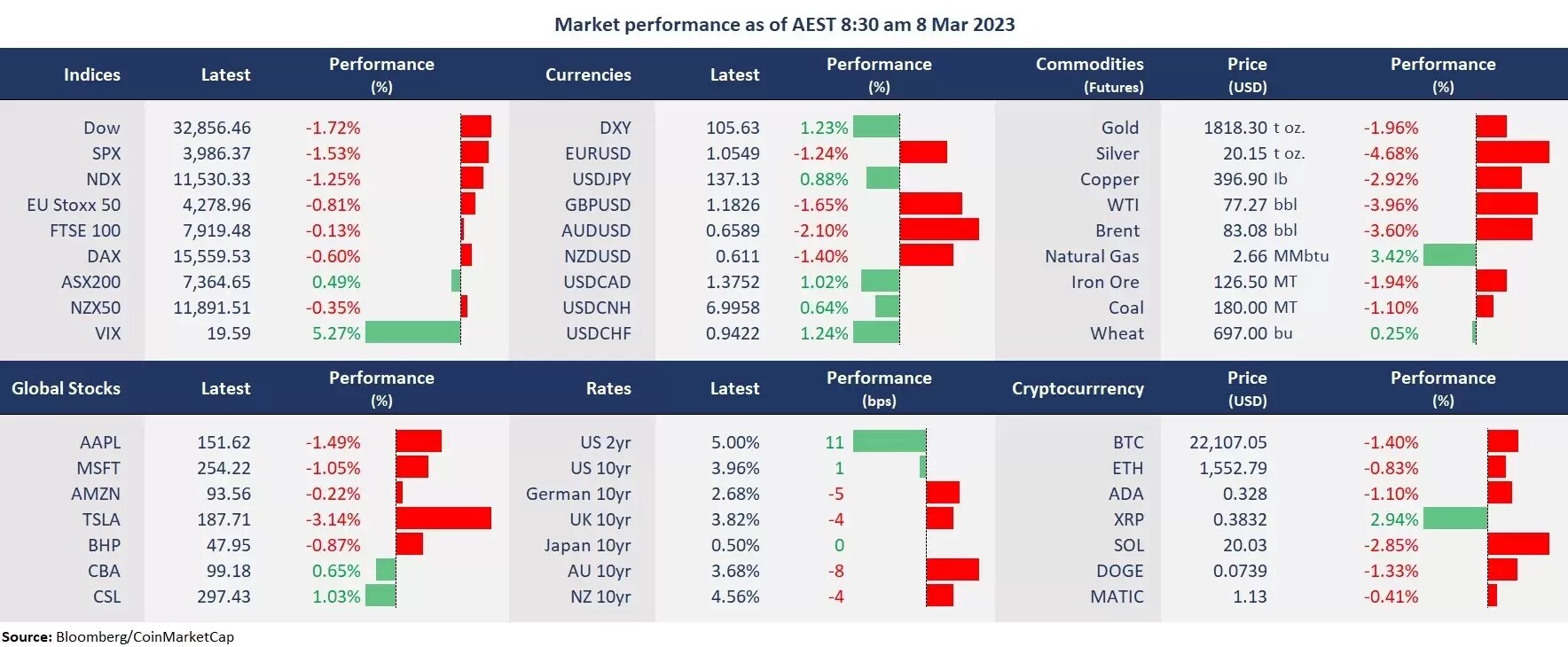

Wall Street retreated sharply after a 3-day rally following Fed Chair Powell’s comments on higher rates. Powell said, “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.” in his testimony before Congress. While all three benchmark indices fell more than 1%, the US 2-year bond yield jumped to 5.01%, topping 5% for the first time since 2007. According to CME FedWatch Tool, the Fed may raise rates by 50 basis points in both March and May, with a terminal rate of 5.75% in June, which is much higher than the previously projected 5% one month ago.

The US dollar index surged to a 3-month high and sent all the other currencies sharply lower, particularly the Australian dollar, down 2% against the greenback amid RBA’s dovish stance on Tuesday when the Reserve Bank indicated a pause on rate hikes after a widely anticipated 25 bps increase. The strengthened US dollar has also crushed commodity markets, including metal and crude oil, which followed China’s light GDP growth target for 2023.

Asian markets are set to open lower. The ASX futures were down 0.79%. The Hang Seng Index futures slid 1.31% and Nikkei 225 fell 0.42%.

- 8 out of 11 sectors in the S&P 500 finished lower, with utility and real estate stocks leading losses, down 1.7% and 1.4% respectively. Energy stocks outperformed due to a rebound in oil prices, with Occidental Petroleum up 2%, and Exxon Mobil rising 1%. Most of the big tech shares were down 1-2%.

- Meta plans to cut thousands of jobs for a second round of layoffs after a 13% reduction, 11,000 workers in November 2022. The social media giant is to eliminate more employment to become a more efficient organization. Meta’s shares rose 2.3% before pulling back and ended slightly lower due to the broad selloff.

- Salesforce launches a ChatGPT-supported A.I. tool that helps salespeople review, provide client service with responses, and write marketing content. The company’s shares surged 11% last week when it reported strong quarterly earnings. The share’s price retreated 4 consecutive days since and close slightly lower on Tuesday.

- Gold futures tumbled 35 dollars per ounce on a jump in the US dollar and rates, erasing most of the gains from last week. And near-term key support is seen at the 100-day moving average of around 1,800.

- Crude oil slumped the most in 2 months amid the Fed-induced broad selloff in risk assets. Oil prices were also pressured by a light GDP growth target set by China on Monday. Both WTI and Brent futures test on the 50-day moving average support at 77.80 and 84, respectively.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.