Macro Scenes:

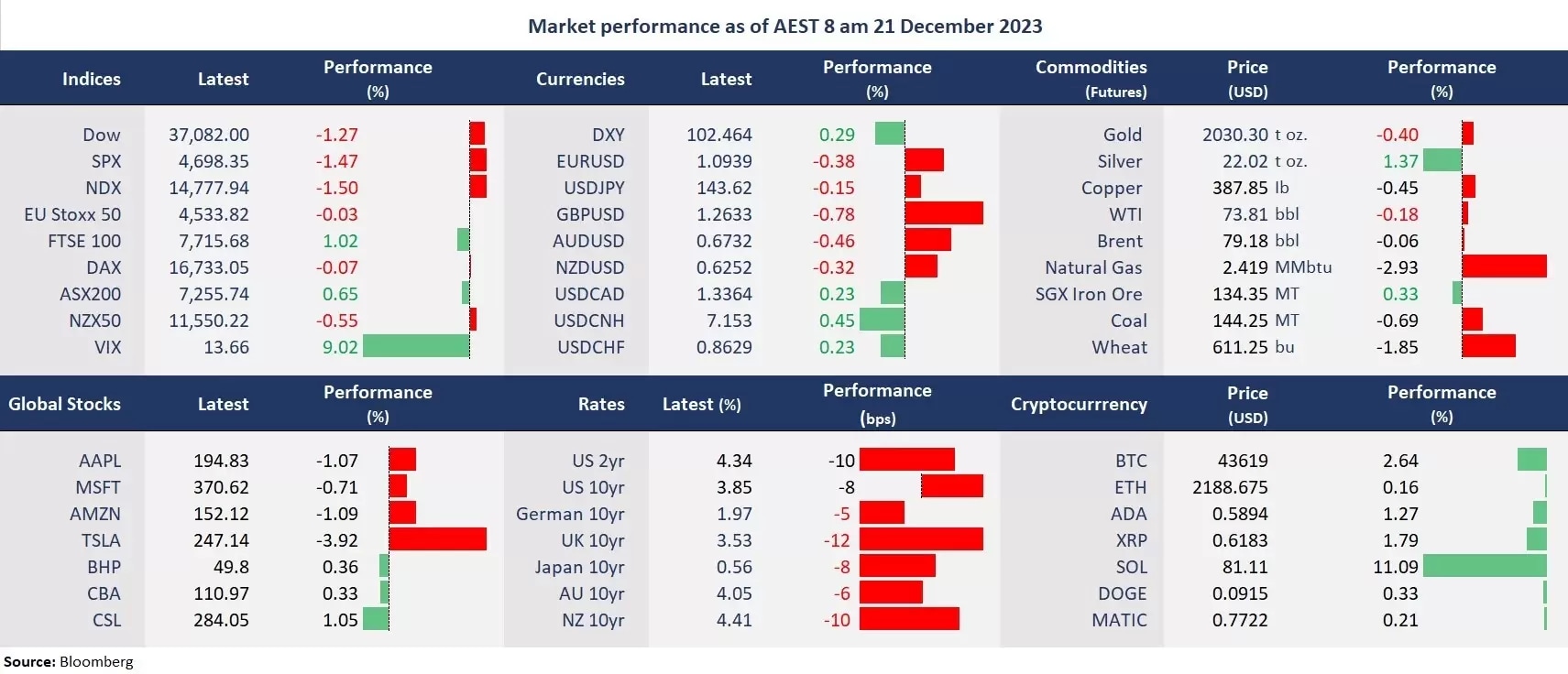

- Wall Street fell: Three US benchmark averages sharply retreated in the late session after hitting their respective intraday highs, snapping a more-than-one-week winning streak. This could be due to an overbought market as rate cuts optimism ran out of steam. Soft-landing and higher for long rates can still be on the table amid the recent Red Sea turmoil.

- Bond yields slid on risk-off: Global government bond yields accelerated falling due to risk-off sentiment. The US dollar and the Japanese Yen strengthened as a haven currency. The CBOE VIX jumped 9% to 13.7.

- Rate cut bets strengthened in Europe: The UK’s November headline CPI printed at 3.9%, much lower than an estimated 4.6%. This followed a light inflation data for the Eurozone. Rate-cut bets for the BOE grew significantly, sending the 10-year UK gilt yield down 12 bps, weakening the British Pound.

- Gold and crude oil lower: Commodities fell in general due to a strengthened USD. Oil prices were under pressure after the US reported an increase of 2.9 million barrels in the stockpile last week. However, the Red Sea supply chain disruption may continue to offer a bullish factor.

- Bitcoin briefly topped 44,000: The largest cryptocurrency briefly topped 44,000 before pulling back to about 43,500.

- Asian markets to open lower:ASX 200 futures fell 0.69%, the Hang Seng Index futures were down 0.77%, and Nikkei 225 futures slid 1.62%.

Chart of the Day:

Bitcoin, daily – Despite another spike, a potential bearish divergence remains in place as the RSI and price move in opposite directions. The immediate resistance can still be around 44,400, which is the highest level in December. While a near-term pullback is expected, a bullish breakout of this level could take Bitcoin to reach a higher potential resistance of about 48,000.

Company News:

- Alphabet (NDX: GOOG) rose to a 52-week high on the news that the tech giant plans to reorganize a 30,000-person sales unit as it shifts focus to machine-learning technology. This may imply more layoffs following an announcement of cutting 12,000 jobs in January.

- The Chinese internet technology company ByteDance’s sales surged to US$110 billion, potentially surpassing Tencent to be the third-largest Chinese tech company in revenue. The social platform provider has projected a 30% growth rate in 2023, exceeding the pace of Meta Platforms and Tencent.

Today’s Agenda:

- New Zealand Credit Card Spending for November

- Canada’s Retail Sales for October

- US Final Q3 GDP, Unemployment Claims & Philly Fed Manufacturing Index

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.