European markets have fallen every day this week, although yesterday’s losses were by far the worst, and look set to continue again today. US markets also struggled yesterday, although their losses have been much more modest.

Yesterday’s weakness was driven by concerns over softer than expected Chinese as well as European services PMIs, which fed into increased slowdown worries, as well as rising interest rate risk, which fed into weakness in basic resources, energy and financials, and has translated into further weakness in Asia markets.

Today’s Germany factory orders numbers for May could signal a brief respite, after 2 months of weakness with a rebound of 1%, up from -0.4% in April, although on an annualised basis it is expected to decline by -9.7%, the 15th month in a row it’s been in negative territory.

The release of last night’s Fed minutes showcased some significant splits amongst policymakers over the decision to signal a rate pause in June, citing “few clear signs” of progress that US inflation was falling quickly enough.

Some officials wanted to carry on with rate hikes of 25bps but given the “uncertainty” about the outlook it was decided a pause would be preferable, just so long as it was made clear that the door to a July hike, as well as further hikes was pushed to the top of the narrative. This helps to explain the very hawkish guidance with no rate cuts expected by Fed officials until 2024.

The publication of the minutes, and the clear willingness amongst many members to do more on rates saw US 2-year yields close higher on the day, wiping out their early decline.

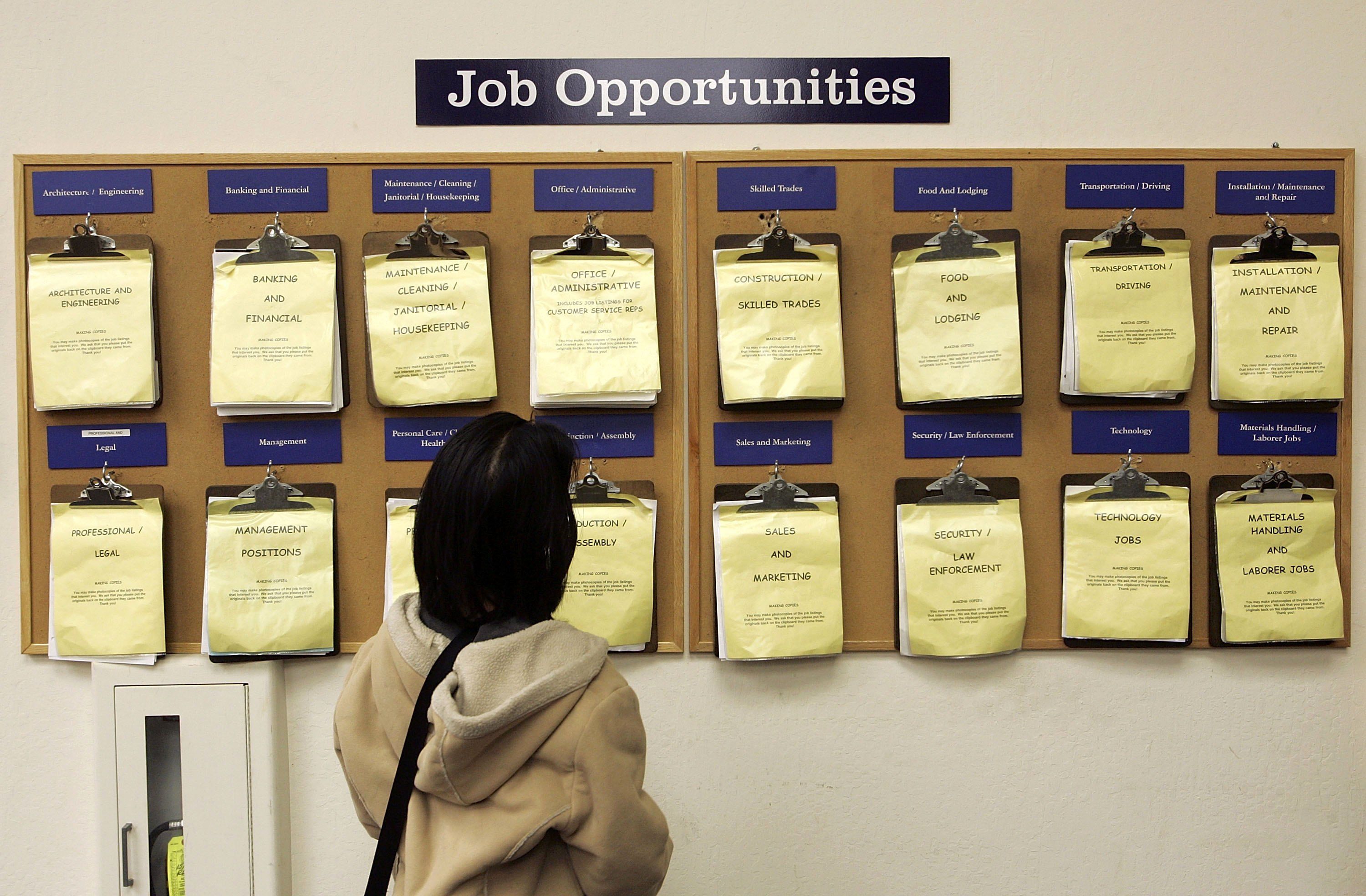

The committee noted the strength of the US labour market saying it “remained very tight” evidence of which is likely to be borne out by today’s data from the JOLTS data for May, the latest weekly jobless claims and the June ADP payrolls report, as well as the latest ISM services numbers.

The resilience of the US labour market was no better illustrated than in the April JOLTS report which saw vacancy numbers surge back above 10m from 9.7m in March. Today’s May numbers are expected to see this number drop back to 9.9m, still an eye wateringly higher number, and well above the levels we saw pre-pandemic.

Weekly jobless claims also appear to have hit a short-term peak sliding back from 265k to 239k last week and are expected to edge higher to 245k. While weekly claims have been rising in recent weeks continuing claims have been falling, slipping to a 3-month low last week of 1,742k.

Today’s ADP payrolls report is expected to see another solid number of 225k, down slightly from 278k.

While the number of job vacancies available remains at current levels it’s hard to imagine a scenario where we might see a weak jobs report in the coming months, which means that its unlikely to be the labour market that prompts the Fed to signal a pause in the near term.

Services inflation has been the one area which the Fed has expressed concern that it might be stickier than it needs to be.

Today’s ISM services report is expected to see headline activity edge higher to 51.3, while a close eye will be kept on prices paid which slowed to 56.2 in May, and a 3-year low.

EUR/USD – looks set for a test of support around the 1.0830/40 area and 50-day SMA, with resistance remaining at the 1.1000 area. A break below the lows last week opens the way for a potential move towards 1.0780.

GBP/USD – still in a tight range with support above the 50-day SMA at 1.2540, as well as trend line support from the March lows, bias remains higher for a move back to the 1.3000 area. Currently have resistance at 1.2770.

EUR/GBP – looks set to retarget the 0.8515/20 area and June lows, while below resistance at the 0.8570/80 area. Below 0.8510 targets 0.8480. We also have resistance remaining at the 50-day SMA which is now at 0.8655. Behind that we have 0.8720.

USD/JPY – looks set for a test of the 143.80 area, while below the key resistance at 145.20. A break below 143.80 targets a move back to the 142.50 area. Above 145 20 opens up 147.50.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.