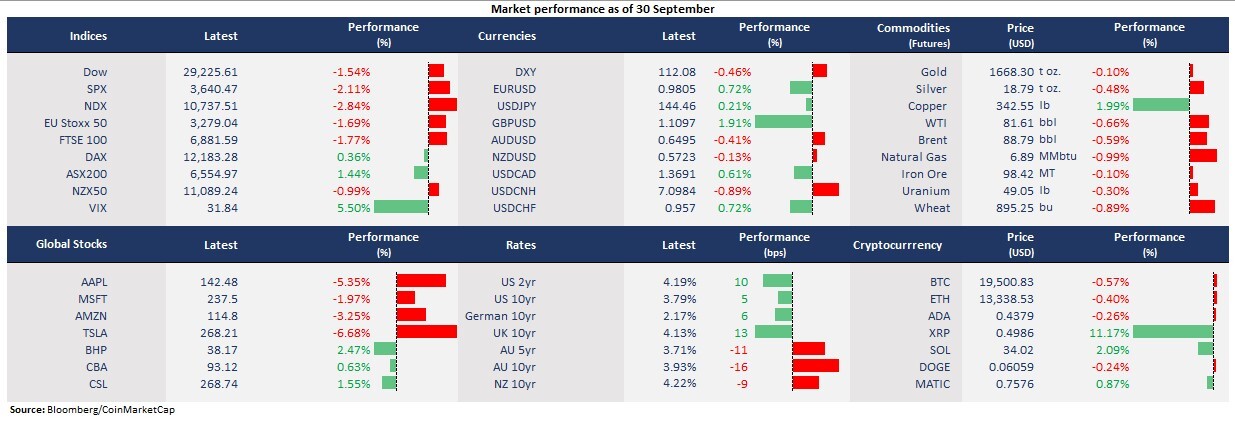

The market sell-off resumed on Wall Street as the Bank of England's bond-buying plan only offered temporary relief. Government bond yields climbed again across the board, with the UK 10-year gilt yield rising to 4.13% from 4.00%, and the US 10-year Treasury yield climbing to 3.79% from 3.73%.

The US dollar, however, slid against the eurodollar and the British pound amid dip-buys in the regional currencies. In the meantime, Bank of America downgraded Apple's stocks, which sparked concerns about a slowdown in major companies' growth. Apple's shares slid 4.8%, and Tesla slumped 6.8%. Both Alphabet and Microsoft hit their one-year lows.

- S&P 500 closed at a new year low amid the broad selloff. Dow was down 1.54%, S&P 500 fell 2.11%, and Nasdaq slumped 2.84%. All 11 sectors in the S&P 500 finished lower, with Utilities (-4.07%) and Consumer Discretionary (-3.38%) stocks leading losses, while Energy (-0.13%) and Healthcare (-0.92%) outperformed.

- Nike’s shares dropped 10% in after-hours trading despite a beat on earnings expectations. The company’s revenue grew 4% annually, but net income was down 22% in the first fiscal quarter as inventories and supply issues deteriorated the outlook.

- Weakened demand outlooks slashed growth stocks. Thursday’s selloff was triggered by a downgrade in Apple’s shares after the iPhone maker pulled back the production increase plan as the demand was not as strong as anticipated Tesla’s electric cars may also face demand tests in the upcoming earnings report. Softened online advertising demand has already sent Meta Platforms’s shares down 60% this year.

- US dollar may face downside pressure, as the US bond yields retreat sharply from decades high this week, while the UK gilt yields have surpassed their US peers, sending GBP/USD surging almost 2% overnight.

- Asian markets are set to open mixed despite a broad selloff in the US markets. ASX futures were down 0.34%. Nikkei 225 futures fell 0.72% and Hang Seng Index futures rose 0.57%. The NZX 50 fell 0.9% in the first trading hour.

- WTI futures were slightly down 0.66% after bouncing off session lows. Oil prices were resilient due to a softened US dollar while the supply issues again become a focus of traders.

- Gold futures were little changed at 1,668 after the sharp rebound on Wednesday, making the key support just above 1600, which is the lowest since April 2020.

- XPR surged 11%, outperforming crypto markets. The digital coin spiked on bets that the Ripple blockchain may win a lawsuit versus the US SEC.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.