Macro Scenes:

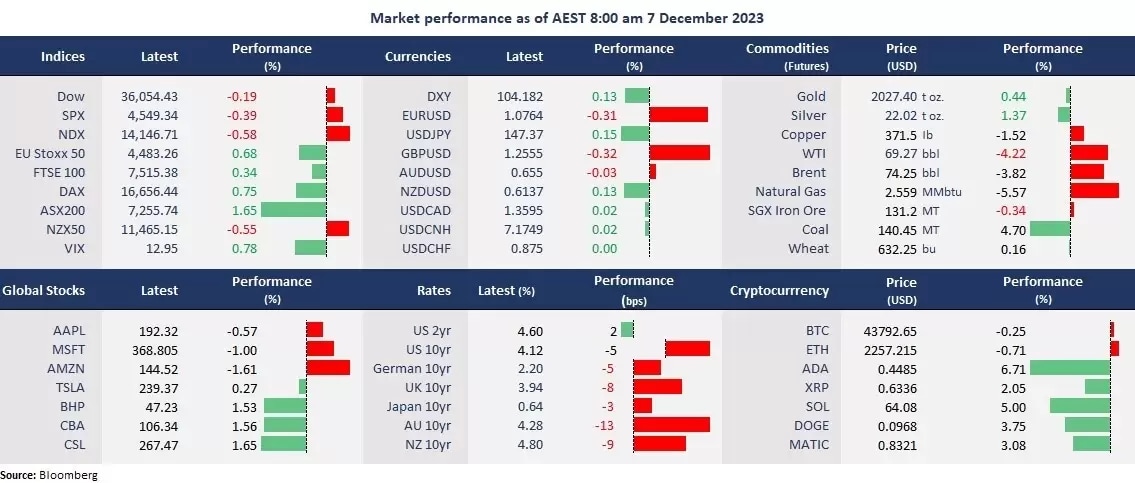

- US stocks fell, while DAX hit a record high: Wall Street cut early gains and finished broadly lower following the weaker-than-expected ADP job data. This might be due to growing economic concerns and continuing profit-taking trades after a strong November performance. By contrast, the European stock markets were extremely strong, with DAX refreshing record highs for the second straight trading day, led by mining stocks.

- US bond yields mixed: The US 10-year government bond yield fell to 4.12%, the lowest since 1 September. But the 2-year yield was slightly high. Markets may have reassessed the outlook for the Fed policy path. However, investment sentiment remained positive, with the CBOE VIX under 13. This can also be reflected in a rally in the small caps, the Russel 2,000, and a jump in cryptocurrencies.

- USD climbed: The USD index extended gains as the Eurodollar and the British Pound weakened following a slump in their respective government bond yields.

- Crude oil tumbled: Crude oil plunged more than 4%, with the WTI futures falling below US$70 per barrel, the lowest since June. Despite larger-than-expected US inventory data, the overall ramp-up production and China’s disappointing data contributed to the recent slump in oil prices. However, oil markets may have been oversold, which could be set for a short-term rebound.

- Gold bounced: Gold futures rebounded slightly after a two-day slide after hitting a record high on Monday. The precious metal might maintain its upside momentum if Friday’s non-farm payroll data offered evidence for a slowdown labour market.

- Asian markets to open lower: On Wednesday, the Australian stock markets rallied broadly following weaker-than-expected Q3 GDP data. Mining stocks may be set to rise following the European markets. But Asian markets are set to open lower. The ASX 200 futures were down 0.23%, the Hang Seng Index futures slid 0.13%, and Nikkei futures fell 2.04%.

Chart of the Day:

USD/JPY, daily – The uptrend is intact, with near-term potential support around 146. RSI shows a bottom reversal pattern, which may support the pair's rebounding. However, a bearish breakout of 146 may take it to test further support of about 142.66.

Company News:

- Google (NDX: GOOGL) launched the large language model Gemini, which includes Gemini Ultra, Gemini Pro, and Gemini Nano. The company plans to enable its access to customers from 13 December. Gemini will also be used to power the Bard chatbot.

- Advanced Micro Devices Inc. (NDX: AMD) unveiled MI300 AI chips, with an aim to compete with NVIDIA. CEO Lisa Su forecasted that the AI chip industry could reach over $400 billion in 2027. Meta, OpenAI, and Microsoft expressed interest in AMD’s new chips.

Today’s Agenda:

- China’s Trade Balance for November

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.