On Friday the United Kingdom will release its first estimate of fourth-quarter gross domestic product (GDP). Economists expect the data to show that economic growth was flat quarter-on-quarter, versus a decline of 0.3% in the third quarter. Meanwhile, on a year-on-year basis, GDP is expected to have risen by just 0.4%, versus the previous quarter’s gain of 1.9%.

If GDP was unchanged on a quarterly basis in Q4, it would mean that the UK avoided a technical recession, defined as two consecutive quarters of contraction in GDP. However, if the figures are worse than expected and the economy contracted quarter-on-quarter in Q4, that would put the economy in a recession.

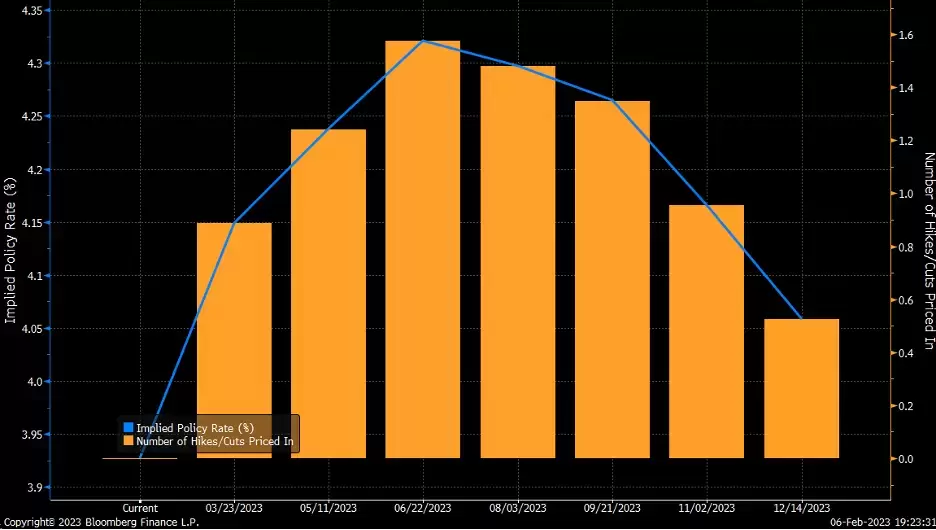

Interest rates set to move higher before falling

Whether or not the UK is in a recession could have little bearing on monetary policy. The bond market seems to think that slower economic growth will lead the Bank of England to raise interest rates to a terminal rate of about 4.3% by June, as the chart below indicates. Soon after that, the central bank is expected to start cutting rates, perhaps by as much as 30 basis points by December.

China reopening buoys UK index

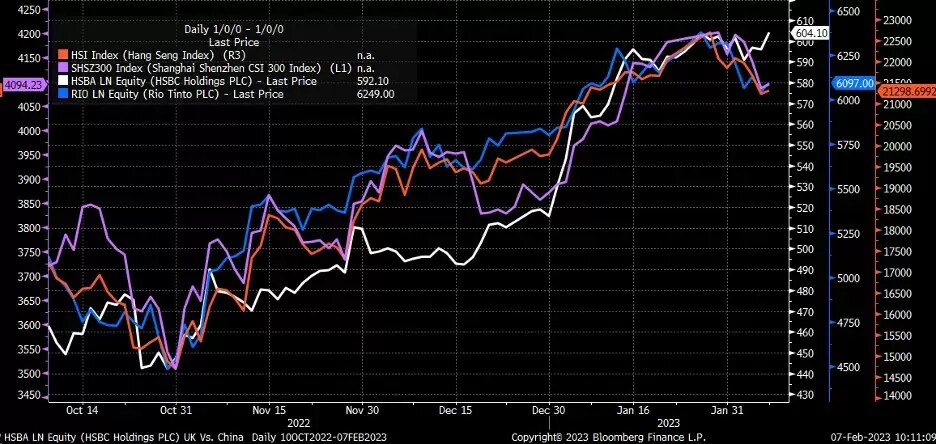

Despite recession concerns, the FTSE 100 hit a fresh all-time high of 7,934.30 this morning. The index is up more than 15% since the mid-October low, thanks in part to its heavy weighting of financial and mining stocks. Constituents such as HSBC, Rio Tinto, Prudential and Anglo-American, which make large profits from operations outside the UK, have all made strong gains this year.

Their outperformance suggests that the recent rally in the FTSE may have more to do with China’s post-Covid reopening than the state of the British economy. Many of these companies are heavily geared towards Asia. The lifting of Covid restrictions and economic reopening in China, the world’s second-largest economy, could continue to be bullish for many FTSE 100-listed companies. Since October, shares of HSBC and Rio Tinto have moved more or less in step with Hong Kong’s Hang Seng Index and the China CSI 300, as shown in the chart below.

Rather than focusing solely on UK economic data, keeping tabs on these Hong Kong and mainland China indices could give investors a deeper understanding of where the FTSE 100 may be heading. This is because the FTSE 100’s ups and downs – just like those of some of its major stocks – seem closely tied to changes in the Hang Seng Index and China CSI 300, as the chart below shows.

The Hang Seng Index recently broke an uptrend off its October lows. The FTSE 100 may not be far behind as it approaches an uptrend of its own that started around the same time. This could send the FTSE 100 down to around 7,400 in the near term if the relationship with Hong Kong and China continues.

Pound and euro weaken against the dollar

Meanwhile, the pound has been showing signs of weakening versus the dollar, especially since the stronger-than-expected US jobs report on 3 February. The pound met resistance around $1.25 and has now failed to break above this level twice. Sterling appears to be forming a double-top reversal pattern, as marked on the chart below. The pound must fall below $1.18 to confirm this pattern, which could lead to a drop to around $1.1250. However, if the pound rises above resistance at $1.25, it could strengthen to approximately $1.26.

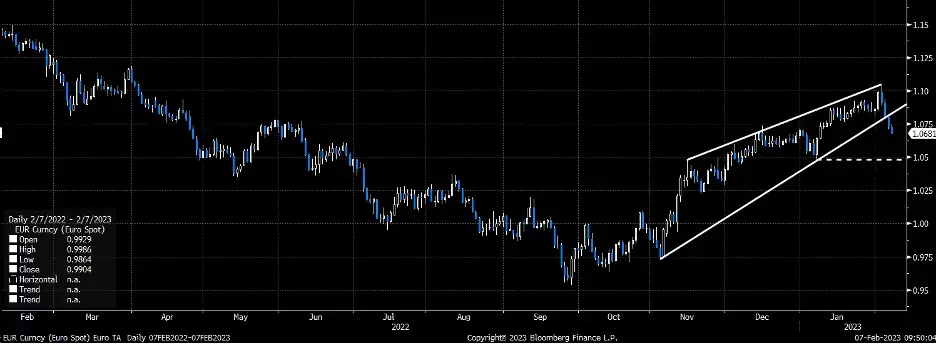

Due to US interest rate hikes and the strengthening dollar, there has also been a meaningful reversal in the euro. An apparent rising wedge pattern – indicated by white lines on the chart below – has formed off the November lows. The euro recently fell below the lower trend line that helped to support the currency in previous weeks. The first significant level of support for the euro comes at around $1.05.

While the British GDP report on Friday 10 February could help to shape some direction in both the FTSE 100 and the pound, it seems more likely that the index and sterling will continue to be affected by outside forces such as China’s reopening and the US Federal Reserve’s rate-hiking cycle.

Staying on top of those macroeconomic factors may be more critical than ever in determining where UK markets could be heading.

Charts used with the permission of Bloomberg Finance LP. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index may be available through investable instruments based on that index. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment. Michael Kramer and Mott Capital have received compensation for this article.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.