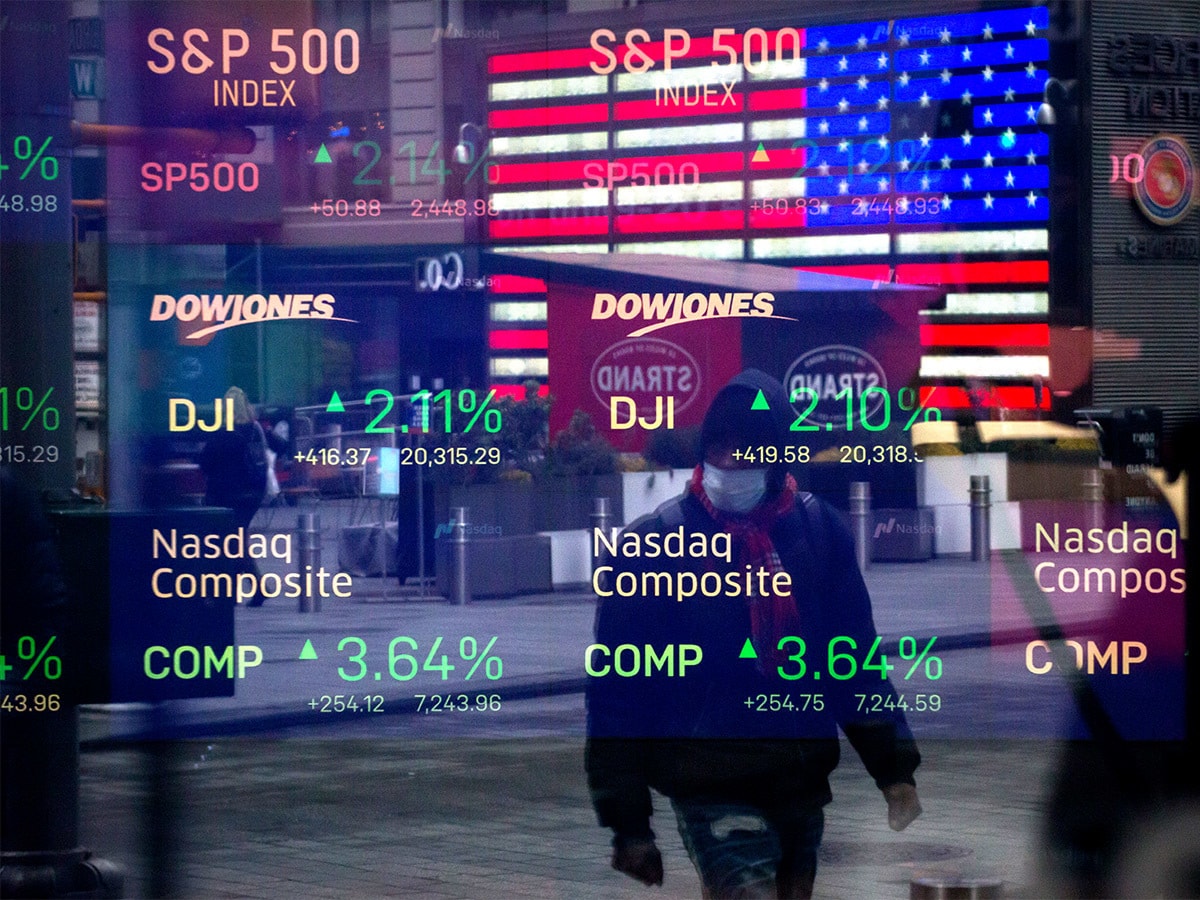

Stock market corrections

A market correction occurs in a situation when the price movement of a financial security, such as a share or a stock index, experiences a rapid decline from a peak, by a minimum of 10%. After a period of time, the decline is halted and the market regains its equilibrium. This article focuses on stock market corrections in particular, and describes how and why they can happen. A stock market correction can be disadvantageous to some traders whereas others may seek to benefit from them. Read on and learn about its causes, real life examples, and how traders can prepare for and trade a stock market correction with derivatives on our award winning* Next Generation spread betting and CFD trading platform.