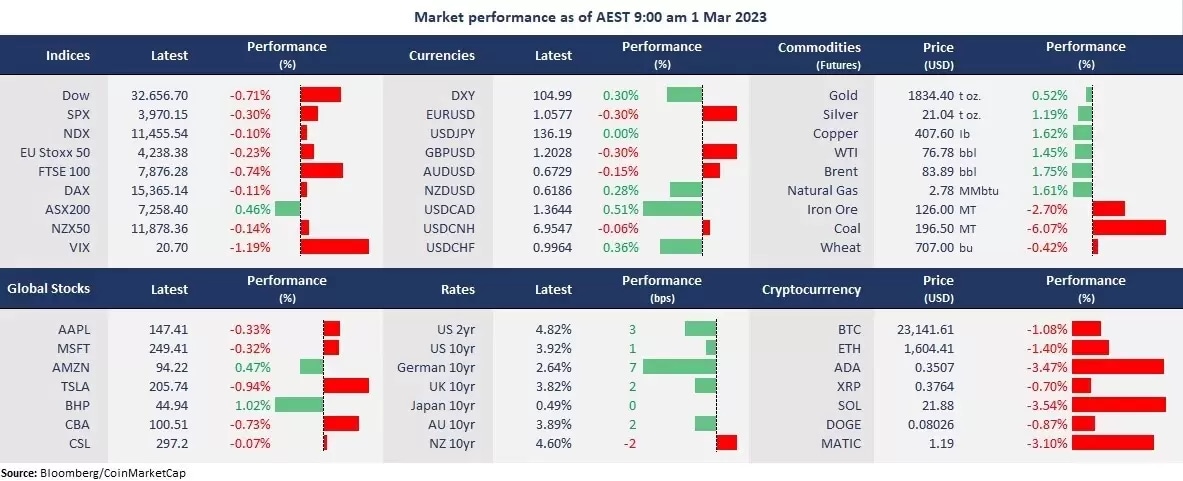

US stocks finished lower as bond yields stayed at high levels after a volatile session. Tech shares led Nasdaq to gain initially but pared gains in the final hour, while energy stocks led broad losses in the Dow and the S&P 500. Three benchmark indices all posted a monthly decline for February due to a jump in rates amid Fed’s hawkish policy guidance.

The US dollar regained strength as both the Eurodollar and the British Pound retreated amid uncertainty about the UK-EU trade deal over North Ireland. But commodities were resilient, with both oil and gold finishing higher for the session ahead of China’s PMI data.

Asian markets are set to open mixed on the first day of March. The ASX futures was down 0.32% ahead of the January CPI data and the fourth quarter GDP. The Hang Seng Index futures rose 0.60% and Nikkei 225 fell 0.11%.

- 6 out of 11 sectors in the S&P 500 finished higher, with the material, financial and communication services, leading gains, while energy stocks and utilities were laggards, both down more than 1%. Major tech stocks were also mixed, with Meta Platforms outperforming, up 3%.

- The US consumer confidence unexpectedly declined in February, implying high inflation and rising rates are weakening the outlook for incomes, jobs and business conditions for the next six months. The Conference Board (CB) consumer confidence index fell to 102.9 from 106 the prior month, also lower than an estimated 108 5.

- Tesla is planning to build a new plant in Monterrey, Mexico. The Mexican President said Tesla agreed to use recycled water at the plant throughout the entire vehicle production process. Tesla’s shares were slightly down on Tuesday.

- Rivian’s shares slumped 8% in after-hours trading amid mixed earnings results. The EV maker lost 1.73 per share in the fourth quarter, less than an estimated $1.94 loss. But its revenue came as $663 million, less than an expected $742.4 million. The company expects to produce 50,000 vehicles in 2023, doubling last year’s number but lower than the 60,000 expected.

- Crude oil climbed higher ahead of China’s February manufacturing PMI data. China’s reopening and Russia’s production cuts may be brewing a new wave of a rebound in oil prices, while the US crude inventory may see a decline with more refineries recovering operation.

- Cryptocurrencies are under pressure as the recent optimism faded, which requires a technical correction. Both Bitcoin and Ethereum surface a bearish divergence in their charts, with further selloffs expected.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.