In the video that accompanies this article, I discuss the clear split between markets that are travelling in a negative direction and those that are taking a positive course, based on our proprietary Relative Rotation Graphs (RRG).

The markets heading towards and into the leading quadrant are primarily European. One of the larger markets in this group is Germany’s Dax.

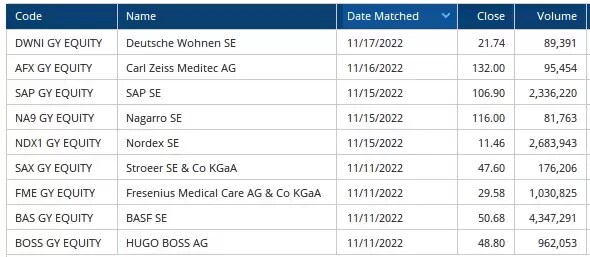

Our index scan of potential short-term trading opportunities delivered the following list of stocks (the date indicates when the stock matched our criteria):

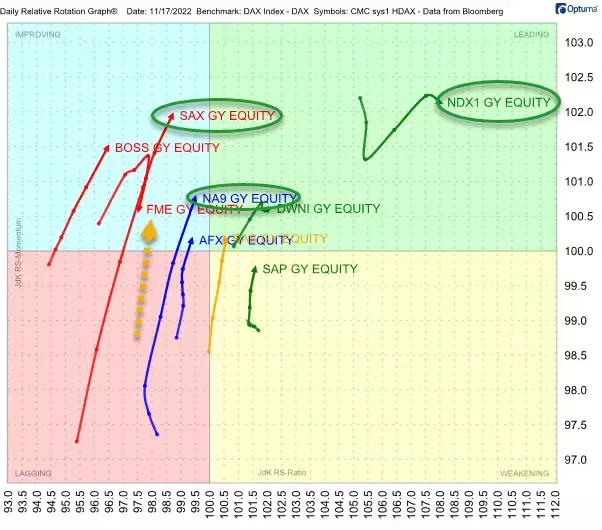

Plotting these results on a RRG produces the following chart:

The first interesting observation is that, after meeting our search criteria, Fresenius Medical Care (FME) has already reversed and is heading back towards the lagging quadrant, making it a less attractive proposition. Other stocks have continued to perform well, and it is towards these companies that we now turn our attention.

Three stocks showing strong upward potential have been circled in green on the above chart. Let us now study the price charts for these three stocks.

Stroeer SE & CO KGaA [SAX]

Shares in out-of-home advertising company Stroeer [SAX] fell at the end of 2021 (not shown on the above chart) and continued to decline in 2022, reaching a low of around €35 in September.

A new series of higher lows is emerging out of the September low. After the stock improved against the Dax, the price took out horizontal resistance at €45 and rallied towards the next barrier at €50

A new high was set against that overhead resistance level of €50. Now, SAX is back near €45, which should act as support, since old resistance levels tend to become support levels once broken.

This situation may present a risk-reward opportunity. Provided that the €45 support level holds, we could see a move back to the barrier near €50, implying upside potential of around 10%. However, a break below €45 would quash that theory.

Nordex SE [NDX1]

Wind turbine producer Nordex [NDX1] saw its stock peak above €18 earlier this year, before it dropped below €7 in July. After this two-thirds decline, the shares found support around €7.50.

As the chart above shows, in August NDX1 rallied towards €11, where it met resistance. The second test of that support level at around €7.50 occurred in October. Another rebound from that support area recently took out the horizontal barrier near €11. The shares have now held above that level for three days.

With both RRG-Lines above 100 points and rising, it appears that NDX1 is getting stronger from a relative perspective and in terms of price. The move above €11 signals a break from a trading range that started back in May and spanned roughly €3.50. Based on the height of this range, an initial price target for the next move higher could perhaps be pegged at around €14.50, based on the breakout level plus the height of the range.

On the way up, Nordex may meet intermediate resistance around €12.50, where the February low and the May peak align. If the stock were to drop below that level and back into the range, the stock could trend lower again.

Nagarro SE [NA9]

IT company Nagarro’s [NA9] stock price has almost halved this year, but the tide now appears to turning.

The chart above shows that a major falling resistance line has recently been broken to the upside. Perhaps more importantly, the bottom formation that has been completed below that trendline shows an inverted “head and shoulders” pattern. A head and shoulders pattern is a chart formation showing a baseline with three peaks – or, in this inverted case, three lows. These lows have been circled on the above chart, and the “neckline” connects the two in-between highs.

Taking out that neckline was the first signal that a reversal could be in the making. The subsequent move above the long-term falling resistance line supports the notion that the turnaround is now underway.

Based on the inverted head and shoulders pattern, an initial price target could be set at around €125, with the next significant resistance level at about €130. The chart suggest that NA9 may have upside potential with limited downside risk back to the level of the falling resistance line, which should now start to act as support.

Pricing is indicative. Past performance is not a reliable indicator of future results. RRG’s views and findings are their own and should not be relied upon as the basis of a trading or investment decision.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.