 x 40% = $1,650 |

5 | 0 | 50% | 0 |

Total | 6,500 | | Total = $3,437.50 |

The notional value of your total position is $17,875.00 ($6,500 x $2.75).

CFD margin requirement

As you can see, margin trading allows you to open a position by depositing a percentage of the full value of the position. This means that your losses will be amplified and you could lose more than your initial deposit. Profits and losses are relative to the full value of your position.

Trading using margin is not necessarily for everyone, so you should ensure that you understand the risks of CFDs, and if necessary, seek independent professional advice before placing any trades.