The US labour market report for November, due out on Friday 2 December, may be upstaged by Federal Reserve chair Jay Powell’s speech two days earlier. His address at the Brookings Institution on Wednesday could, if hawkish enough, render Friday’s jobs update a non-event. Even the bond market suggests that now is not the time for the unemployment rate to rise.

Economists estimate that the US economy added 200,000 jobs in November – a solid showing, even if it would mark a drop from the October reading of 261,000. Meanwhile, the unemployment rate is forecast to remain flat at 3.7%.

White-hot labour market

Wage growth, another key part of the jobs report, is expected to have risen 0.3% month-on-month and 4.6% year-on-year in November. These growth rates would represent a slight decrease from October's 0.4% and 4.7%, respectively. Additionally, the labour force participation rate is expected to climb to 62.3% from October's 62.2%.

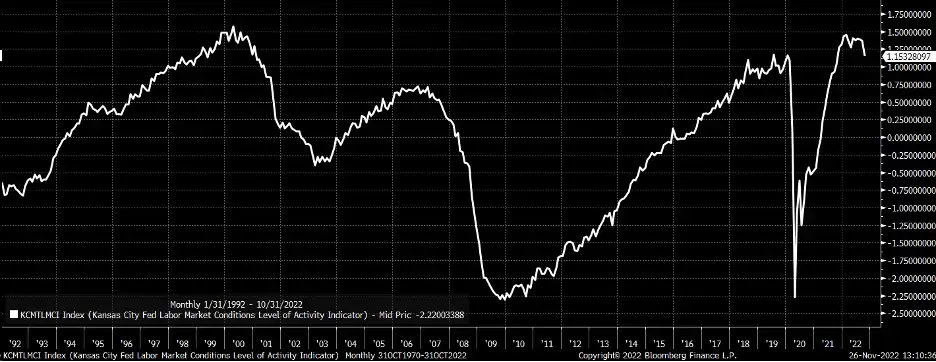

The unemployment rate remains historically low. The Fed is trying its best to get the jobless rate higher to help slow the economy and rein in persistently high levels of inflation. The Kansas City Fed's labour market conditions index, shown below, indicates that the job market is at historically tight levels not witnessed since the late 1990s.

Even more interesting is the Atlanta Fed's wage growth tracker among job switchers, below, which shows wages climbing at more than 7% – the highest rate in the metric's history, and nearly a percentage point higher than in the 1990s. Based on these data points, even if the November report shows signs of a cooling labour market, it is unlikely to be enough to make a significant dent in these longer-term trends.

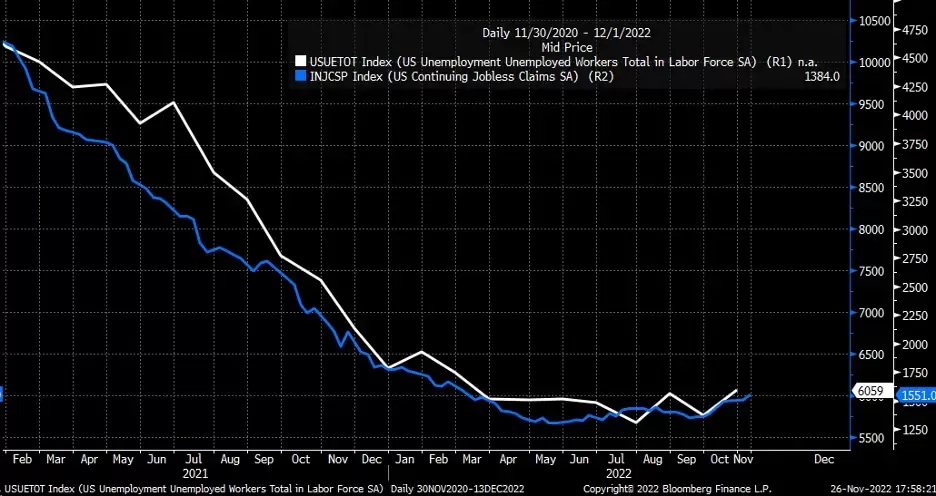

Four-week jobless claims data have also been on the rise, as indicated by the chart below. Should that trend continue, it is likely that the unemployment rate could soon head higher too. Typically, rising continuing claims are a leading indicator for a rising unemployment rate. At this point, though, jobless claims point to only a minor increase in the unemployment rate.

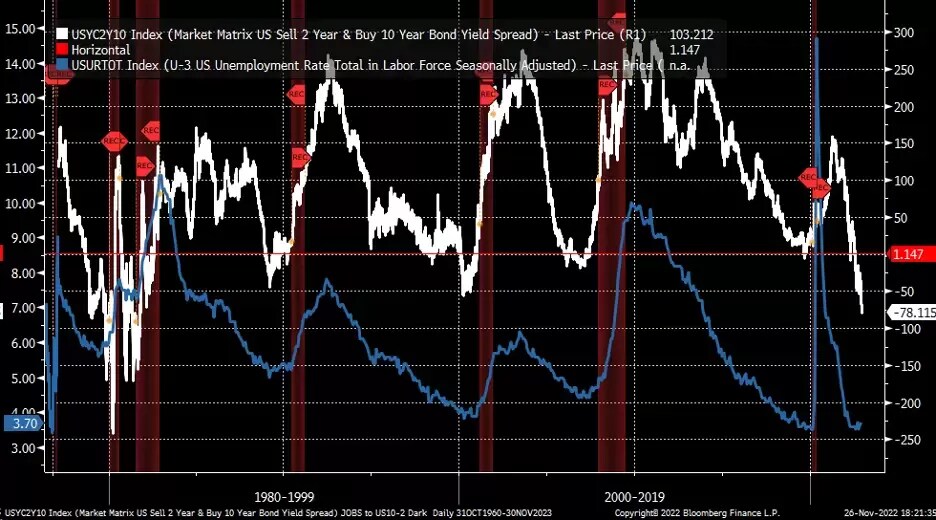

US 10-year minus two-year spread still contracting

The Fed wants the unemployment rate to rise. The only question is how much the rate needs to rise to loosen the job market and take pressure off wage growth. For that, one should turn to the spread between two-year and 10-year US government bonds. This spread is a leading indicator of changes in the unemployment rate, and could signal when the Fed might be ready to go from raising interest rates to cutting them. The spread is still contracting and has the lowest negative value since the early 1980s.

When the spread starts to rise again, it will be because the front of the curve is falling at a faster pace than the back of the curve, and that will be because the Fed is either communicating to the market that it is preparing to cut rates or because the rate cutting process has already begun. The Fed has not yet indicated that it has even finished raising the overnight rate. Additionally, there is hardly enough evidence that the unemployment rate is steadily increasing.

If the Fed continues to try and jawbone rates on the front of the curve higher while the back end remains convinced a recession is right around the corner, it is possible that this spread could sink to even lower levels.

If Powell’s speech on Wednesday signals a desire to keep financial conditions tight and restrictive, short-term rates and the dollar could move higher. If Powell’s speech is particularly hawkish, Friday’s job report may only be meaningful if it contains a major surprise. Anything short of that could make the jobs report an anti-climax.

Charts used with the permission of Bloomberg Finance LP. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index may be available through investable instruments based on that index. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should know the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past 12 months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment. Michael Kramer and Mott Capital received compensation for this article.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.