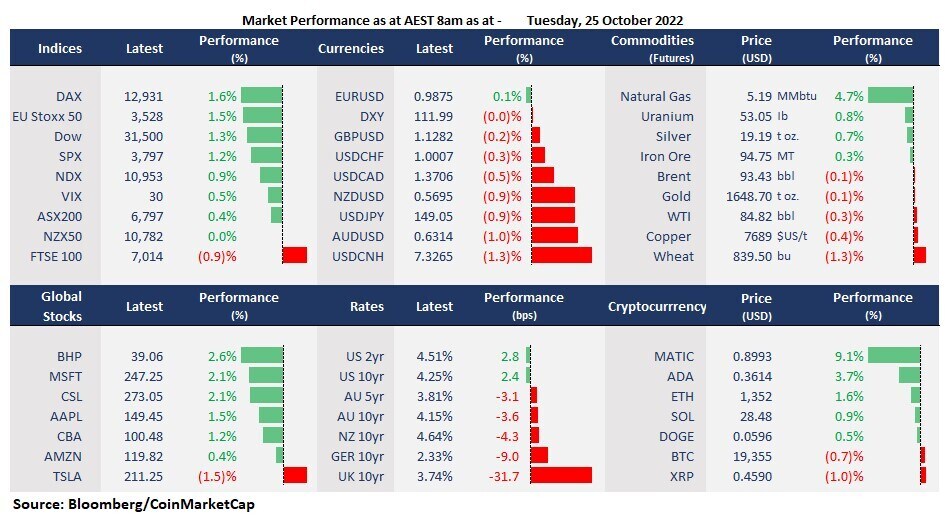

US stocks extended gains after the best weekly performance since June ahead of the major tech earnings this week. Investors may start betting for a scaleback on rate hikes by the Fed amid gloomy economic outlooks, while some major companies’ earnings came in strong-than-expected last week, sparking dip buying in the equity markets. Despite a 14-year high US 10-year bond yield of 4.24%, the VIX fell to 29. 85 from above 34 in early October, suggesting that the earnings optimism may take the rebounding trend further into major tech earnings. Microsoft and Alphabet are to report the third quarter results after the US markets close tomorrow.

Elsewhere, China’s new leadership and mixed economic data sparked concerns about the world-second-largest country's economic growth, sending Hong Kong stocks plummeting 6%, to the lowest level since 2009. China’s third-quarter GDP printed at 3.9%, stronger than an estimated 3.5%. But the September retail sales showed a weakened increase of only 2.5%, a sharp decline from 5.4% in August, due to the renewed Covid curbs.

- S&P 500 climbed back to the key resistance of 3,800, the highest in one month, a breakout of this level may take the benchmark index to go back to 3,900. 9 out of the 11 sectors in the S&P 500 finished higher, with Healthcare and consumer stables leading gains, up 1.91% and 1.79, respectively.

- Apple raises prices for its services on Apple TV+ and Apple Music. The iPhone maker raised the monthly individual subscription of Apple Music from $9.99 to $10.99, and the Apple TV+ from $4.99 to $ $6.99. The company’s shares were up 1.5% as investors see it as positive for earnings. The tech giant is to report the third quarter result on Thursday.

- UK’s former finance minister, Rishi Sunak, is set to become the new Prime Minister, which stabilised its bond markets’ sentiment. The UK government bonds spiked, with the 10-year gilt yield falling from above 4% to 3.73%. The British Pound fell 1% against the US dollar, with GBP/USD at 1.1282 at AEST 7:37 am.

- The US-listed Chinese shares and the Chinese Yuan slumped amid economic and policy uncertainties after the Party Congress nailed the new leadership, with the Nasdaq Golden Dragon China Index tumbling about 20%. However, the major Chinese tech shares Alibaba, JD.dom, Baidu, and NIO all bounced off session lows, finishing between 12% and 16% down after a 20% drop on Monday. The offshore Yuan tumbled to a fresh record low, with USD/CNH reaching 7.3266 this morning.

- APAC currencies are all dragged by the Yen and Yuan due to monetary policy divergence and economic uncertainties in China. Both the Australian and New Zealand dollar were down 1.3% against the US dollar. The Japanese Yen returned to weakness after a one-day rebound due to BOJ’s exchange rate intervention, with USD/JPY rising back to above 149.

- Asian markets are set to open mixed following divergence moves in the US and Chinese markets. ASX futures were up 0.41%. Nikkei 225 futures were up 0.70% and Hang Seng Index futures fell 0.20%.

- Crude oil bounced off day lows amid mixed signals from the Chinese economic data. Despite weakened retail sales both China’s third-quarter GDP and industrial output in September rose more than expected, which suggests the demand outlook may not be so bad as previously projected.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.